Annual Report 2015

EXECUTIVE VICE-CHAIRMAN’S REPORT

29

rental performance of Shanghai

Hong Kong New World Tower.

F u r t h e r mo r e , p o s i t i v e r e n t a l

reversion has been achieved for

Wuhan New World International

Trade Tower upon tenancy renewal.

The abovementioned factors have

provided upside support to NWCL’s

rental businesses.

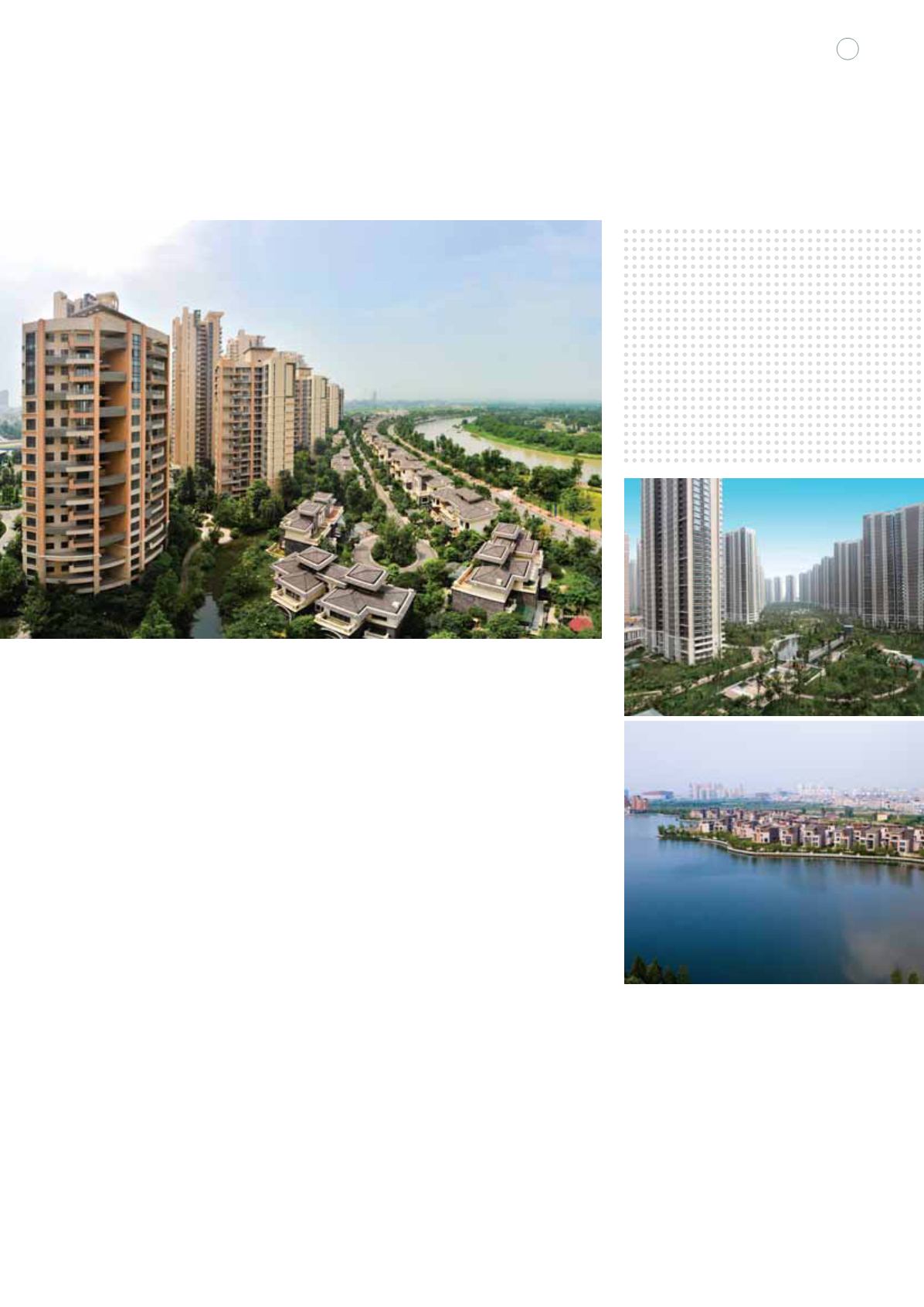

located in Guangzhou, Shenzhen,

Shenyang, Tianjin, Wuhan and Beijing.

The overall contracted property sales

of NWCL in FY2015 reached a total

GFA of 1,090,891 sq m and the

gross sales proceeds amounted to

RMB15.4 billion.

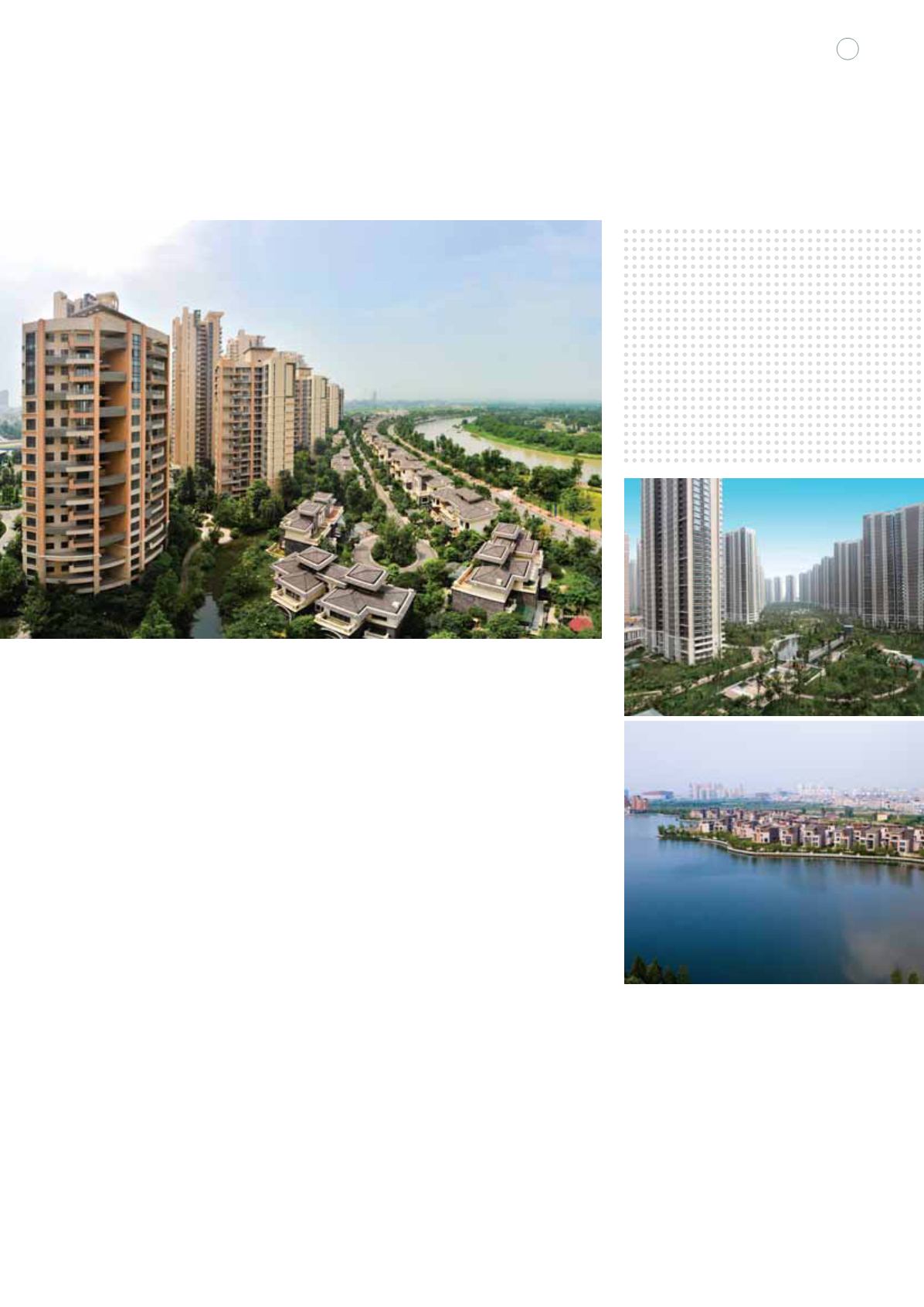

Du r i ng t he yea r unde r r ev i ew,

NWC L ’ s c omp l e t e d p r o p e r t y

development projects for sale in

Mainland China amounted to a

total GFA of 1,089,163 sq m, of

which residential GFA amounted

to 1,015,223 sq m. In FY2016, it is

anticipated to complete property

development projects totalling a GFA

of 1,254,982 sq m in Mainland China,

of which residential GFA will amount

to 1,047,432 sq m.

The opening of Shanghai K11 Art

Mall has stimulated the patronage,

o c c u p a n c y a n d e n h a n c e d t h e

New World China Land Limited

(“NWCL”) is the flagship Mainland

China property arm of the Group. The

development portfolio comprises 30

major projects spanning over several

large cities or major transportation

hubs in Mainland China. During the

year under review, NWCL achieved

a profit attributable to shareholders

of HK$3,313.1 million, representing a

decrease of 28.6% year-on-year.

Taking into account the attributable

revenue from the joint-development

projects, the revenue and segment

results from property development in

Mainland China during the year under

review amounted to HK$15,292.7

million and HK$4,837.7 million

respectively, representing a decrease

of 22.6% and 35.6% year-on-year.

The contributions from property

development in Mainland China

was mainly attributable to the sales

of residential units in the projects