Annual Report 2015

MANAGEMENT DISCUSSION AND ANALYSIS

37

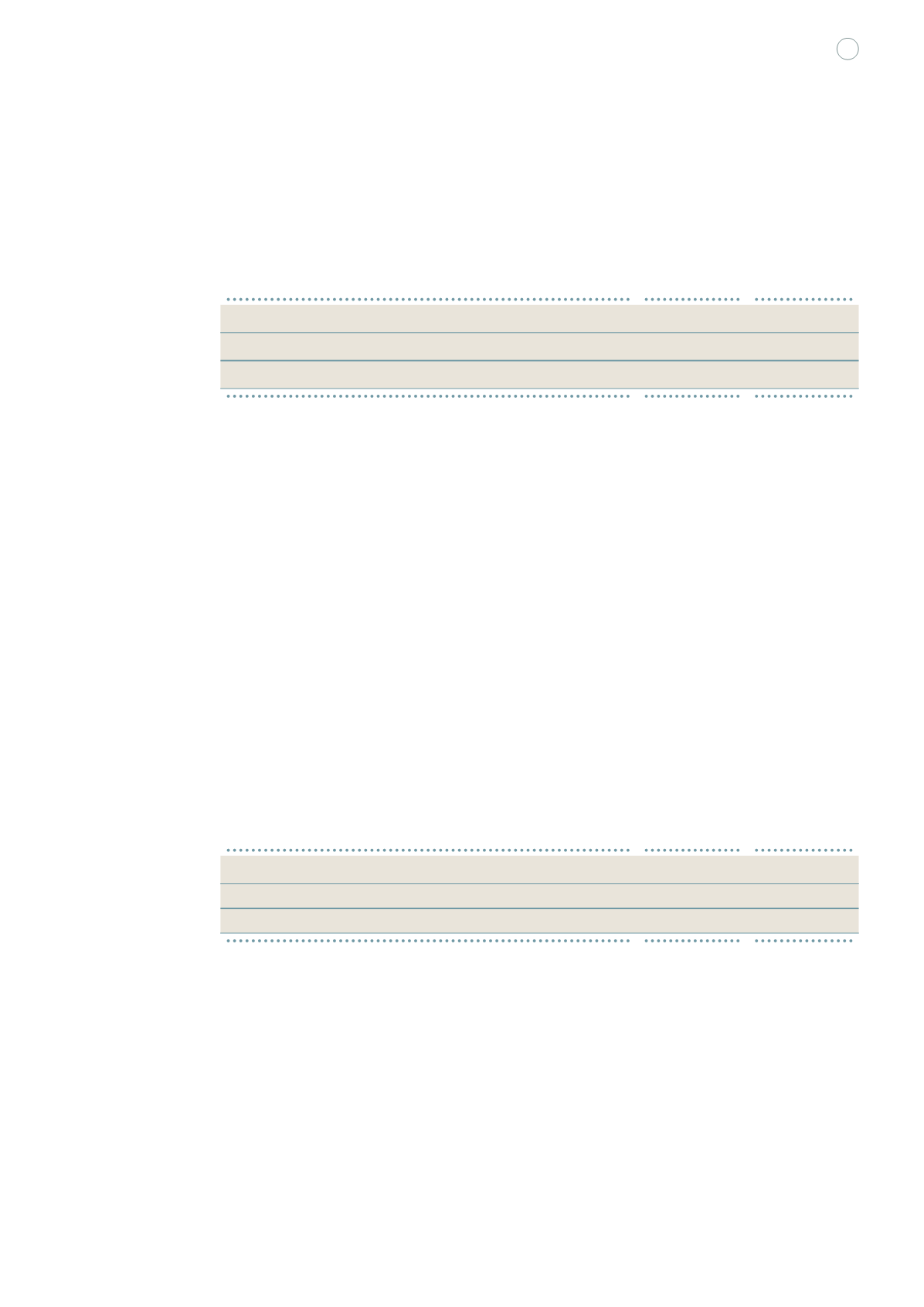

Property development

Analysis of segment results by region

FY2015

FY2014

HK$m

HK$m

Hong Kong

3,295.1

2,079.5

Mainland China

4,837.7

7,507.4

Total

8,132.8

9,586.9

In FY2015, the segment results from property development was HK$8,132.8 million, down 15.2%. In

Hong Kong, the segment results increased over 50% year-on-year. Several residential projects, namely

“The Austin” and “Grand Austin” in Southwest Kowloon, “Park Signature” and “The Reach” in Yuen

Long, together with “Double Cove” and “Double Cove Starview” in Ma On Shan, provided major

contribution to the segment results.

During the year under review, the Group has already surpassed the FY2015 attributable contracted

sales target in Hong Kong of HK$12.0 billion, attaining HK$17.2 billion.

The Group launched two new residential projects in Hong Kong, namely “THE PAVILIA HILL” and

“Double Cove Starview Prime” in FY2015. In particular, “THE PAVILIA HILL”, a trendy and premium

project on Tin Hau Temple Road in North Point, has attracted the attention of many home-buyers. Up

to 13 September 2015, over 93% residential units were sold.

In Mainland China, the overall recorded property sale volume of NWCL for the year under review

decreased by 39.5% to GFA of 855,414 sq m, with gross contracted sales registered at approximately

RMB13,068.3 million. The decrease in contribution from property sales was mainly resulted from

decrease in volume of completed projects by 30% to 1,089,163 sq m during the year under review.

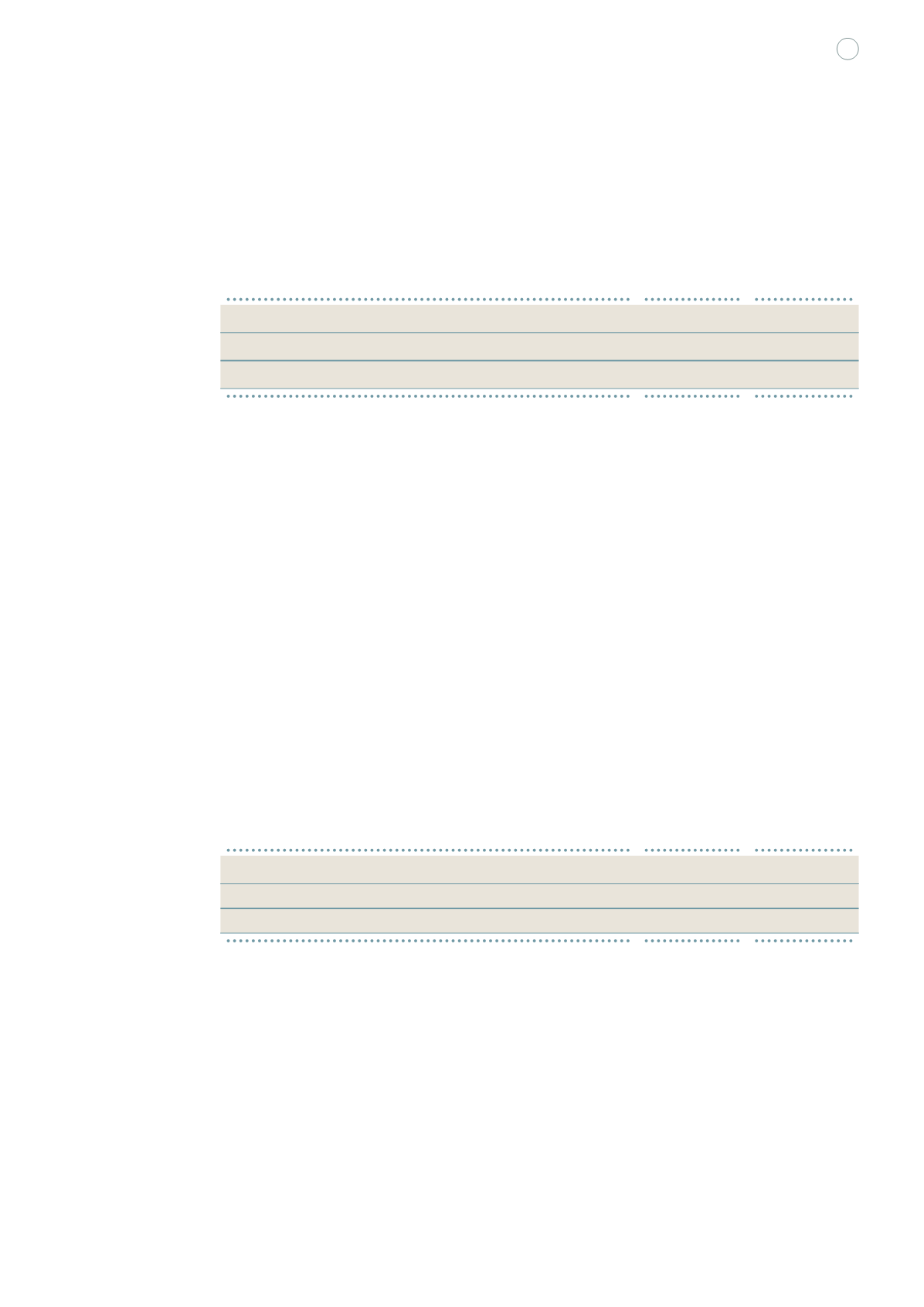

Property investment

Analysis of segment results by region

FY2015

FY2014

HK$m

HK$m

Hong Kong

1,185.1

1,233.3

Mainland China

731.6

798.6

Total

1,916.7

2,031.9

Segment contribution from property investment recorded HK$1,916.7 million in FY2015, down 5.7%,

mainly due to the decrease in the rental income of NWDS.

In FY2015, due to resumption of the underground retail space at 12 Salisbury Road Tsim Sha Tsui

(previously named as “SOGO Tsim Sha Tsui”) on 14 February 2014 for alterations and the overhaul

of Discovery Park Shopping Centre, the contribution from the investment properties in Hong Kong

was affected. If stripping out the effect of the abovementioned two projects, the Group’s gross

rental income in Hong Kong was up 5.0%. New World Tower and Manning House, both being office

buildings located in Central, achieved satisfactory performance in terms of occupancy and rental rates.

For Tsim Sha Tsui K11, FY2015 marked the 5th anniversary of its opening. K11 has continued to

reinforce its differentiated museum retail concept with clear positioning for locals market which has

demonstrated strong performance with almost 100% occupancy rate during the year under review.