Annual Report 2015

FINANCIAL SECTION

161

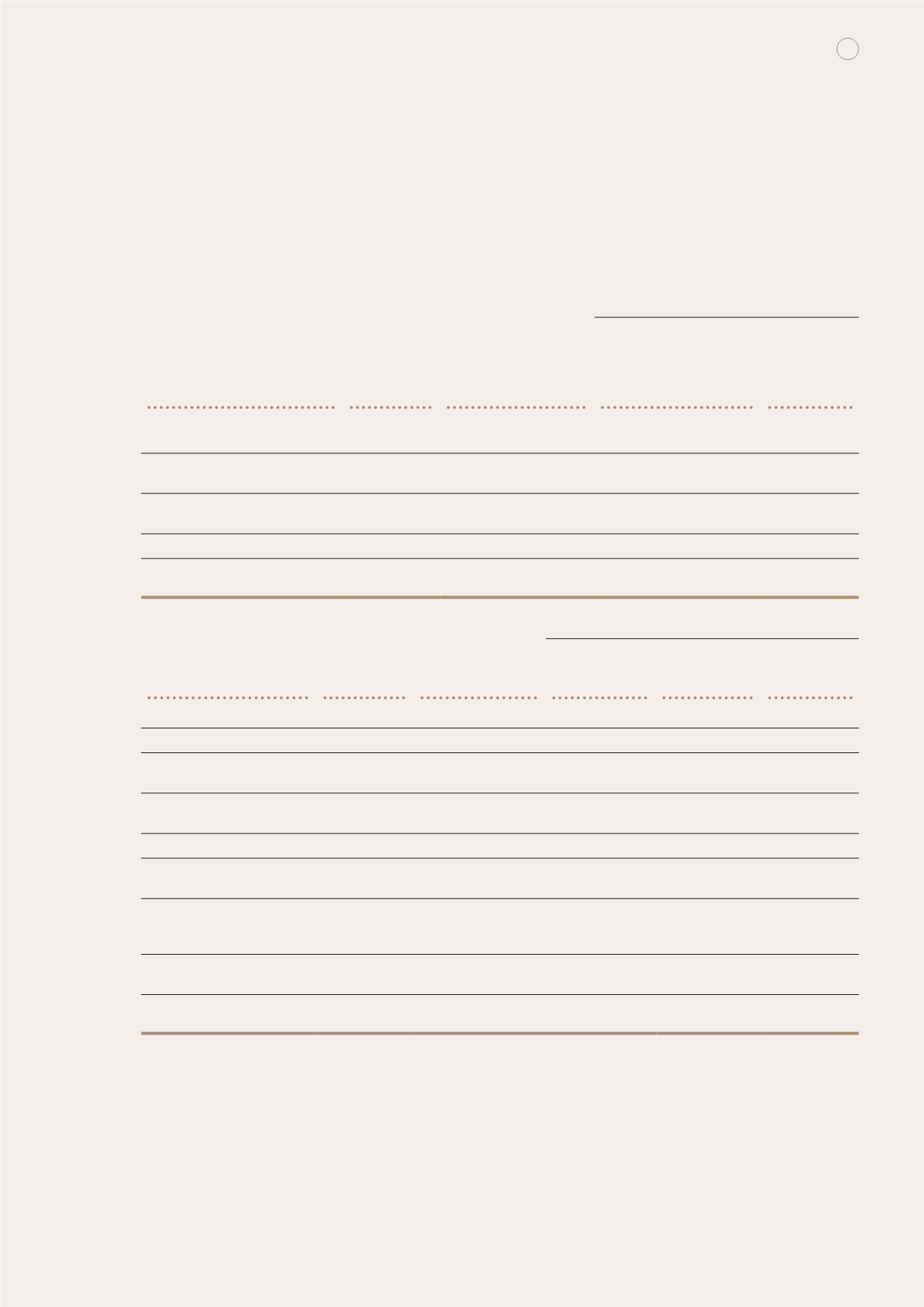

16 INVESTMENT PROPERTIES

(continued)

Valuation techniques

(continued)

Range of significant unobservable inputs

2015

Fair value

Valuation techniques

Unit price

Estimated

developer’s

profit and risk

margins

HK$m

Investment properties under

development

Commercial

31,573.3

Residual

HK$1,750–HK$53,500

per square feet

5.0%–25.0%

Carparks

1,323.3

Residual

HK$125,000–HK$262,500

per carpark space

0.3%–5.0%

Residential

83.8

Residual

HK$14,400 per square metre

7.0%

Total

32,980.4

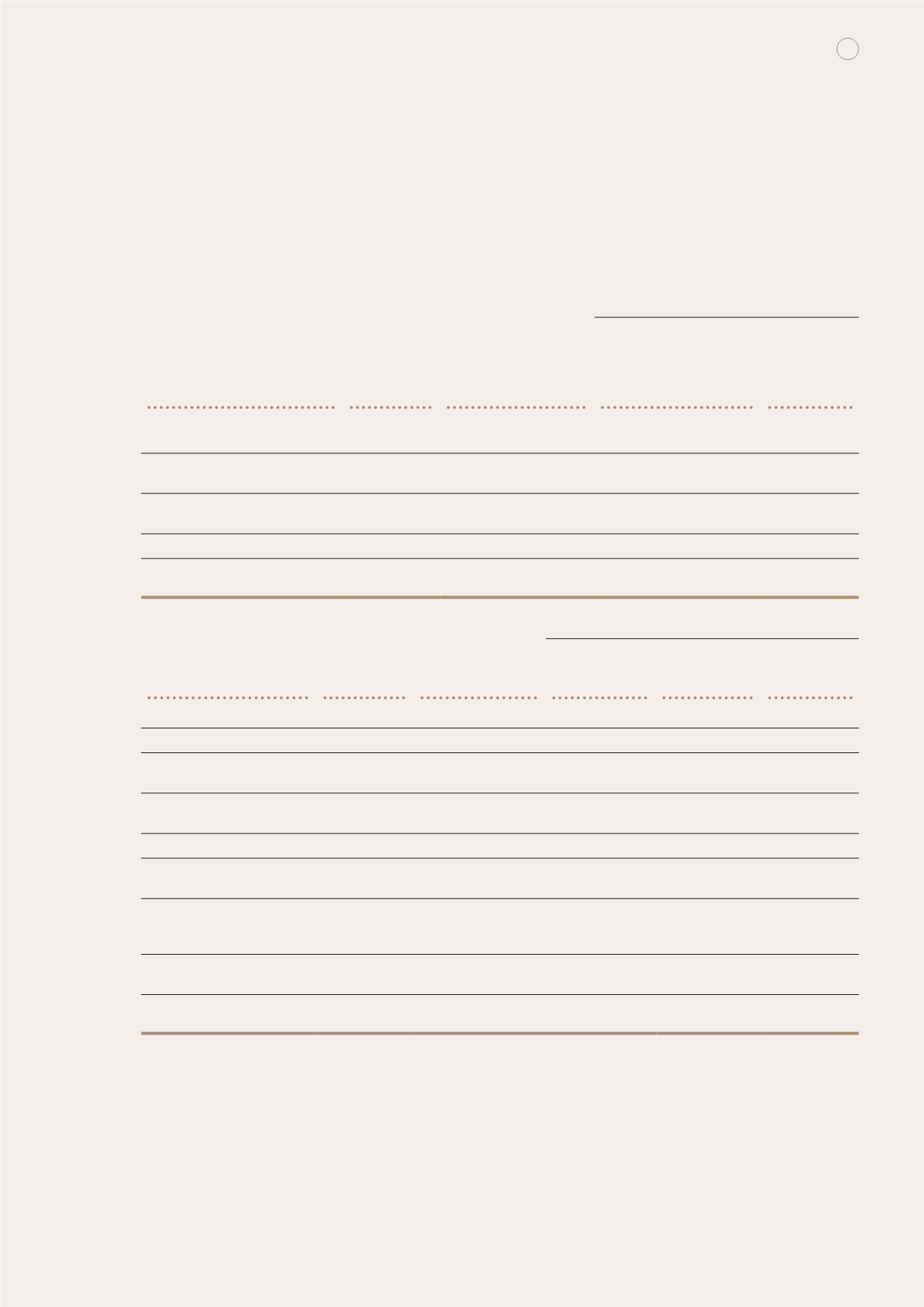

Range of significant unobservable inputs

2014

Fair value

Valuation techniques

Prevailing market

rents per month

Unit price Capitalisation

rate

HK$m

Completed investment properties

Hong Kong

Commercial

29,396.6 Income capitalisation

HK$13–HK$435

per square feet

N/A

1.6%–7.5%

Carparks

1,279.0 Income capitalisation HK$2,800–HK$4,750

per carpark space

N/A

4.3%–6.5%

Mainland China

Commercial

15,275.1 Income capitalisation

HK$23–HK$267

per square metre

N/A

4.0%–8.8%

Carparks

4,559.1 Direct comparison

N/A

HK$81,000–

HK$437,000

per carpark space

N/A

Residential

2,680.8 Income capitalisation

HK$14–HK$202

per square metre

N/A 4.0%–15.0%

Total

53,190.6