New World Development Company Limited

154

Financial Section

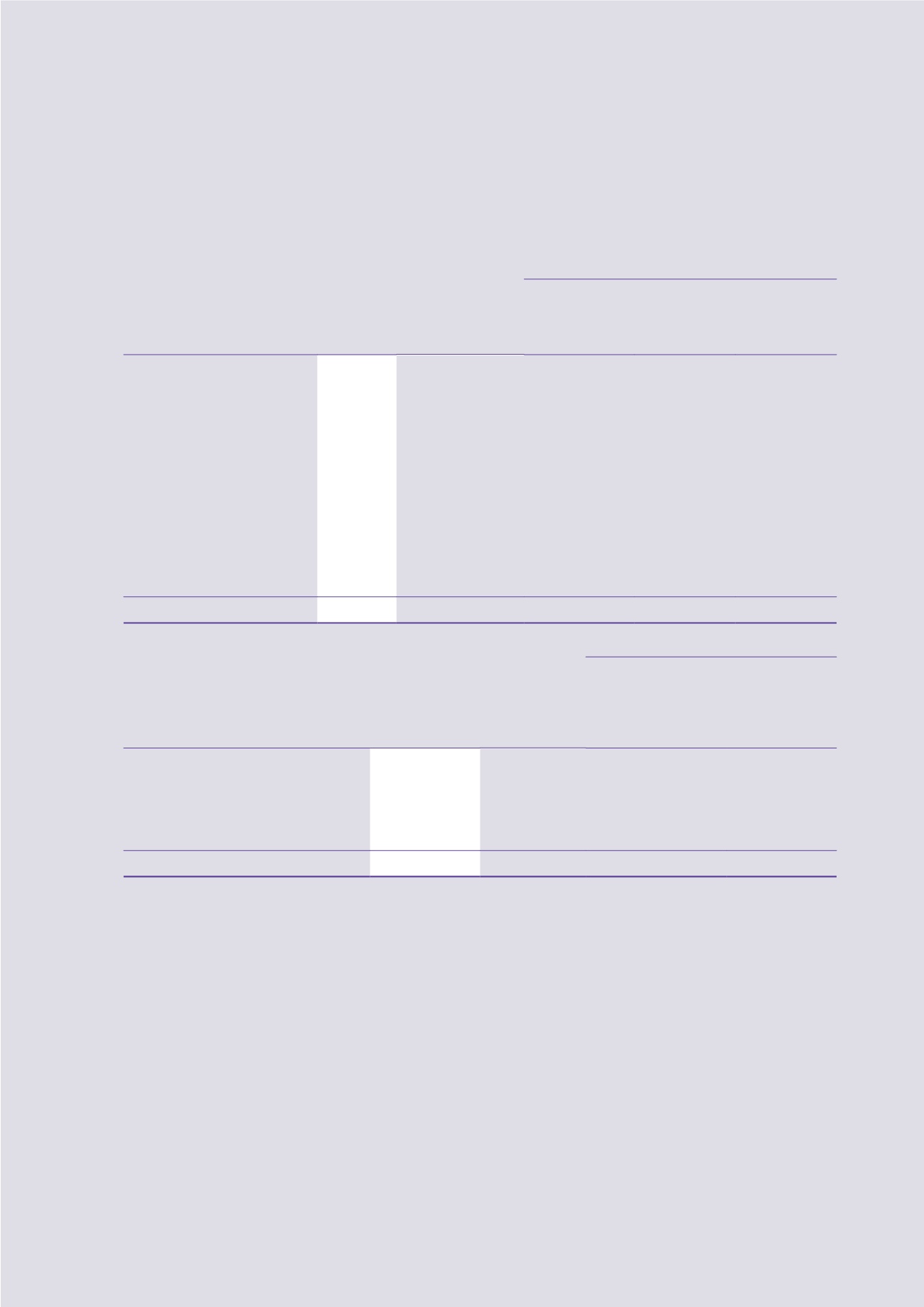

16 Investment Properties

(continued)

Valuation techniques

(continued)

Information about fair value measurements using significant unobservable inputs:

Range of significant unobservable inputs

2016

Fair value

Valuation

techniques

Prevailing

market

rent per month

Unit price Capitalisation

rate

HK$m

Completed investment properties

Hong Kong

Commercial

30,520.1

Income capitalisation

HK$23–HK$480

per square feet

N/A

1.5%–5.4%

Carparks

1,579.1

Income capitalisation HK$1,950–HK$6,000

per carpark space

N/A

4.5%–4.7%

Mainland China

Commercial

14,784.2

Income capitalisation

HK$29–HK$268

per square metre

N/A

3.0%–9.0%

Carparks

4,973.1

Direct comparison

N/A

HK$76,000–

HK$503,000

per carpark space

N/A

Residential

1,528.8

Income capitalisation

HK$116–HK$199

per square metre

N/A

4.8%–15.0%

Total

53,385.3

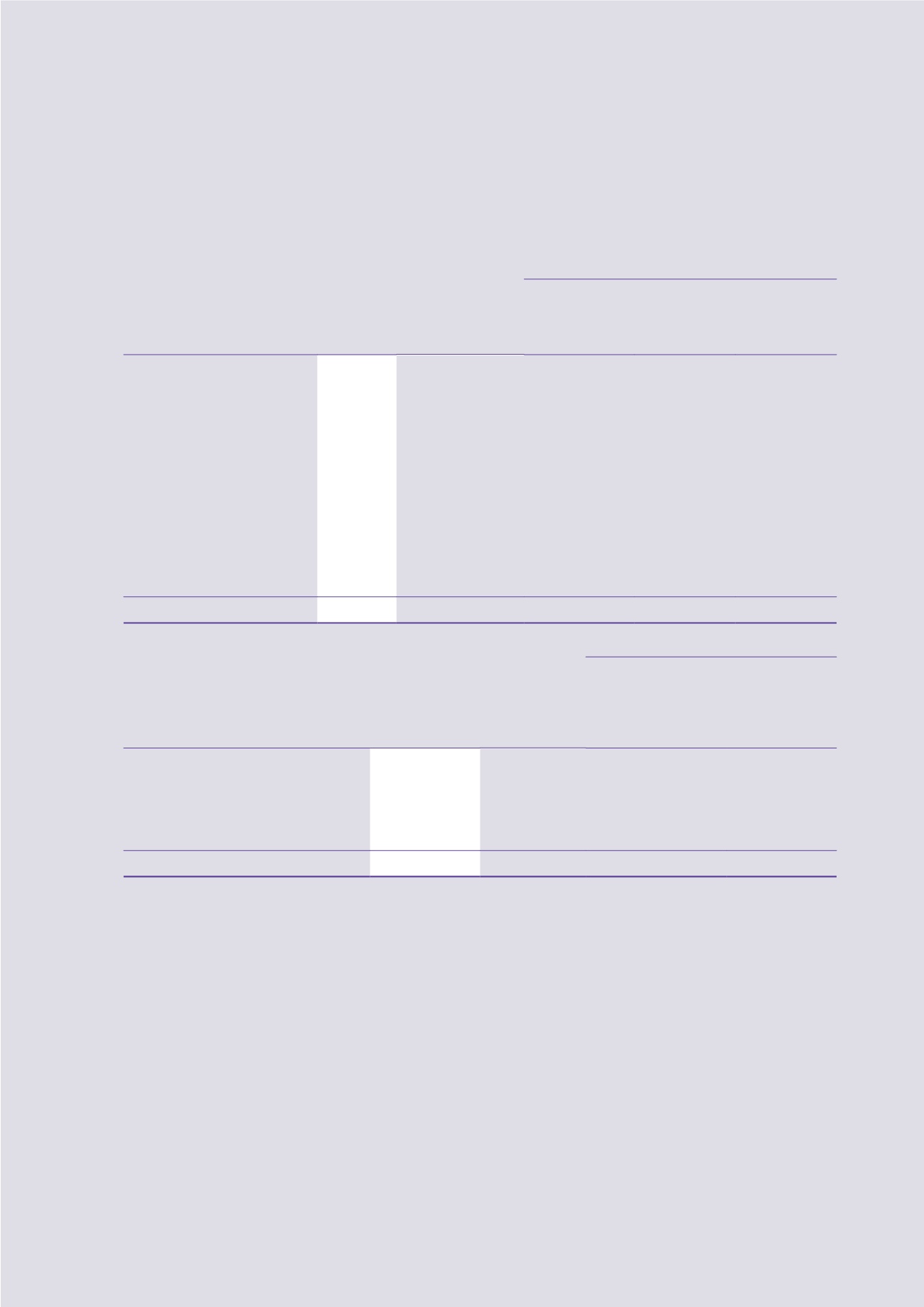

Range of significant unobservable inputs

2016

Fair value

Valuation

technique

Unit price

Estimated

developer’s

profit and risk

margins

HK$m

Investment properties under development

Commercial

31,673.1

Residual

HK$1,750–HK$60,000

per square feet

5.0%–20.0%

Carparks

1,538.6

Residual

HK$152,000–

HK$269,000

per carpark space

1.0%–5.0%

Total

33,211.7