NewWorld Development Company Limited

FINANCIAL SECTION

176

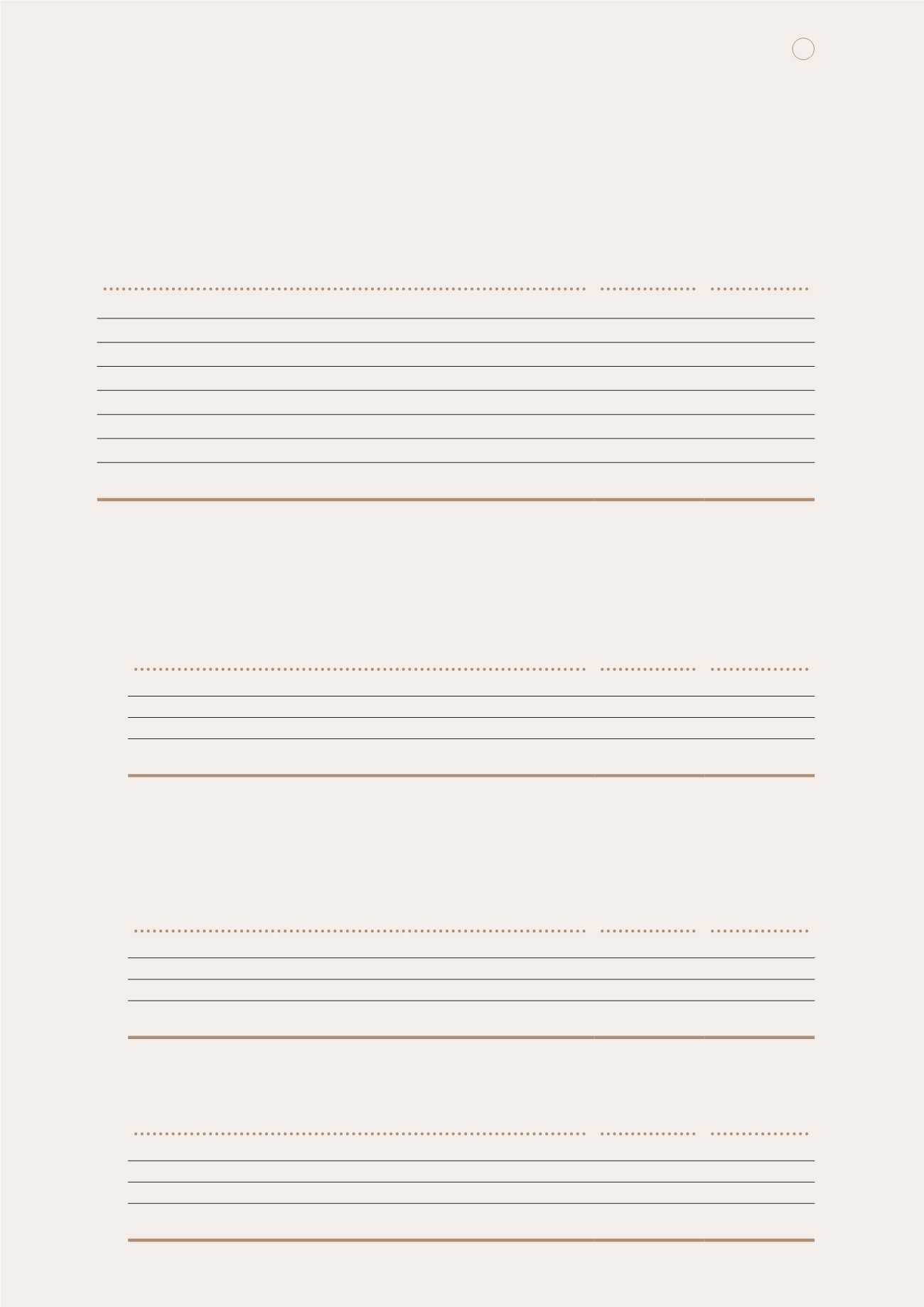

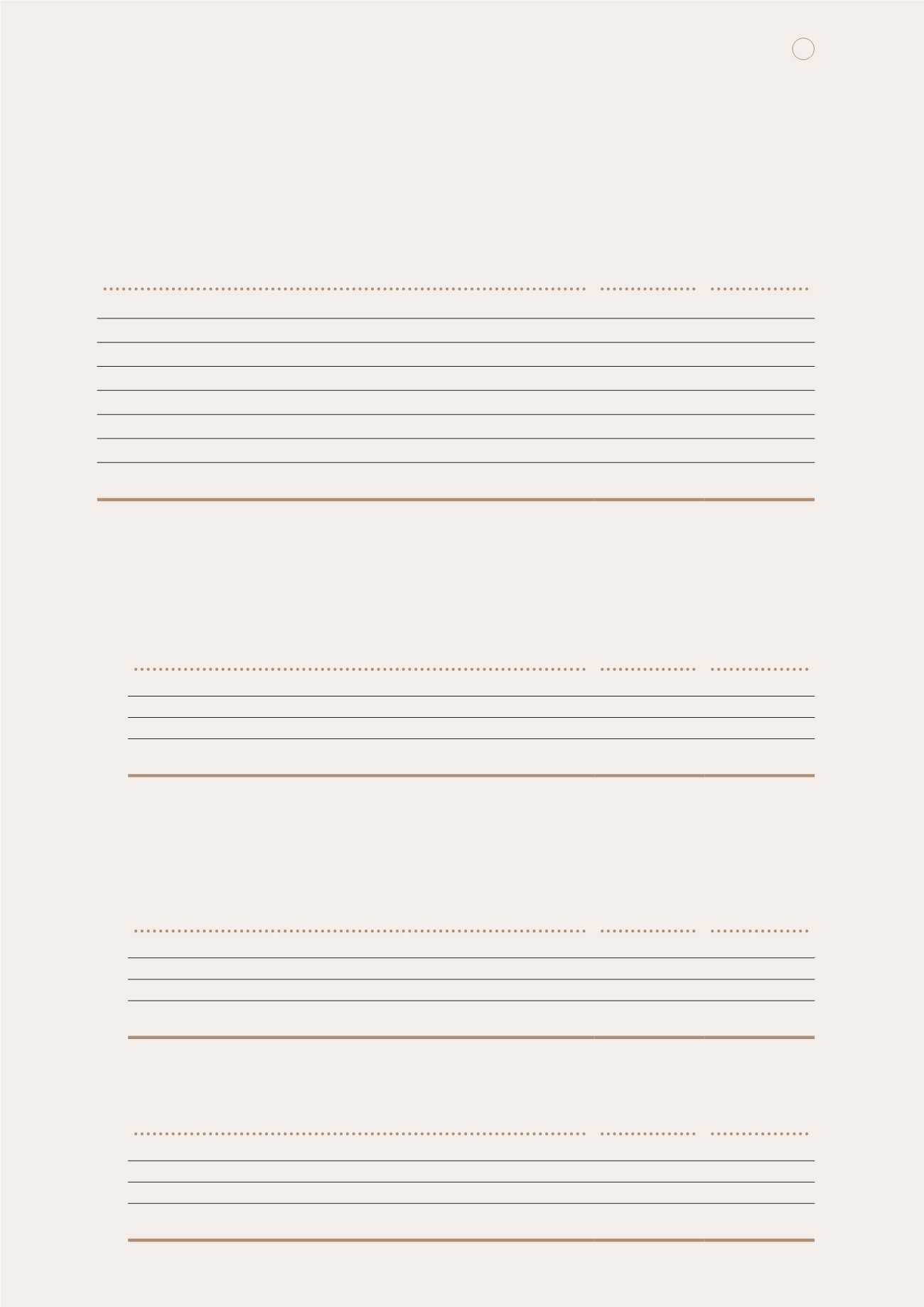

31 DEBTORS AND PREPAYMENTS

2015

2014

HK$m

HK$m

Trade debtors (note (a))

4,901.8

6,442.4

Amounts due from customers for contract work (note 34)

154.8

251.0

Retention receivable for contract work

932.0

717.6

Payment for purchase of land and land preparatory costs

5,338.2

5,019.0

Deposits, prepayments and other debtors

8,035.4

10,396.9

Amounts due from associated companies (note (f))

1,582.4

70.3

Amounts due from joint ventures (note (g))

283.3

360.9

21,227.9

23,258.1

Notes:

(a) The Group has different credit policies for different business operations depending on the requirements of the markets and

businesses in which the subsidiaries operate. Sales proceeds receivable from sale of properties and retention receivable in

respect of construction services are settled in accordance with the terms of respective contracts.

Aging analysis of trade debtors based on invoice date is as follows:

2015

2014

HK$m

HK$m

Current to 30 days

2,859.5

3,751.6

31 to 60 days

595.1

731.1

Over 60 days

1,447.2

1,959.7

4,901.8

6,442.4

There is no concentration of credit risk with respect to trade debtors as the customer bases are widely dispersed in different

sectors and industries.

(b) At 30 June 2015, trade debtors of HK$1,716.6 million (2014: HK$2,881.1 million) were past due but not impaired. These

relate to a number of independent customers for whom there is no recent history of default. The aging analysis of these

trade debtors is as follows:

2015

2014

HK$m

HK$m

Current to 30 days

767.2

1,275.2

31 to 60 days

42.5

483.6

Over 60 days

906.9

1,122.3

1,716.6

2,881.1

At 30 June 2015, trade debtors of HK$56.6 million (2014: HK$34.8 million) were impaired. The aging analysis of these

debtors is as follows:

2015

2014

HK$m

HK$m

Current to 30 days

0.9

0.7

31 to 60 days

0.6

1.0

Over 60 days

55.1

33.1

56.6

34.8