NewWorld Development Company Limited

EXECUTIVE VICE-CHAIRMAN’S REPORT

24

HONG KONG INVESTMENT

PROPERTY

The retail industry in Hong Kong was

undergoing an adjustment stage.

Since the launch of the Individual

Visit Scheme in 2003, the spending

by inbound visitors from Mainland

China has been a strong support for

the Hong Kong retail industry and the

rental of retail shops. Nevertheless,

with more experience in travelling

and spending, the rapid growth of the

middle class, and the implementation

o f t h e Ce n t r a l Go v e r nme n t ’ s

anti-corruption policies, inbound

visitors from Mainland China have

demonstrated prominent changes

in their consumption patterns, from

the preference for high-end luxury

goods and jewellery and watches to

mid-range brands and mass market

products gradually, and from touring

core tourism districts to sightseeing

a t p e r i p h e r a l a r e a s o f l o c a l

neighbourhoods. Meanwhile, local

consumption maintained a steady

pace of development, under the

favourable economic climate and low

unemployment rate in recent years.

The pursuit from youngsters and the

middle class for trendy and unique

lifestyle drove relevant consumption,

attracting some brands with the same

style establishing their footprints in

Hong Kong for the first time.

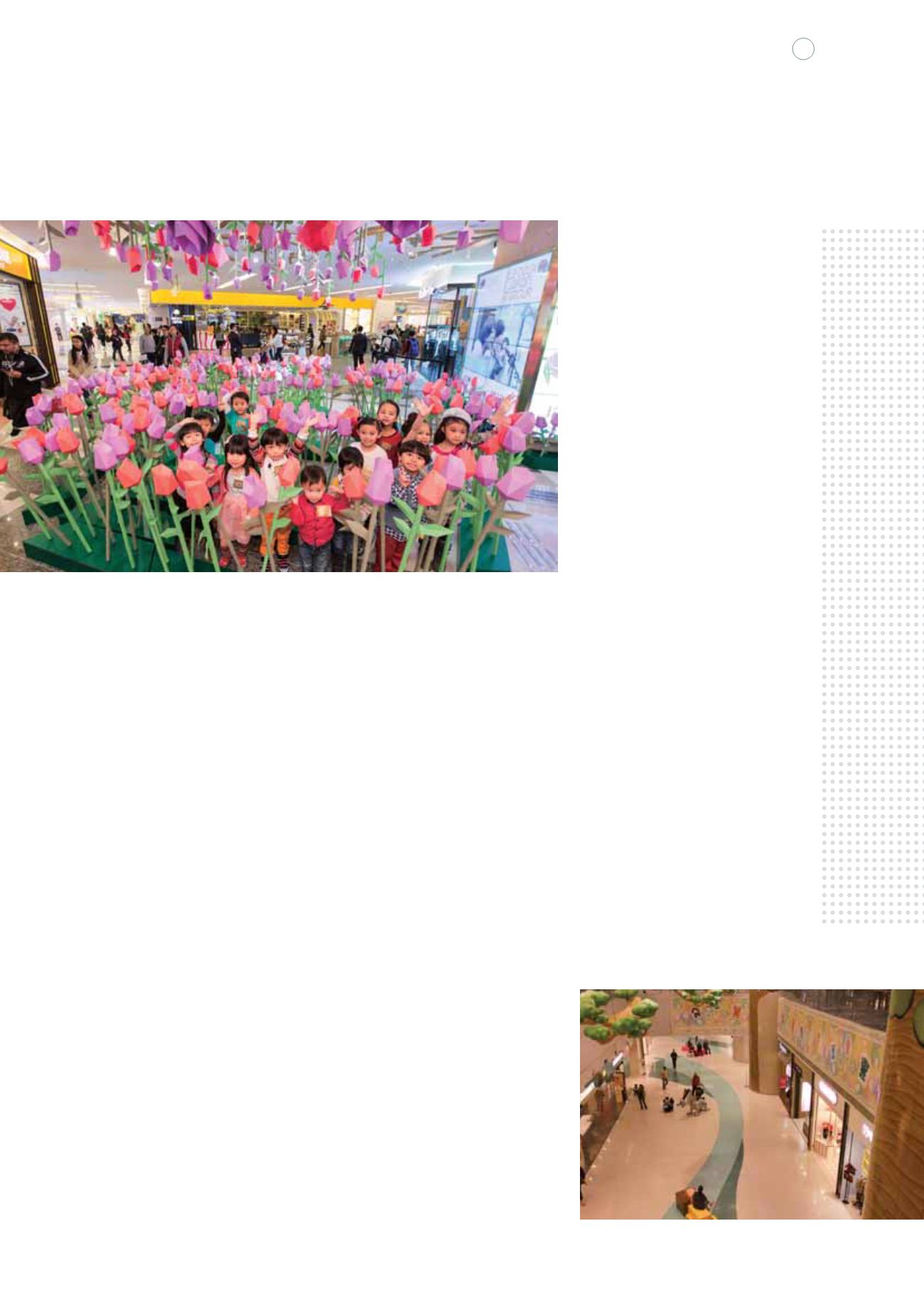

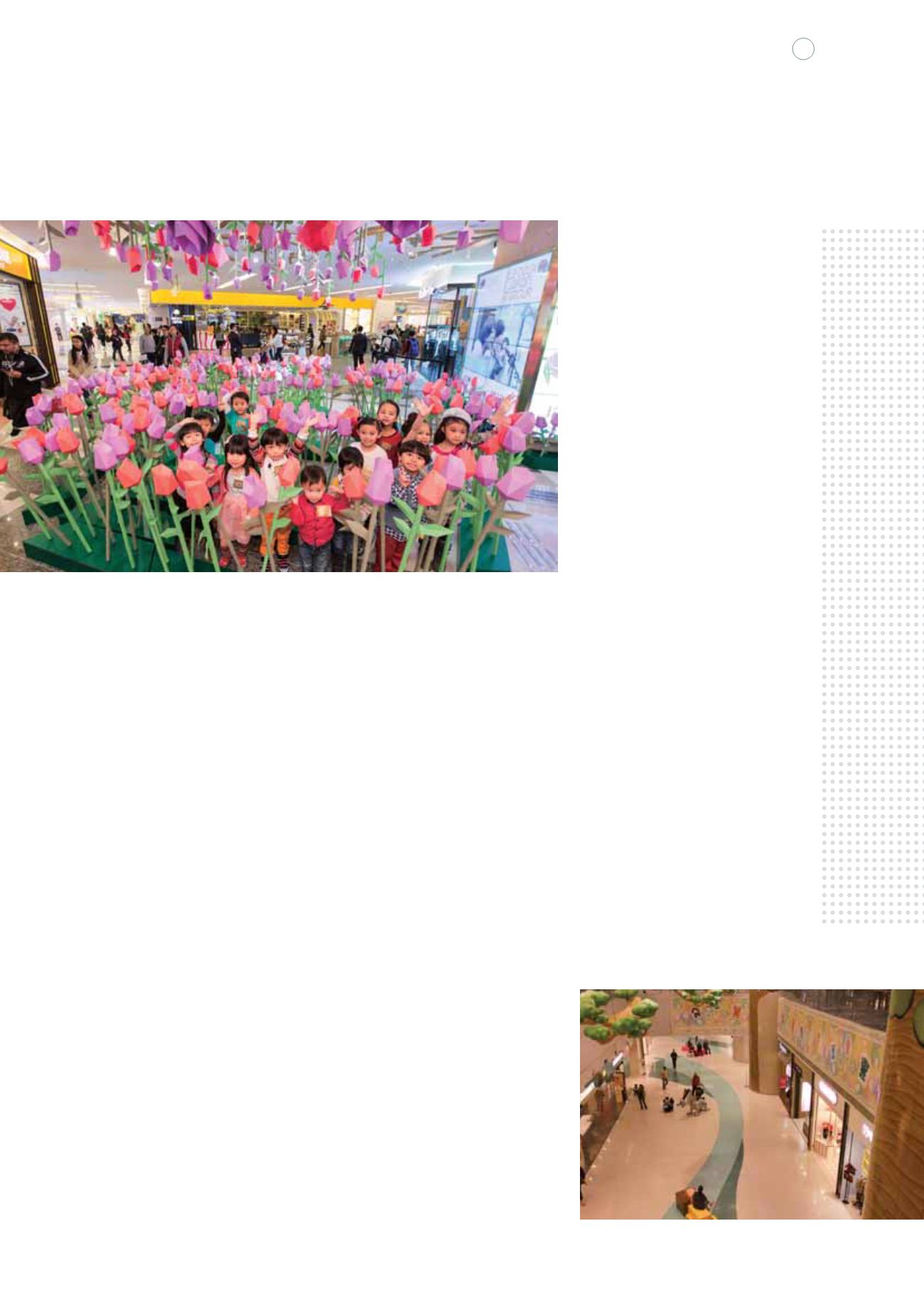

In response to the opportunities

brought by the above changes, many

mall owners had in recent years

proactively reviewed the layout

and visitor flow of their projects,

enhanced the variability in physical

facilities, reshuffled the brand and

retail mix and brought in assorted

themes and activities, aiming at

uplifting the appeals, catering for the

changing consumer taste, and in turn

stabilising the rental performance

of the projects. For some street

shops at prime retail locations, the

diminished sales performance of

luxury goods had led to the removal

of relevant luxury brands which used

to be willing to lease at higher rents,

and in turn heightened vacancy rate

of those street shops. In view of this,

and owing to the lower variability of

street shops as compared to malls,

the sole strategy available to these

owners was to adjust rental rates to

attract the original and new tenants to

lease, resulting in a larger downward

pressure on the rental rates of street

shops at prime retail locations.

The overall sentiment of economic

activities in Hong Kong was positive,

with expedited business expansion

of enterprises relating to banking

and finance sectors, including the

commencement of operations in

Hong Kong for many enterprises

eng a ged i n f i n a n c i a l s e r v i c e s

following the official launch of

Shanghai-Hong Kong Stock Connect

at the end of 2014. Furthermore, the

interest rate cut policy promulgated

in Mainland China since 2014 and the

reduction in deposit reserve ratios for

financial institutions by the People’s

Bank of China gave rise to the

sufficient capital in Mainland China

and its flow to the Hong Kong capital

market contributing to the robust IPO

activities in Hong Kong. In the first

half of 2015, Hong Kong, being the

first time, raised the most funds from

IPO in the world. The entry of newly-

listed enterprises stimulated the

demand for quality office space. In

June 2015, the vacancy rate of office

buildings in Central was 1.7%, which

was the lowest since the outbreak

of global financial crisis in late 2008.

The vacancy rate in the overall market