Annual Report 2015

91

REPORT OF THE DIRECTORS

DIRECTORS’ INTERESTS IN SHARES, UNDERLYING SHARES AND DEBENTURES

(continued)

(B) Long position in underlying shares – share options

(continued)

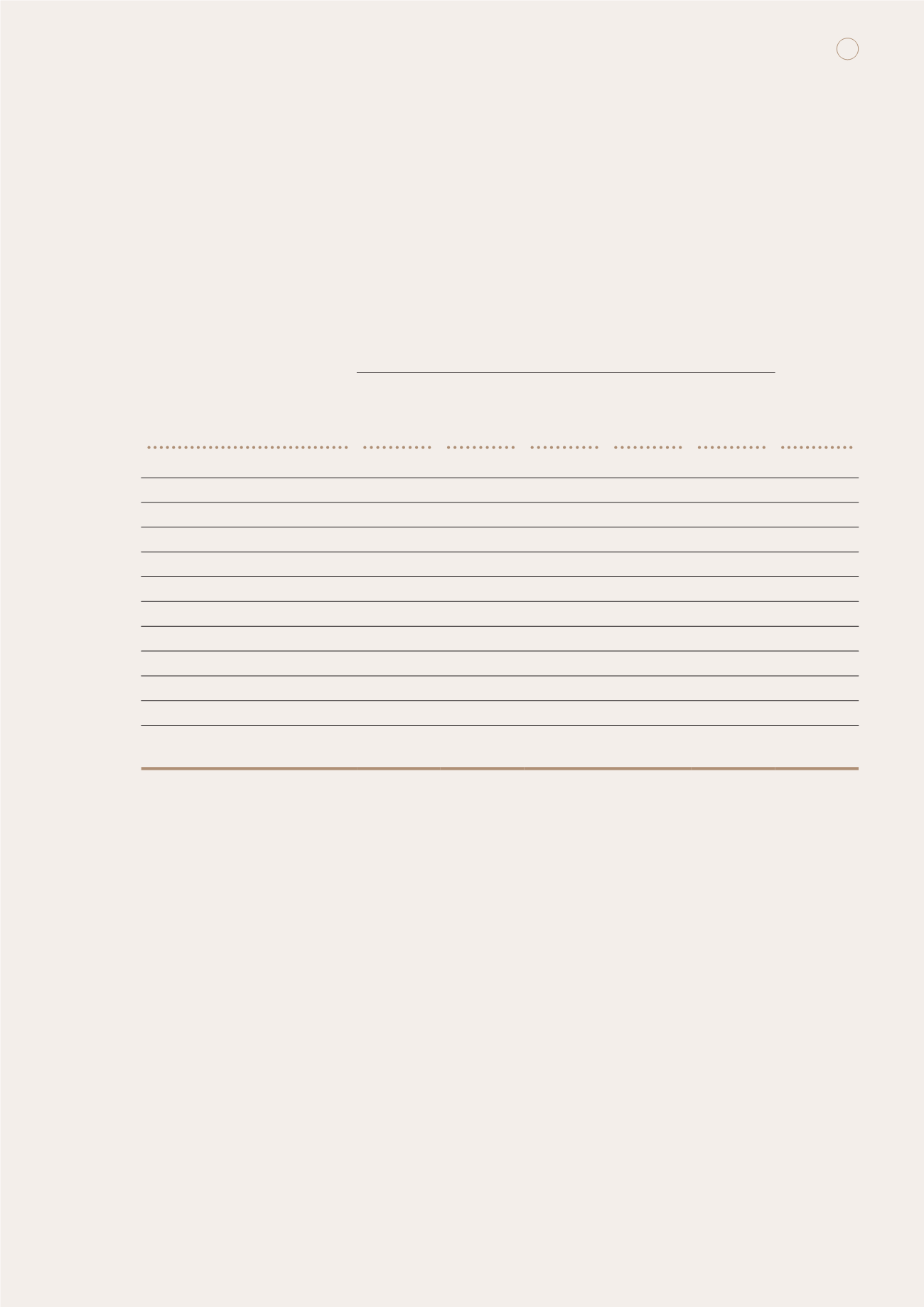

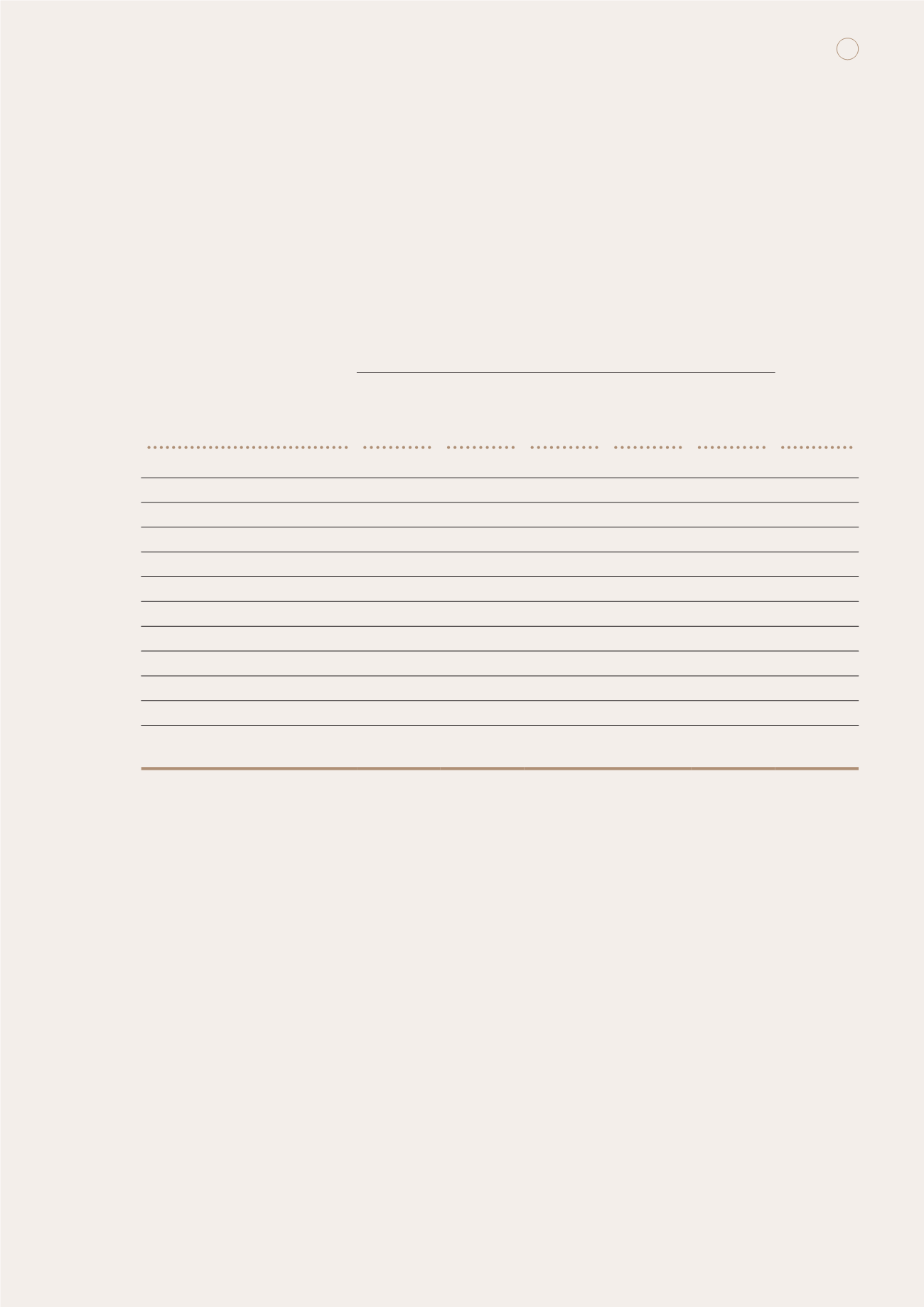

Share Option Schemes of New World China Land Limited (“NWCL”)

(continued)

Share options granted to other eligible participants

(continued)

NWCL 2011 Share Option Scheme

Date of grant

Number of share options

(1)

Exercise

price

per share

HK$

Balance

as at

1 July 2014

Granted

during

the year

(3)

Exercised

during

the year

(2)

Lapsed

during

the year

Balance

as at

30 June

2015

3 May 2012 to 30 May 2012

4,071,680

–

(1,073,280)

(200,000)

2,798,400

2.450

22 October 2012 to 16 November 2012

448,700

–

(139,200)

(110,400)

199,100

3.370

7 January 2013 to 1 February 2013

3,824,100

–

(632,580)

(452,960)

2,738,560

3.880

2 April 2013 to 29 April 2013

1,933,990

–

(104,800)

(37,200)

1,791,990

3.350

24 June 2013 to 25 June 2013

1,168,400

–

(110,400)

(165,600)

892,400

2.762

15 October 2013 to 17 October 2013

1,749,900

–

(44,800)

(230,000)

1,475,100

4.010

9 January 2014 to 13 January 2014

3,739,440

–

(355,620)

(12,800)

3,371,020

3.970

10 July 2014 to 11 July 2014

–

1,266,000

(105,600)

(286,400)

874,000

4.720

23 October 2014 to 24 October 2014

–

1,132,000

(66,000)

(264,000)

802,000

4.420

11 March 2015 to 12 March 2015

– 10,896,400

(44,000)

– 10,852,400

4.968

8 May 2015 to 11 May 2015

–

914,000

–

–

914,000

5.420

16,936,210 14,208,400 (2,676,280)

(1,759,360)

26,708,970

Notes:

(1) The share options are exercisable within five years commencing from one month after the dates of grant, provided that the

maximum number of share options that can be exercised during each anniversary year is 20.0% of the total number of the

share options granted together with any unexercised share options carried forward from the previous anniversary years.

(2) The weighted average closing prices of the shares immediately before the dates on which share options were exercised

under the NWCL 2002 Share Option Scheme and the NWCL 2011 Share Option Scheme were HK$4.890 and HK$5.085,

respectively.

(3) The closing prices per share immediately before 10 July 2014, 23 October 2014, 11 March 2015 and 8 May 2015, the dates

of offer to grant, were HK$4.69, HK$4.28, HK$4.88 and HK$5.31, respectively.

(4) The cash consideration paid by each eligible participant for each grant of share options is HK$10.0.

The fair values of the share options granted during the year with exercise prices per share of HK$4.720, HK$4.420,

HK$4.968 and HK$5.420 are estimated at HK$1.501, HK$1.335, HK$1.540 and HK$1.704 each, respectively using

the Binomial pricing model. Values are estimated based on the risk-free rate ranging from 1.17% to 1.40% per

annum with reference to the rate prevailing on the Exchange Fund Notes, a five-year period historical volatility

ranging from 37.94% to 40.52%, assuming dividend yield ranging from 0.57% to 1.68% and an expected option life

of five years.

The Binomial pricing model required input of subjective assumptions such as the expected stock price volatility.

Change in the subjective input may materially affect the fair value estimates.