NewWorld Development Company Limited

EXECUTIVE VICE-CHAIRMAN’S REPORT

28

the aim for stabilising spending on

residential housing and supporting

the housing demand from those

seeking to acquire their dwellings as

well as those dwelling upgraders,

in fostering the steady and healthy

d e v e l o pme n t o f t h e p r o p e r t y

sector. Such series of favourable

measures were considered by the

market as indications of the Central

Government’s focus on unlocking

demand for residential housing,

stimulating domestic demand, and

seeking a breakthrough beyond the

current bottleneck in the development

of the nation’s real estate market and

its overall economic growth. In view

of the opportunities presented by

the policy adjustments, developers

were actively preparing for their

new development plans as well as

adjusting the combination of project

launches in order to foster sales.

According to the National Bureau of

Statistics, in the first half of 2015, the

aggregate floor area sold and sales

proceeds of residential properties on

a nationwide basis grew at 4.5% and

12.9% year-on-year respectively.

factors, rigid demand in residential

housing was to a certain extent

unlocked in the property market in

Mainland China, and the sentiment

on residential property sales started

to improve.

Back in 2014 during the annual

sessions of the National People’s

Congress (“NPC”) and the Chinese

Peop l e ’ s Po l i t i ca l Consu l t a t i ve

Conference (“CPPCC”), Premier

L i K e q i a n g a l r e a d y p r o p o s e d

the adoption of category-based

regulatory measures and bilateral

regulatory measures for the real

estate market, as opposed to the

previous adherence to the steadfast

control over the real estate market,

bearing testimony to the Chinese

Government’s advocacy of the reform

direction under which the real estate

market shall become more driven by

market forces. In the Report on the

Work of the Chinese Government

released during the annual sessions

of the NPC and the CPPCC in 2015,

the Chinese Government articulated

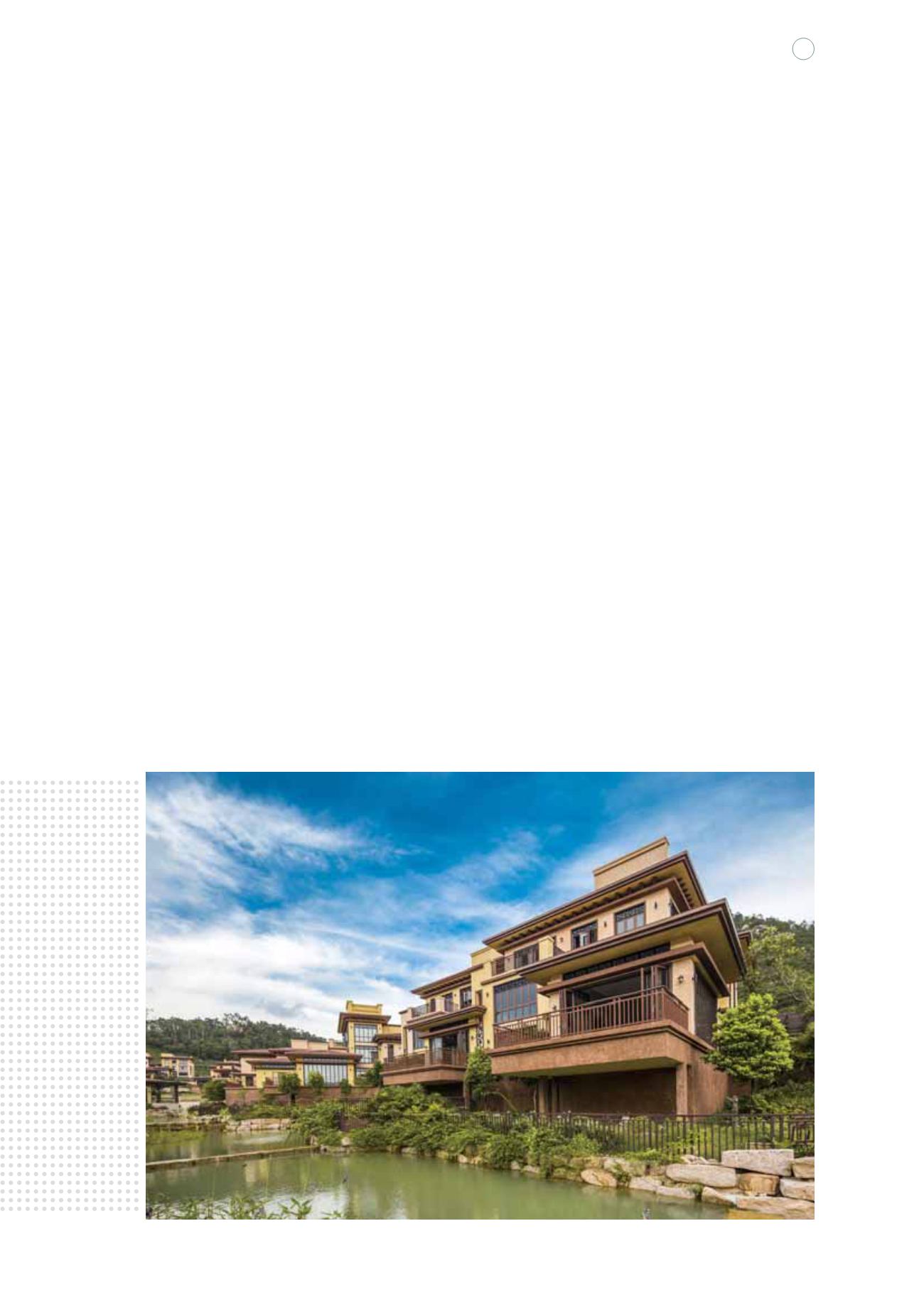

MAINLAND CHINA

PROPERTIES

To alleviate the vast demand for

housing and the downside pressure

on economic growth, it was jointly

announced by the People’s Bank of

China and China Banking Regulatory

Commission in September 2014

that mortgage restrictions applicable

to the property market were to be

relaxed. Accordingly, for a family

purchasing its first ordinary dwelling,

the minimum down payment on

mortgage was set at 30% and the

minimum interest rate of mortgage

lending was set at 0.7 times of

the benchmark lending rate; while

mortgage lending for the purchase of

a second dwelling was to be subject

to a much lower barrier than before.

At the same time, the home purchase

restriction policies adopted by local

governments were gradually relaxed

in most cities in Mainland China with

effect from the third quarter of 2014.

In late November 2014, interest rate

cut was announced by the People’s

Bank of China. Under such favourable