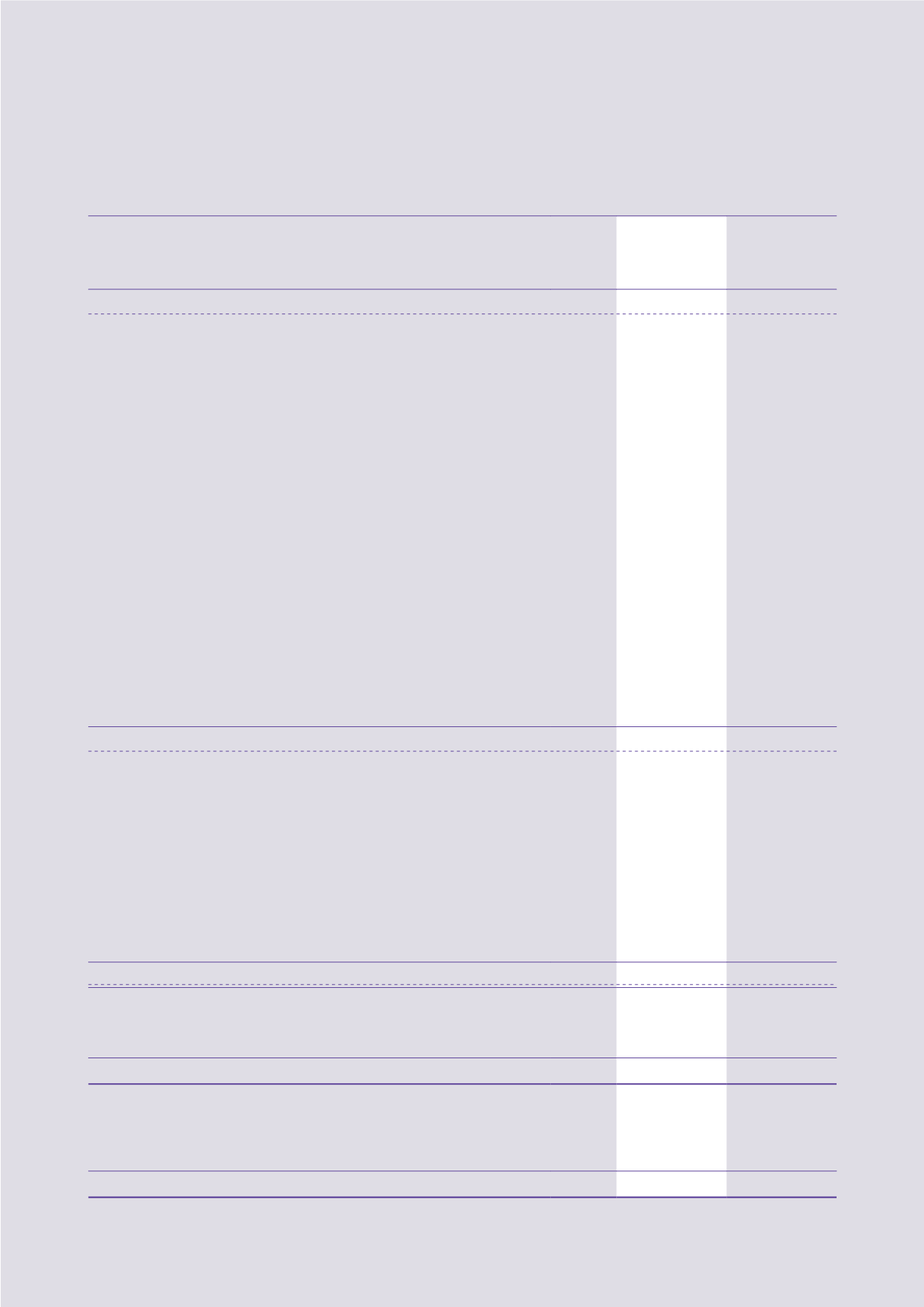

Consolidated Statement of Cash Flows

For the year ended 30 June 2016

New World Development Company Limited

114

Financial Section

2016

2015

Notes

HK$m

HK$m

Cash flows from operating activities

Net cash generated from operations

45(a)

12,364.6

13,828.6

Hong Kong profits tax paid

(1,202.7)

(764.8)

Mainland China and overseas taxation paid

(3,155.9)

(3,217.2)

Net cash from operating activities

8,006.0

9,846.6

Cash flows from investing activities

Interest received

734.6

1,022.0

Dividends received from

Joint ventures

1,491.3

3,652.4

Associated companies

615.3

258.1

Available-for-sale financial assets, perpetual securities and a financial

asset at fair value through profit or loss

693.9

31.8

Additions of investment properties, property, plant and equipment,

intangible concession rights and intangible assets

(8,920.9)

(8,987.3)

(Increase)/decrease in interests in joint ventures

(2,578.4)

397.4

Increase in interests in associated companies

(1,678.9)

(3,716.5)

Increase in other non-current assets

(53.6)

(157.5)

Increase in short-term bank deposits maturing after more than three months

(23.9)

(7.8)

Refund of deposits from potential investments

–

2,375.0

Acquisition of subsidiaries (net of cash and cash equivalents)

45(c)

(14.2)

(3,398.9)

Purchase of available-for-sale financial assets, perpetual securities

and financial assets at fair value through profit or loss

(7,818.1)

(1,178.2)

Proceeds from disposal of

Associated companies

33.8

–

Available-for-sale financial assets and financial assets at fair value

through profit or loss

1,508.0

715.2

Investment properties, property, plant and equipment and intangible

concession rights and their related assets and liabilities

1,996.8

572.7

Joint ventures

189.5

–

Non-current assets classified as assets held for sale

2,894.2

382.5

Subsidiaries (net of cash and cash equivalents)

45(e)

11,538.6

9,686.9

Net cash from investing activities

608.0

1,647.8

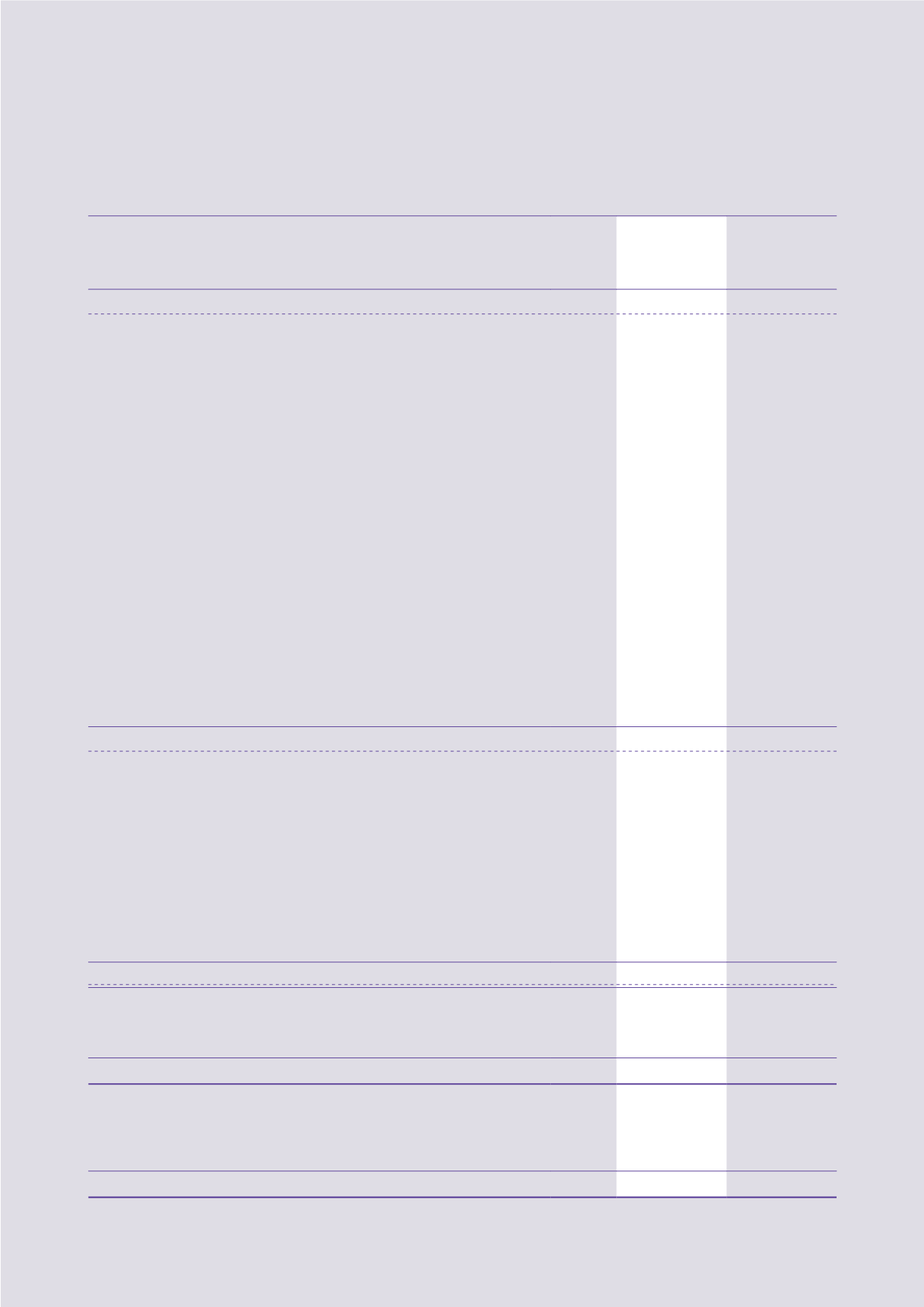

Cash flows from financing activities

Issue of fixed rate bonds and notes payable, net of transaction costs

8,590.0

7,907.3

Redemption of fixed rate bonds

–

(6,558.6)

New bank and other loans

43,570.8

22,135.3

Repayment of bank and other loans

(31,776.6)

(26,421.4)

Decrease in loans from non-controlling shareholders

(1,439.7)

(576.5)

Increase in restricted bank balances

(92.2)

(16.1)

Increase in interests in subsidiaries

(23,975.1)

–

Issue of shares

3.6

148.3

Contributions from non-controlling interests

130.9

–

Interest paid

(5,654.0)

(4,869.4)

Dividends paid to shareholders of the Company

(1,019.2)

(864.7)

Dividends paid to non-controlling shareholders

(863.0)

(4,562.6)

Net cash used in financing activities

(12,524.5)

(13,678.4)

Net decrease in cash and cash equivalents

(3,910.5)

(2,184.0)

Cash and cash equivalents at beginning of the year

58,860.5

61,077.4

Translation differences

(652.5)

(32.9)

Cash and cash equivalents at end of the year

54,297.5

58,860.5

Analysis of cash and cash equivalents

Cash at banks and on hand

33

30,129.1

22,954.4

Short-term bank deposits maturing within three months

24,155.9

35,741.1

Cash and bank balances of subsidiaries transferred to non-current assets

classified as assets held for sale

35(a)

12.5

165.0

54,297.5

58,860.5