Annual Report 2016

37

Managemen t D i s cu s s i on and Ana l y s i s

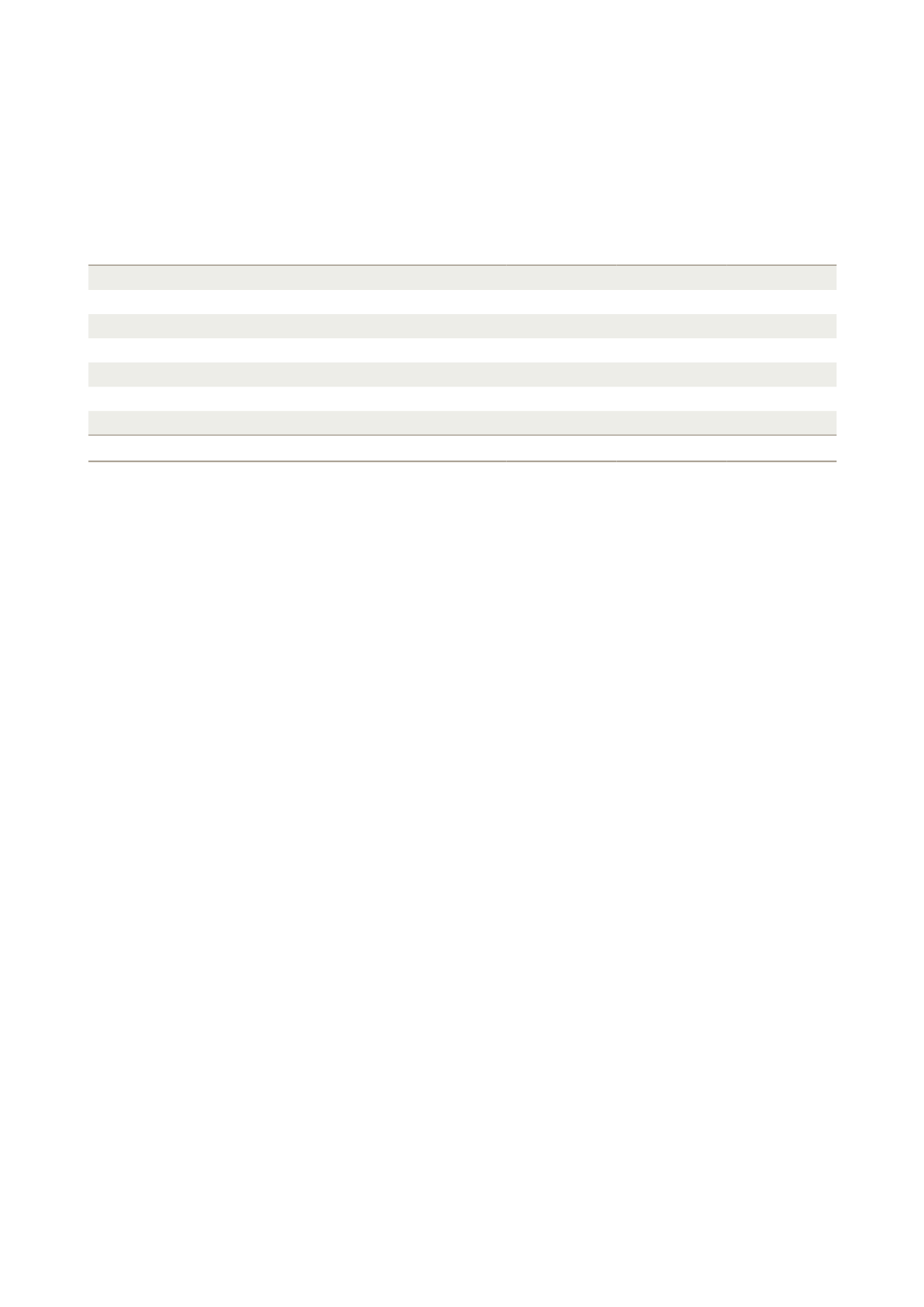

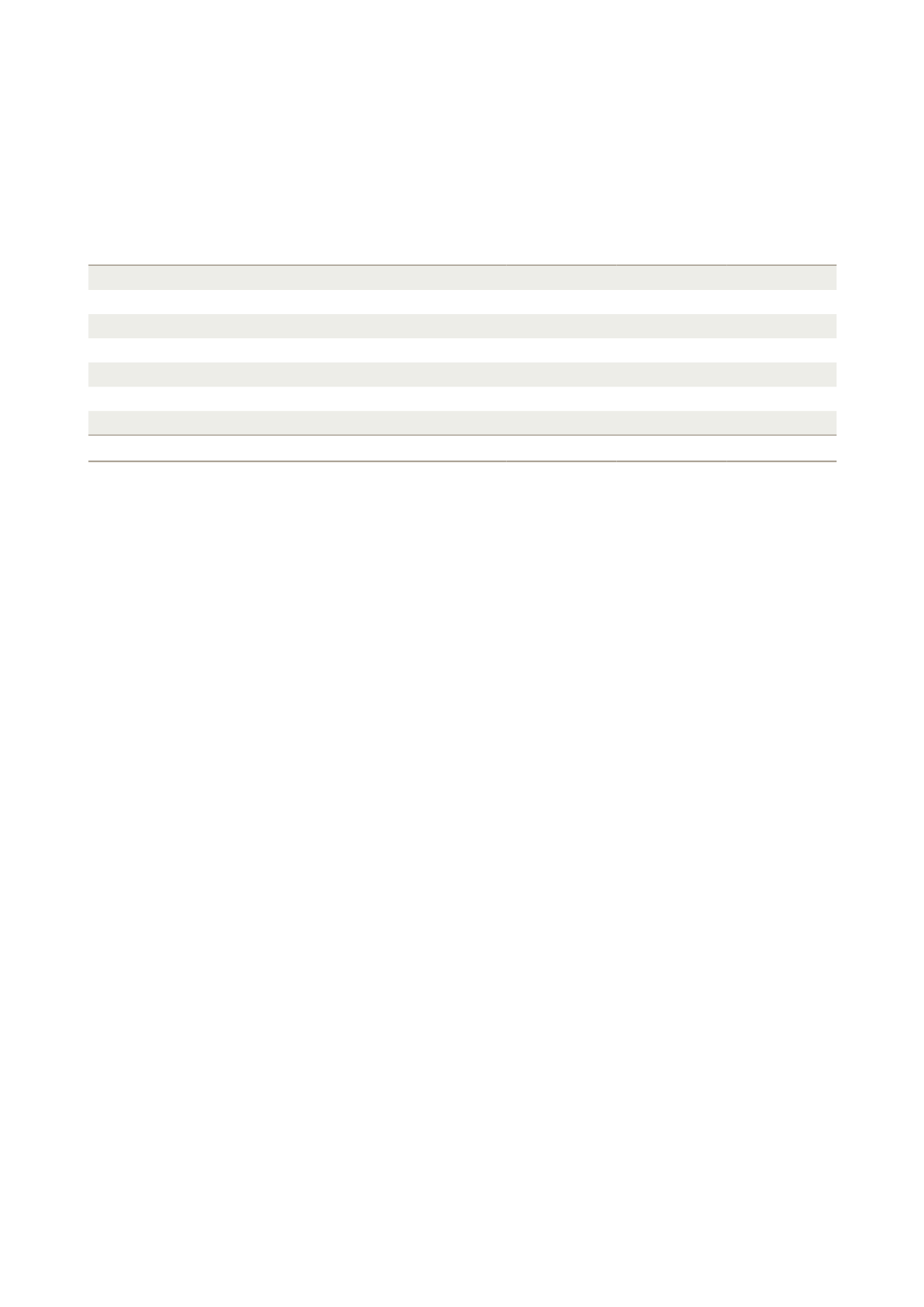

Analysis of Segment Results

FY2016

FY2015

Year-on-year

HK$m

HK$m

change

Property development

7,371.8

8,132.8

(9.4%)

Property investment

1,829.2

1,916.7

(4.6%)

Service

1,519.1

1,504.0

1.0%

Infrastructure

3,042.5

2,711.2

12.2%

Hotel operations

(203.3)

244.7

(183.1%)

Department stores

205.0

307.4

(33.3%)

Others

233.2

(264.3)

188.2%

Total

13,997.5

14,552.5

(3.8%)

Property development

Segment results of property development for FY2016 amounted to HK$7,371.8 million, down 9.4%.

Segment results derived from Hong Kong decreased by 9.6% year-on-year. This was mainly attributable to variations in the

mix of recognised property sales, as well as the incurrence of preliminary marketing expenses for the pre-sale of property

developments. Segment results comprised mainly contributions from several residential projects, namely, “THE PAVILIA HILL”

in North Point, “THE PARKHILL” in Yuen Long, and “Double Cove Starview Prime” and “Double Cove Grandview” in Ma On

Shan, together with the sales of residential units for projects completed in previous fiscal years.

During the year under review, contracted sales in Hong Kong attributable to the Group amounted to HK$6.6 billion. In

addition, the Group launched six new residential projects during the year under review, namely, “SKYPARK” in Mongkok,

“Double Cove Grandview” in Ma On Shan, “THE PARKHILL” in Tong Yan San Tsuen, “55 Conduit Road” in Mid-levels West,

“Double Cove Summit” in Ma On Shan and “BOHEMIAN HOUSE” in Sai Ying Pun and Sheung Wan.

In particular, “BOHEMIAN HOUSE”, a boutique residential development on Hong Kong Island launched by the Group in May

2016, was met with overwhelming market response. Out of the 191 units offered, only one unit was left unsold as at the end

of August 2016.

Segment results derived from Mainland China decreased by 9.2% year-on-year, reflecting mainly the decline in the volume of

completions and lower overall gross profit margin from property sales. Segment results comprised mainly contributions from

property sales in Shenzhen, Guangzhou, Shenyang, Wuhan and Tianjin.

During the year under review, the Group’s overall property contracted sales in Mainland China amounted to RMB22.9 billion.

Property investment

Segment contributions from property investment for FY2016 amounted to HK$1,829.2 million, down 4.6% year-on-year.

Segment results derived from Hong Kong were down 3.2% as compared to the previous year. Such decrease was mainly

attributable to the expiry of the contract for the MacDonnell Road project in Mid-levels and the incurrence of pre-operating

marketing expenses for certain projects.

As a matter of fact, the Group’s gross rental income in Hong Kong increased by 5.8% to HK$1,573.2 million, while satisfactory

occupancy rates were also reported for its leasing properties for the year under review, despite the overall soft retail market

in Hong Kong. In particular, Hong Kong K11, which is located in the traditional core retail and tourism cluster of Tsim Sha

Tsui, recorded an occupancy rate of close to 100% for the year under review. In addition, D•PARK, “the World’s First Multiple

Intelligence Kids Mall” located in the centre of Tsuen Wan, also made positive contributions to the leasing business in Hong

Kong following its grand opening in April 2016.