Annual Report 2016

27

Execu t i v e V i ce - Cha i rman ’s Repo r t

During the year under review, NWD’s proposal to privatise

NWCL was supported by shareholders of both companies,

enabling the proposal to proceed. In January 2016, NWD

proposed to acquire, by way of a general offer, all the issued

shares of NWCL and to cancel all the outstanding options of

NWCL. As at 5 April 2016, NWD had received acceptances of

the privatisation proposal in respect of more than 2,688

million shares or 98.65% and 100% of the share options

holders also tendered their acceptance, thereupon the share

offer had become unconditional and NWD exercised its

rights to compulsorily acquire the remaining NWCL shares.

On 3 Au g u s t 2 0 1 6 , t h e c omp u l s o r y a c q u i s i t i o n wa s

completed and NWCL has become an indirect wholly owned

subsidiary of NWD. NWCL continues to manage all the

Group’s property projects in Mainland China. The listing of

the NWCL shares was withdrawn from the Hong Kong Stock

Exchange on 4 August 2016.

In FY2016, the revenue and segment results from property

development in Mainland China, including the revenue from

the joint-development projects, amounted to HK$15,586.0

million and HK$4,393.2 million respectively. The contribution

from property development in Mainland China was mainly

attributable to the sales of the projects located in Shenzhen,

G u a n g z h o u , S h e n y a n g , Wu h a n a n d T i a n j i n . O v e r a l l

contracted property sales in Mainland China in FY2016

reached a total GFA of 1.3 million sq m and the gross sales

proceeds amounted to RMB22.9 billion.

During the year under review, the completed property

development projects for sale and investment property

projects in Mainland China amounted to a total GFA of

668,183 sq m and 167,604 sq m respectively, of which

residential GFA amounted to 480,037 sq m. In FY2017, it is

anticipated to complete property development projects for

sale in Mainland China amounted to a GFA of 1,694,380

sq m, of which residential GFA will amount to 1,379,531 sq m.

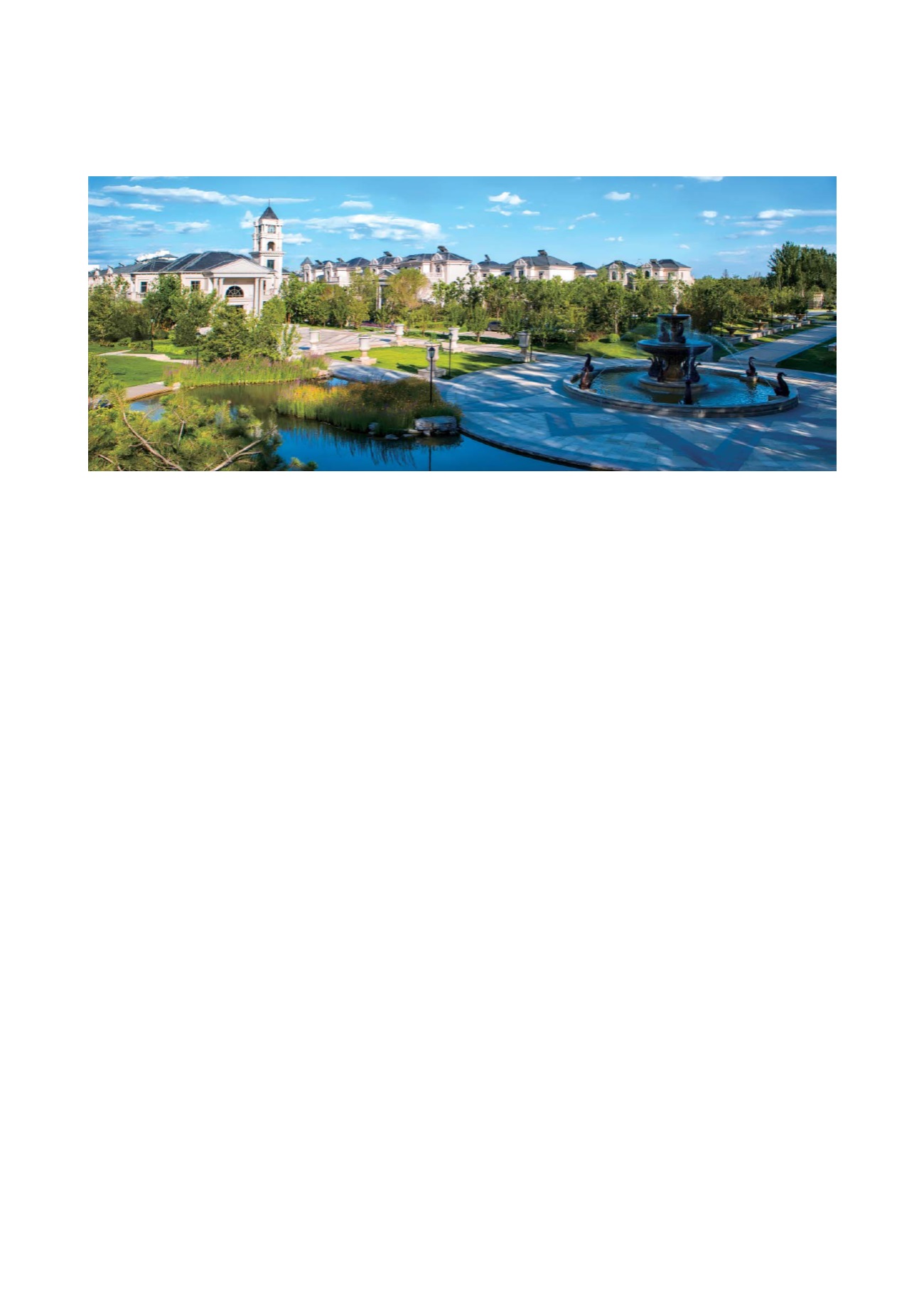

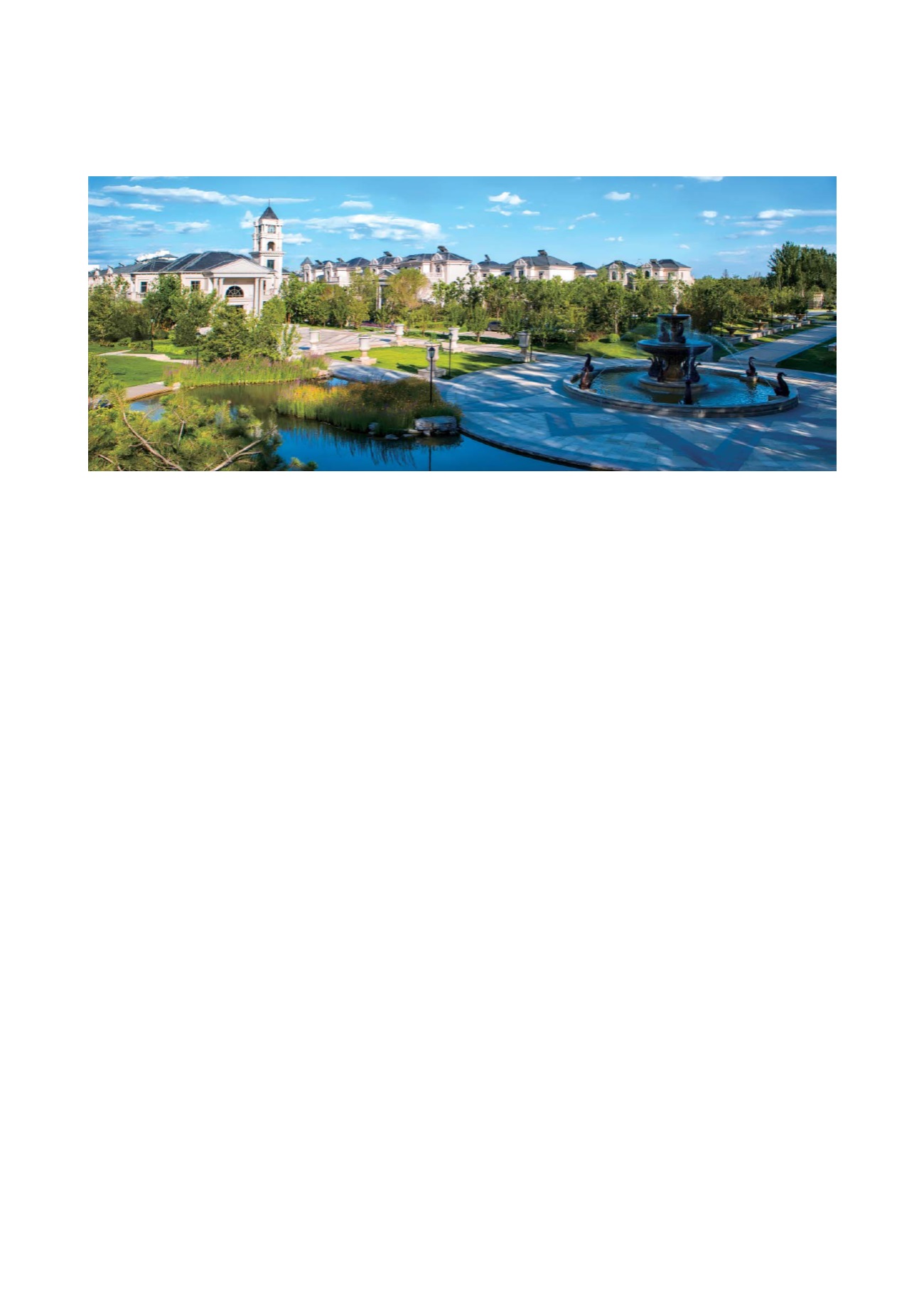

For property leasing in Mainland China, the opening of

Shanghai K11 has enhanced rental performance of the

Group’s trophy asset Shanghai Hong Kong New World Tower.

The outperformance of Wuhan New World International Trade

Tower, the key super grade A office in Central China, provided

satisfactory rental contributions and achieved positive rental

reversion upon tenancy renewal. Furthermore, the high-end

residential cluster of the luxurious serviced apartment Canton

Re s i denc e i n Pea r l R i v e r New Town , Guang z hou ha s

generated strong rental income.

In December 2015, NWCL successively disposed of interests

in five property projects, namely Wuhan Changqing Garden,

Haikou New World • Meilisha, Huiyang Palm Island Resort,

Guiyang Jinyang Sunny Town and Chengdu New World

Riverside, involving a total amount of RMB20.8 billion. The

aforesaid transactions are in line with the Group’s continuing

strategy and have evidenced the Group’s achievements in

effective allocation of resources and asset enhancement. It

will also drive further the Group’s strategy of optimising its

project development and investment portfolio by putting

more resources in key cities and premium projects with good

development potential.