NewWorld Development Company Limited

FINANCIAL SECTION

162

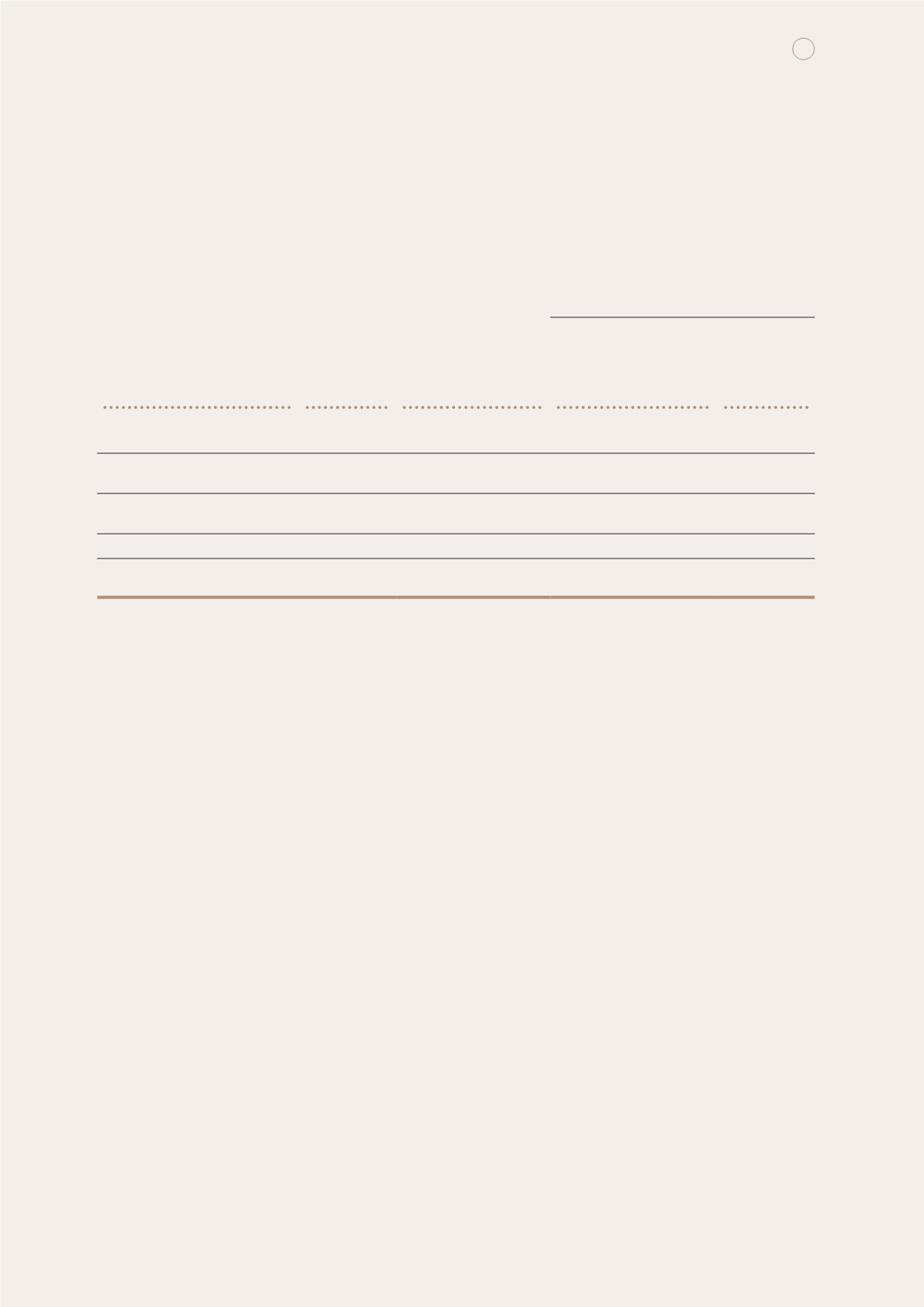

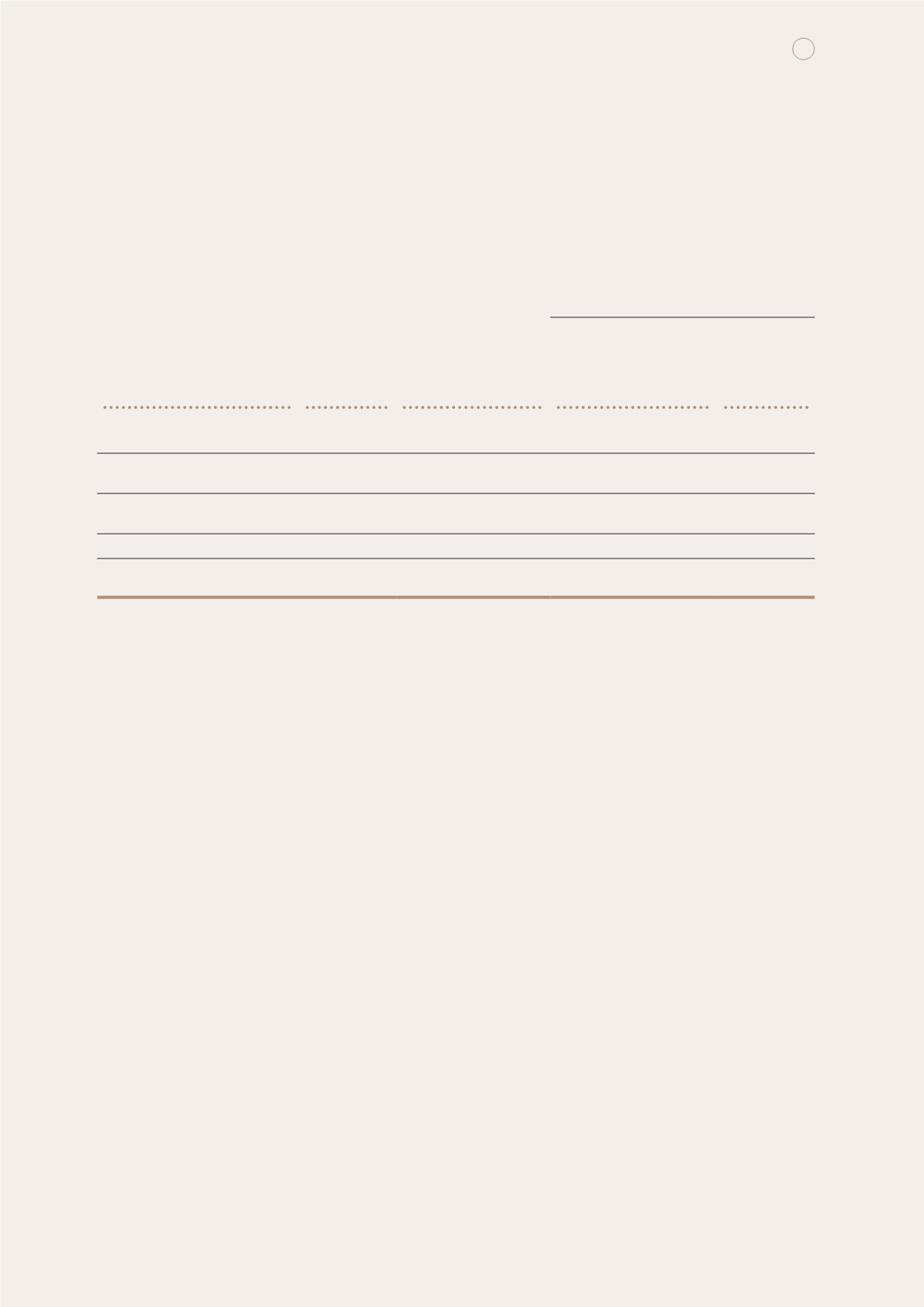

16 INVESTMENT PROPERTIES

(continued)

Valuation techniques

(continued)

Range of significant unobservable inputs

2014

Fair value

Valuation techniques

Unit price

Estimated

developer’s

profit and

risk margins

HK$m

Investment properties under

development

Commercial

23,140.1 Residual

HK$1,000–HK$21,500

per square feet

2.0%–13.0%

Carparks

974.3 Residual

HK$125,000–HK$238,000

per carpark space

2.0%–5.0%

Residential

79.6 Residual

HK$16,300 per square metre

11.0%

Total

24,194.0

Prevailing market rents are estimated based on independent valuers’ view of recent lettings, within the subject

properties and other comparable properties. The higher the rents, the higher the fair value.

Capitalisation rates and developer’s profit and risk margins are estimated by independent valuers based on the risk

profile of the properties being valued and the market conditions. The lower the rates and the margins, the higher

the fair value.

At 30 June 2015, the aggregate fair value of investment properties pledged as securities for the Group’s borrowings

amounted to HK$31,881.0 million (2014: HK$31,420.7 million) (note 39).