NewWorld Development Company Limited

FINANCIAL SECTION

168

20 INTANGIBLE ASSETS

(continued)

Impairment test for goodwill

(continued)

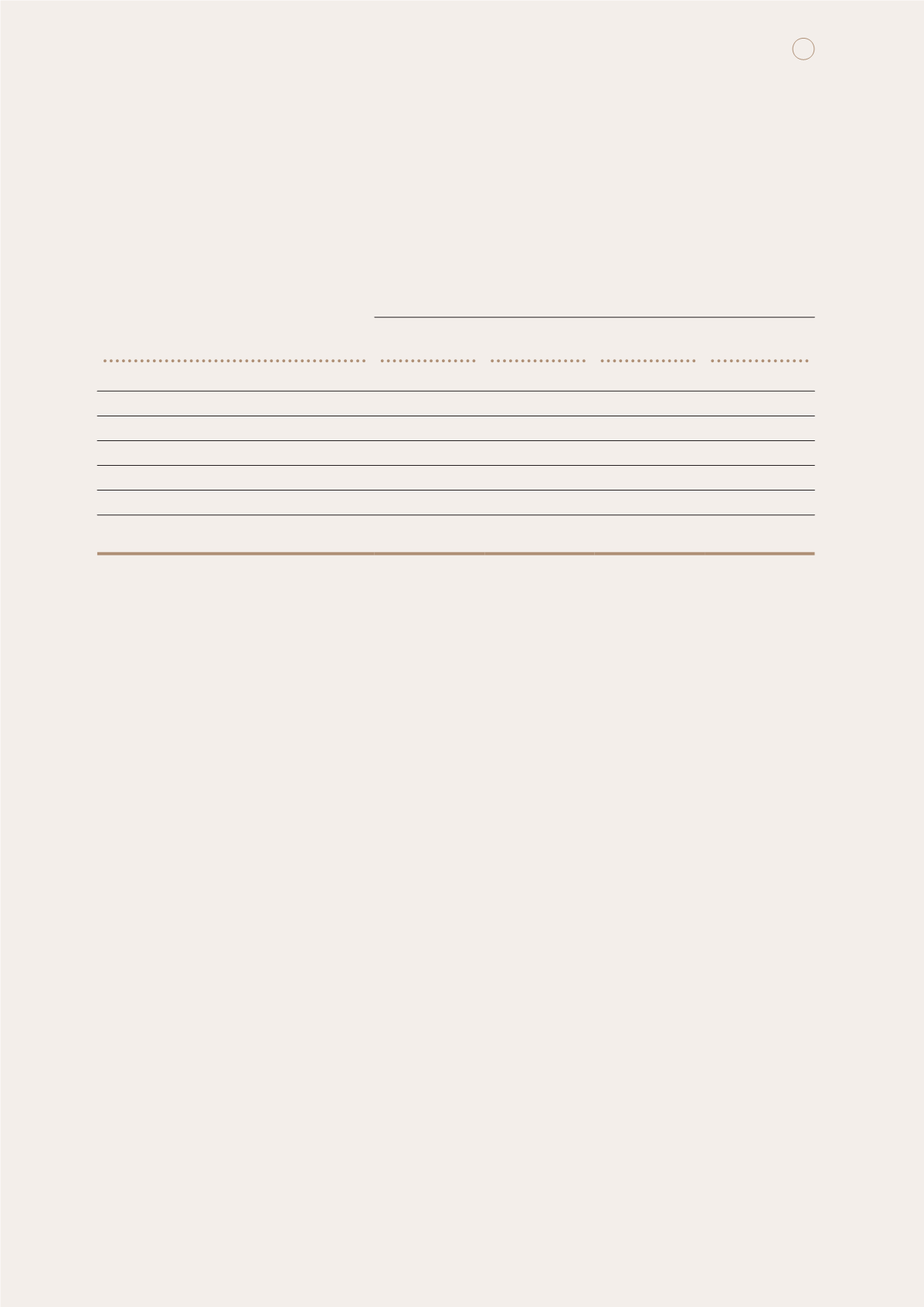

2014

Hong Kong Mainland China

Others

Total

HK$m

HK$m

HK$m

HK$m

Property development

–

14.2

–

14.2

Property investment

–

285.1

–

285.1

Service and infrastructure

849.3

–

–

849.3

Hotel operations

–

9.2

245.1

254.3

Department stores

–

1,168.2

–

1,168.2

Others

60.7

–

–

60.7

910.0

1,476.7

245.1

2,631.8

Goodwill is allocated to the Group’s cash generating units identified according to country of operation and business

segment.

For the purpose of impairment test, the recoverable amount of the business unit is determined based on either fair

value less costs to sell or value-in-use calculations whichever is higher. The key assumptions adopted on growth

rates and discount rates used in the value-in-use calculations are based on management best estimates and past

experience.

For the segment of property investment, growth rates are determined by considering both internal and external

factors relating to the relevant segments. Discount rates used also reflect specific risks relating to the relevant

segment, which was 13.6% (2014: 15.6%).

For the segment of service and infrastructure, growth rates being 0% (2014: 0% to 2%) are determined by

considering both internal and external factors relating to the relevant segment. Discount rates used also reflect

specific risks relating to the relevant segment, which were 6.3% (2014: 6.2%).

The segment of hotel operations includes hotel operations and hotel management services. The growth rates of

hotel operation of 3.5% (2014: 3.5%) are determined by considering both internal and external factors relating to

the relevant segment. Discount rates used also reflect specific risks relating to the relevant segment, which ranged

from 3.4% to 7.5% (2014: 5.1% to 7.5%).

For hotel management services in 2014, the key assumptions adopted on growth rates and discount rates used

in the value-in-use calculations were based on management best estimates. A financial budget of five-year with

growth rates ranging from 23% to 83% were determined by considering both internal and external factors relating

to the relevant segment and the hotel management contracts in the pipeline. Cash flows beyond the five-year

period were extrapolated using the estimated growth rates of 3%. Discount rate used also reflect specific risks

relating to the relevant segment, which was 18.2%.

For the segment of department stores, estimated long-term growth rates of 5% (2014: 5%) are determined by

considering both internal and external factors relating to the relevant segment. Discount rates used are post-tax and

reflect specific risks relating to the relevant segment, which were 13.6% (2014: 15.6%).