Annual Report 2015

FINANCIAL SECTION

137

4 FINANCIAL RISK MANAGEMENT AND FAIR VALUE ESTIMATION

(continued)

(e) Fair value estimation

(continued)

(ii) (continued)

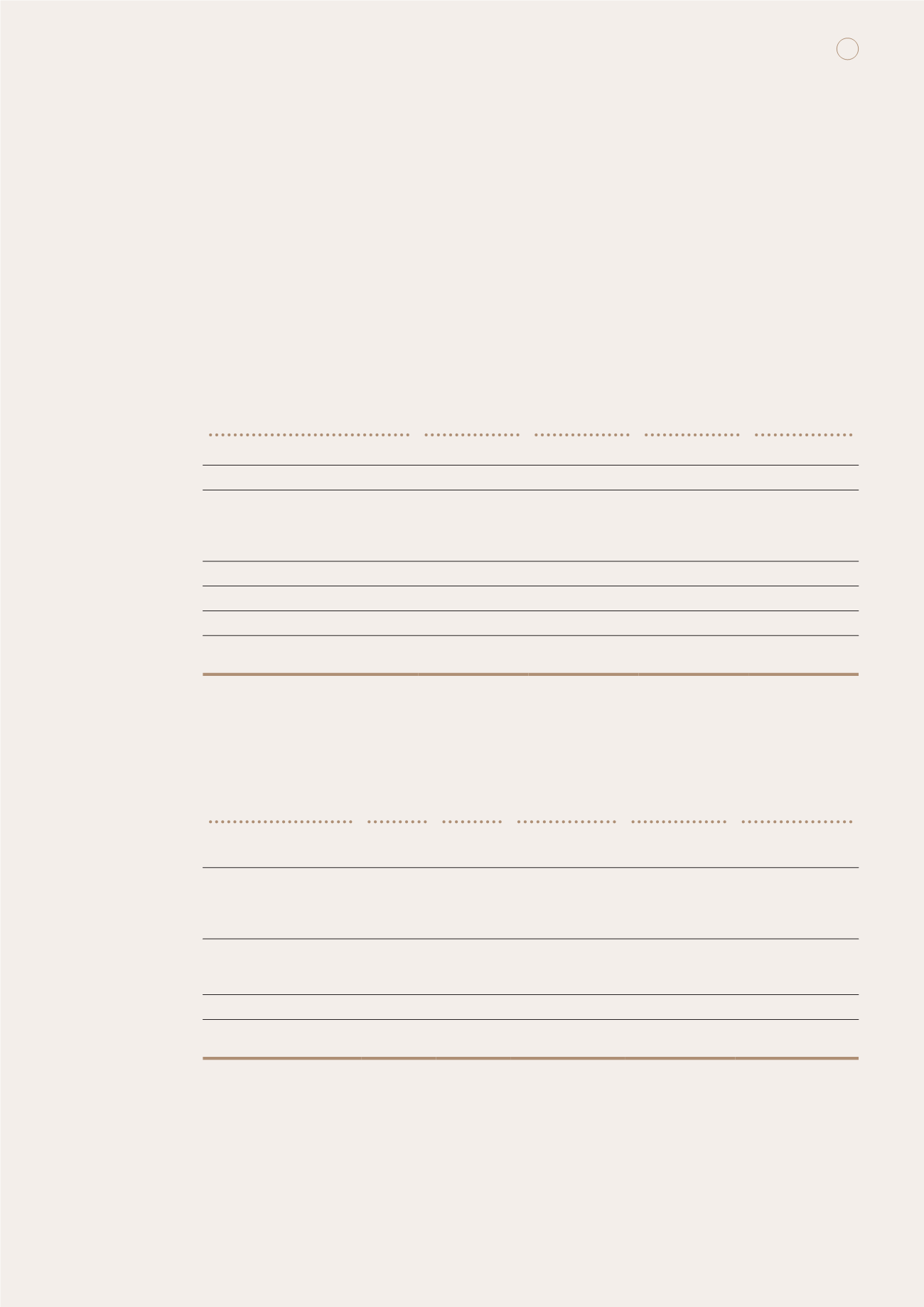

The following table presents the changes in level 3 instruments for the year ended 30 June 2014:

Available-

for-sale

financial

assets

Financial

assets

at fair value

through profit

or loss

Derivative

financial

assets

Derivative

financial

liabilities

HK$m

HK$m

HK$m

HK$m

At 1 July 2013

3,540.6

195.8

58.8

(40.9)

Additions

209.9

231.3

–

–

Net (loss)/gain recognised in the

consolidated statement of

comprehensive income/income

statement

(317.2)

81.4

–

5.3

Disposals

(28.1)

(102.9)

–

–

Transfer to level 1

(583.5)

–

–

–

Transfer from level 1

1.2

–

–

–

At 30 June 2014

2,822.9

405.6

58.8

(35.6)

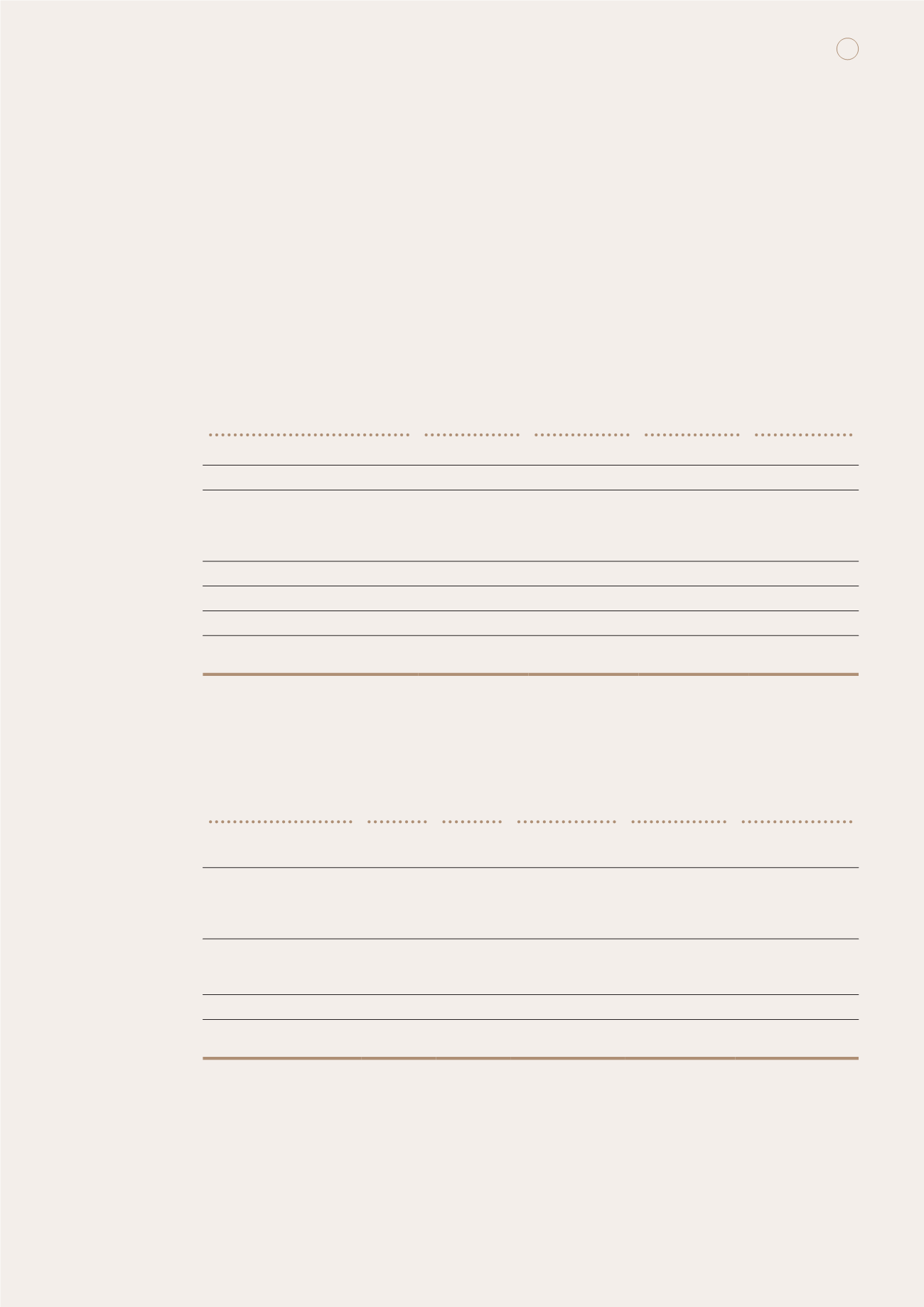

The following unobservable inputs were used to determine the fair value of the available-for-sale financial

assets included in level 3.

2015

Fair value

2014

Fair value

Valuation

techniques

Unobservable

inputs

Range of

unobservable

inputs

HK$m

HK$m

Property investment industry

1,952.8

1,876.0 Net asset value

(note)

N/A

N/A

Entertainment industry

516.1

373.8 Market comparable

approach

Enterprise value/

earnings before

interest and tax

multiple

9.37 times –

25.31 times

(2014: 8.52 times –

37.55 times)

Property development

industry

735.9

85.1 Residual method Development cost,

developer’s profit

and risk margin

N/A

Others

528.0

488.0

3,732.8

2,822.9

Note: The Group has determined that the reported net asset value represents fair value at the end of the reporting

period.