NewWorld Development Company Limited

MANAGEMENT DISCUSSION AND ANALYSIS

40

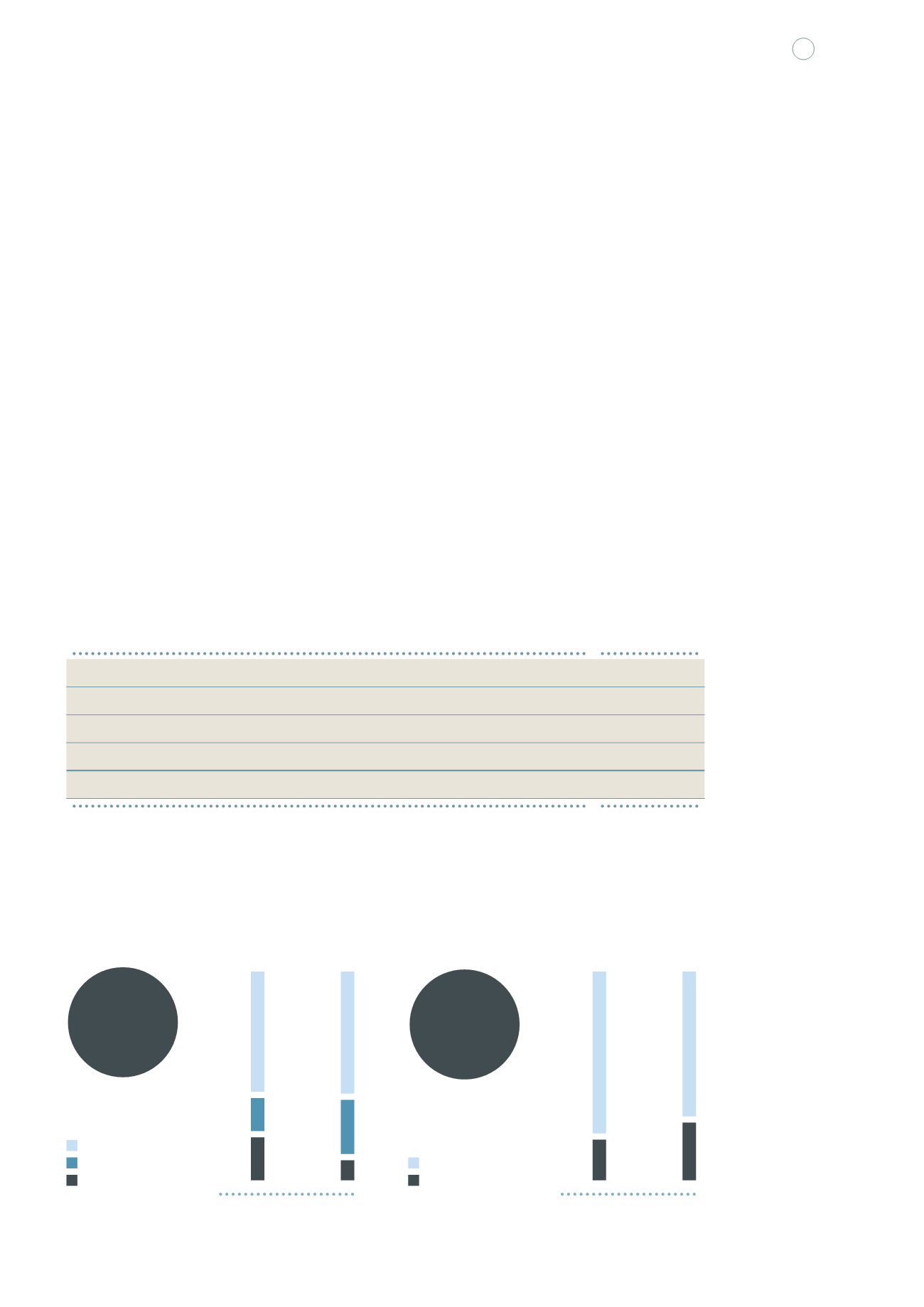

FY2015

29%

71%

21%

79%

Unsecured

Secured

FY2014

Nature of

Debts

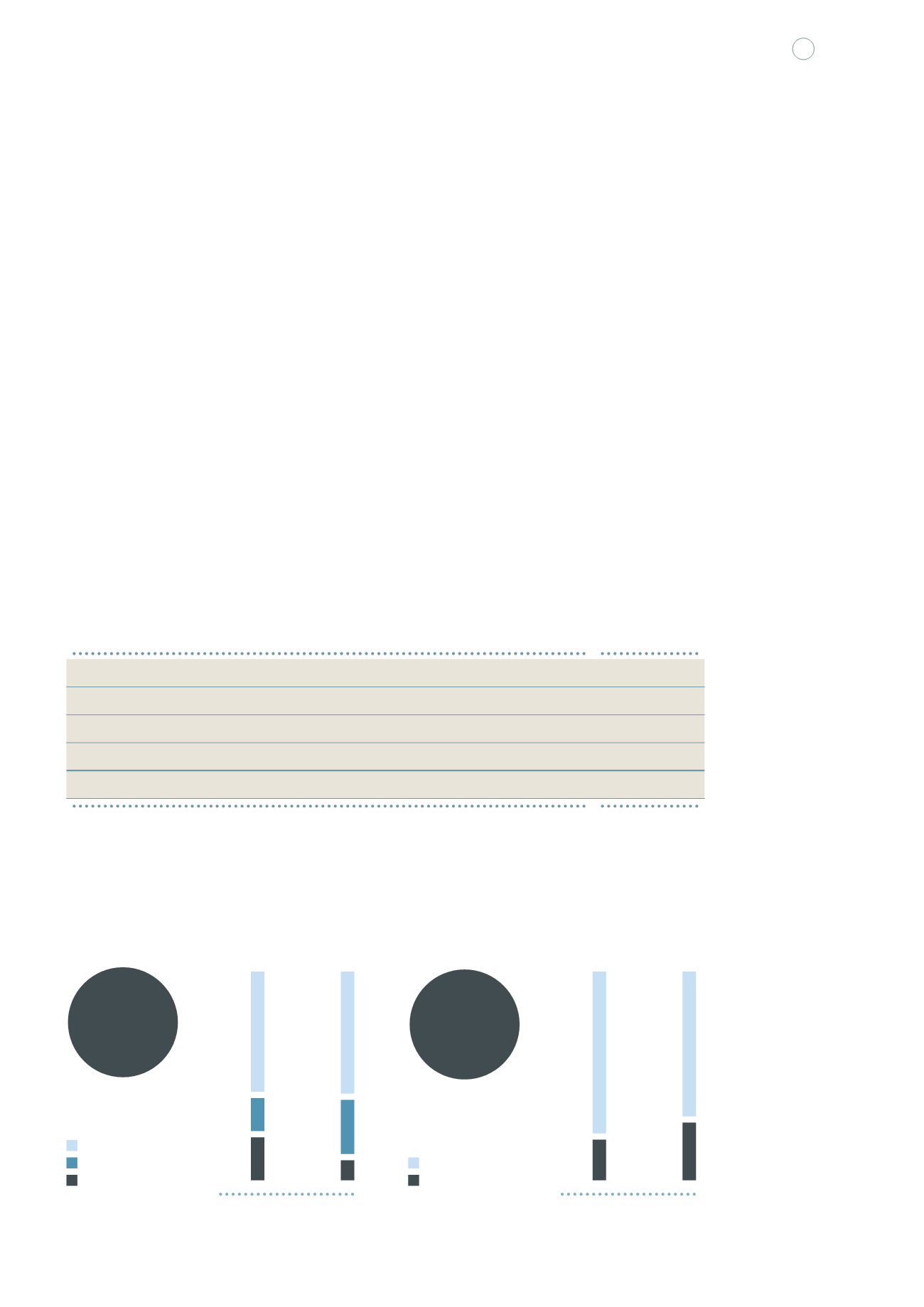

FY2015

11%

29%

60%

22%

19%

59%

HKD

RMB

USD & Others

FY2014

The RMB1,000.0 million (equivalent to approximately HK$1,250.0 million) 2.75% guaranteed bonds

due 2014, which were issued by a subsidiary of the Group and listed on The Singapore Exchange

Securities Trading Limited, matured on 14 July 2014. Such bonds were fully redeemed by that

subsidiary at their principal amount on the said maturity date.

The RMB4,300.0 million (equivalent to approximately HK$5,375.0 million) 8.5% bonds due 2015, which

were issued by a subsidiary of the Group and listed on the Stock Exchange of Hong Kong Limited,

matured on 13 April 2015. Such bonds were fully redeemed by that subsidiary of the Group at their

principal amount on the said maturity date and there was no outstanding balance of such bonds as at

30 June 2015.

As at 30 June 2015, the Group’s cash and bank balances (including restricted bank balances) stood

at HK$59,465.2 million (2014: HK$61,823.2 million) and the consolidated net debt amounted to

HK$53,539.1 million (2014: HK$54,738.8 million). The net debt to equity ratio was 24.1%, a decrease

of 3.2 percentage points as compared with FY2014.

Maturity profile

As at 30 June 2015, the Group’s long-term bank loans, other loans and fixed rate bonds and notes

payable amounted to HK$109,726.7 million. Short-term bank and other loans as at 30 June 2015 were

HK$3,277.6 million. The maturity of bank loans, other loans and fixed rate bonds and notes payable as

at 30 June 2015 was as follows:

HK$m

Within one year

30,534.7

In the second year

16,656.8

In the third to fifth year

50,128.3

After the fifth year

15,684.5

Total

113,004.3

As at 30 June 2015, the Group’s assets of HK$61,374.1 million and certain shares of subsidiaries of

the Group were pledged as securities for certain banking facilities of the Group. Equity of the Group as

at 30 June 2015 increased to HK$222,358.0 million against HK$200,276.5 million as at 30 June 2014.

Currency

Profile of

Borrowings