NewWorld Development Company Limited

FINANCIAL SECTION

136

4 FINANCIAL RISK MANAGEMENT AND FAIR VALUE ESTIMATION

(continued)

(e) Fair value estimation

(continued)

(ii) (continued)

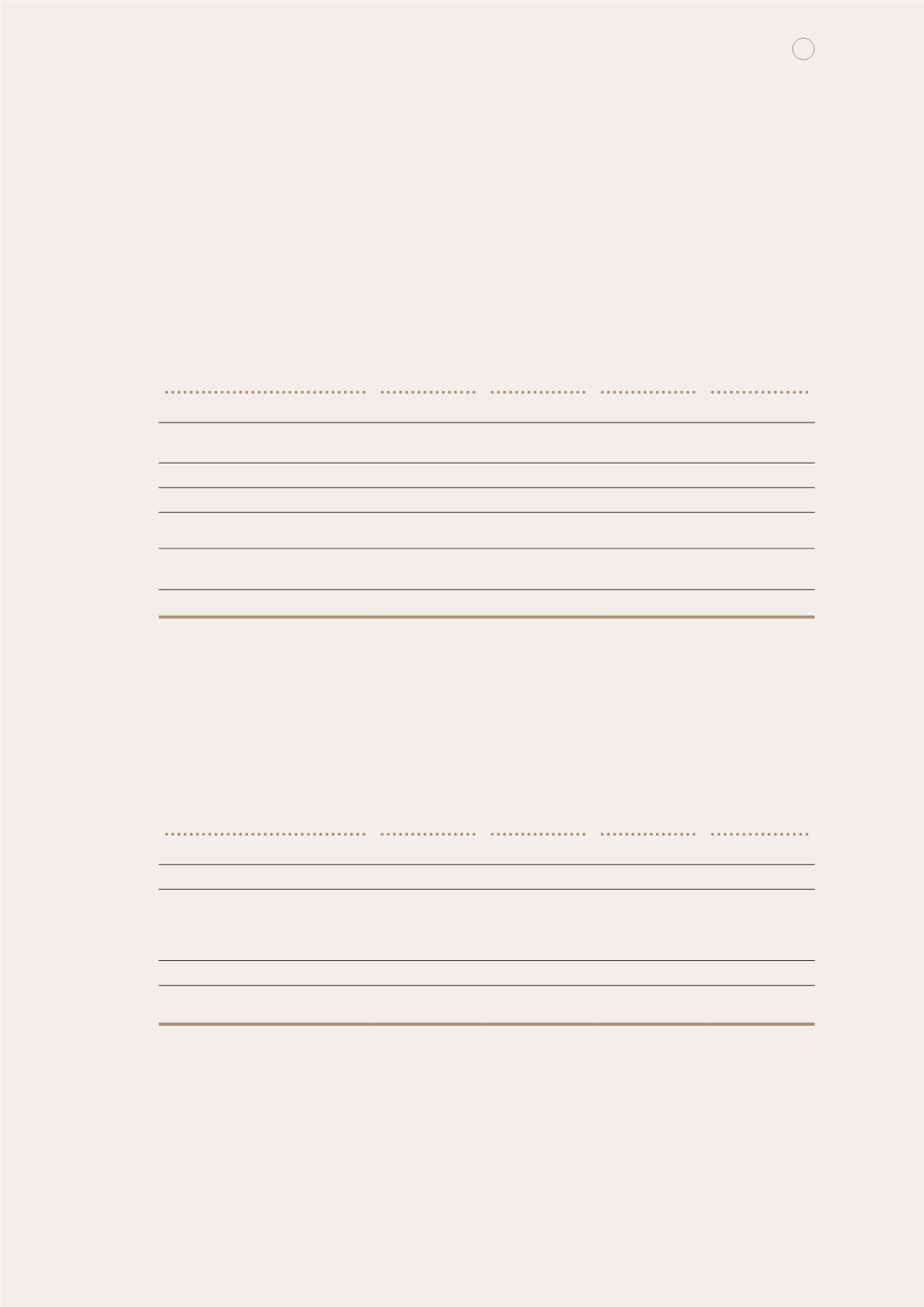

The following table presents the Group’s financial instruments that are measured at fair value at 30 June

2014:

Level 1

Level 2

Level 3

Total

HK$m

HK$m

HK$m

HK$m

Available-for-sale financial assets

1,849.3

57.2

2,822.9

4,729.4

Financial assets at fair value

through profit or loss

179.3

23.3

405.6

608.2

Derivative financial instruments

Derivative financial assets

–

25.8

58.8

84.6

2,028.6

106.3

3,287.3

5,422.2

Derivative financial instruments

Derivative financial liabilities

–

(829.0)

(35.6)

(864.6)

There was no significant transfer of financial assets between level 1 and level 2 fair value hierarchy

classifications.

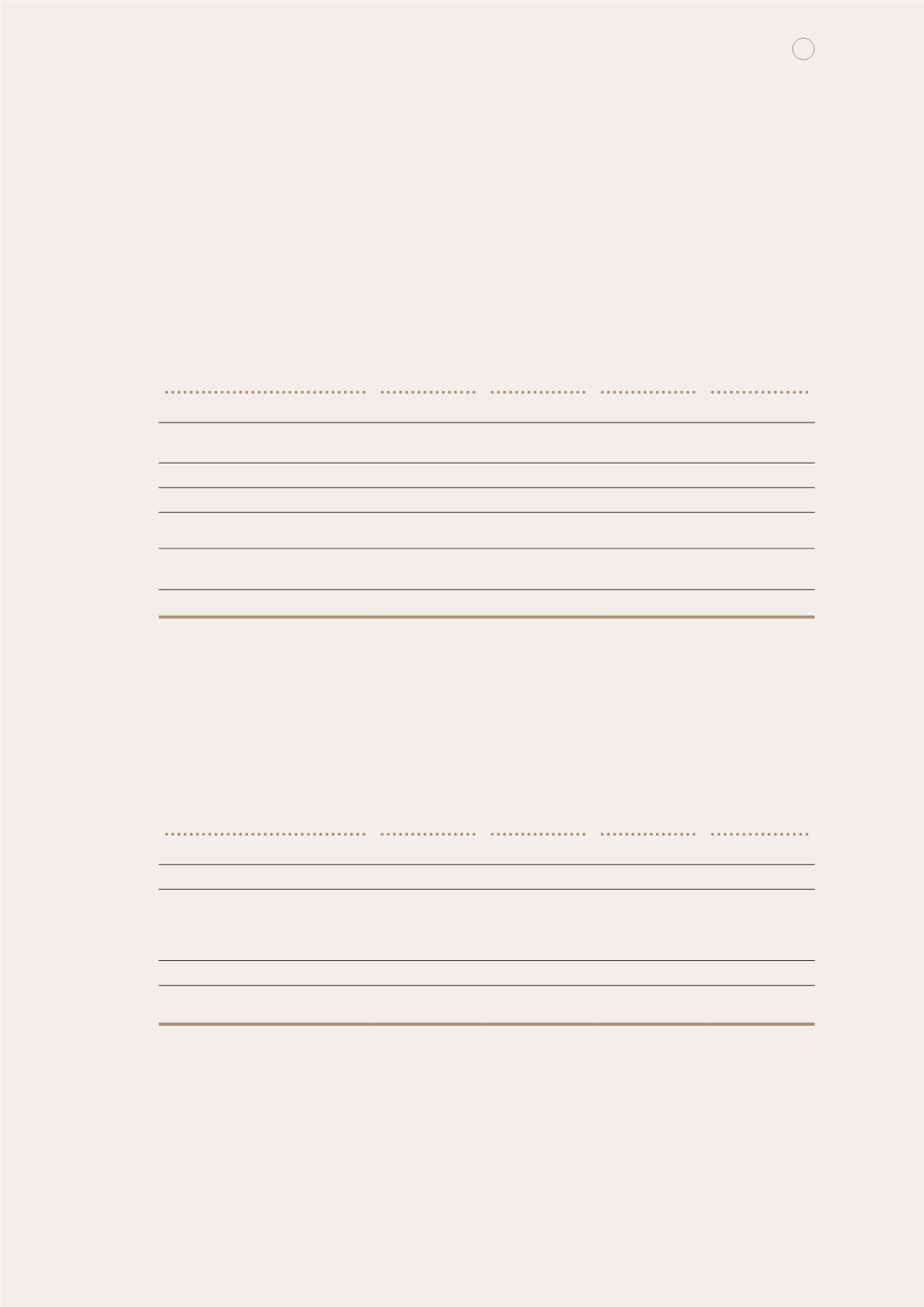

The following table presents the changes in level 3 instruments for the year ended 30 June 2015:

Available-

for-sale

financial

assets

Financial

assets

at fair value

through profit

or loss

Derivative

financial

assets

Derivative

financial

liabilities

HK$m

HK$m

HK$m

HK$m

At 1 July 2014

2,822.9

405.6

58.8

(35.6)

Additions

861.0

317.5

–

–

Net gain recognised in the

consolidated statement of

comprehensive income/income

statement

284.9

123.9

–

5.5

Disposals

(236.0)

–

–

–

At 30 June 2015

3,732.8

847.0

58.8

(30.1)