New World Development Company Limited

164

Financial Section

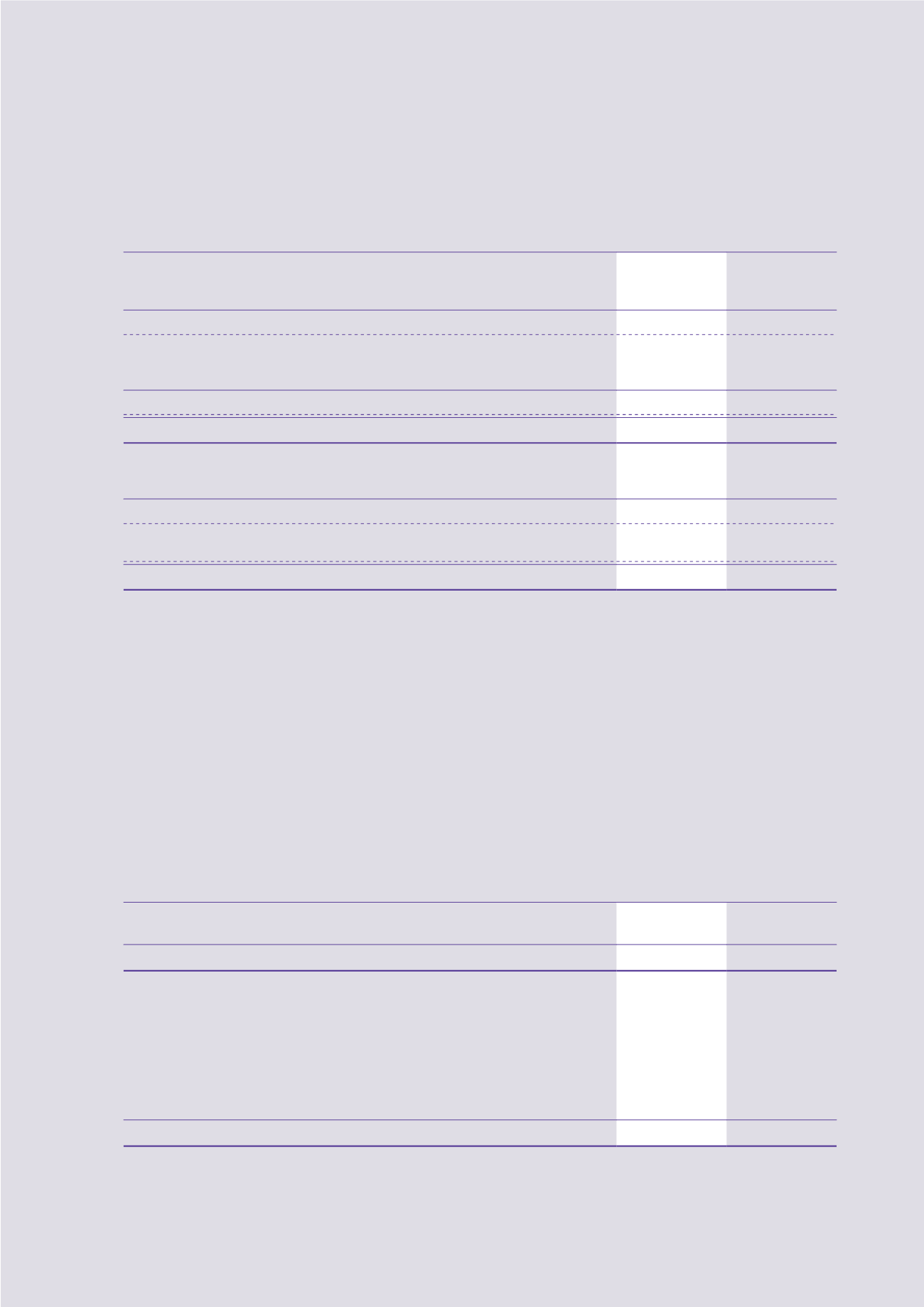

25 Derivative Financial Instruments

2016

2015

HK$m

HK$m

Non-current assets

Foreign exchange and interest rate swaps

41.9

–

Others

39.5

39.5

81.4

39.5

Current assets

Foreign exchange and interest rate swaps

–

11.1

Others

19.3

19.3

19.3

30.4

100.7

69.9

Current liabilities

Foreign exchange and interest rate swaps

(88.4)

–

Others (note)

(97.6)

–

(186.0)

–

Non-current liabilities

Foreign exchange and interest rate swaps

(794.0)

(847.4)

(980.0)

(847.4)

The total notional principal amounts of the outstanding derivative financial instruments as at 30 June 2016 was

HK$13,550.4 million (2015: HK$10,617.4 million).

Note:

The amounts represented the Evergrande’s call option embedded in the perpetual securities (note 23(a)).

26 Properties for Development

At 30 June 2016, the aggregate carrying value of properties for development pledged as securities for the Group’s

borrowings amounted to HK$375.6 million (2015: HK$1,051.7 million).

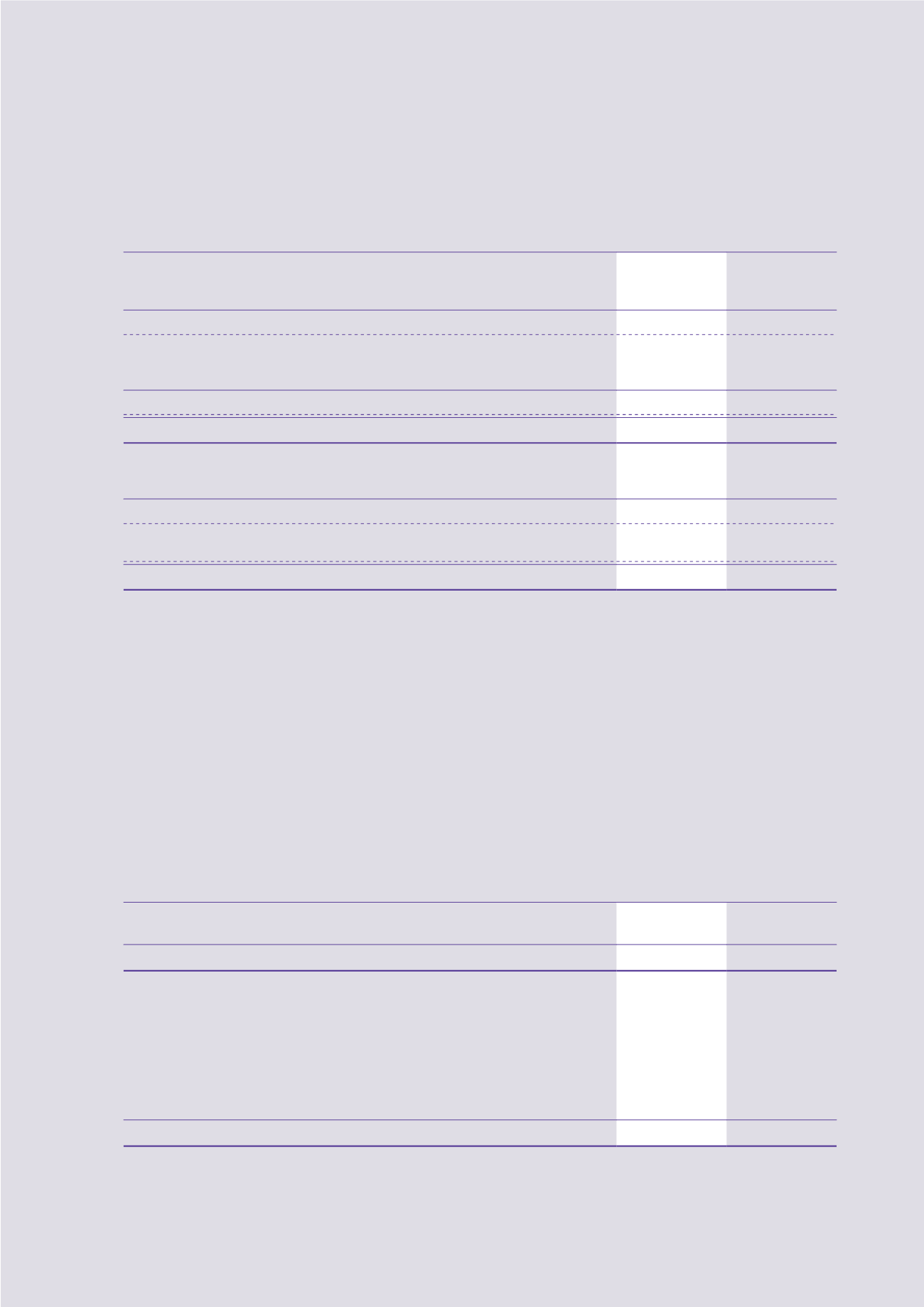

27 Deferred Taxation

Deferred income tax assets and liabilities are offset when taxes relate to the same taxation authority and where offsetting is

legally enforceable. The following amounts, determined after appropriate offsetting, are shown separately on the

consolidated statement of financial position.

2016

2015

HK$m

HK$m

Deferred tax assets

684.9

673.3

Deferred tax liabilities

(8,453.2)

(9,288.0)

(7,768.3)

(8,614.7)

At beginning of the year

(8,614.7)

(8,247.2)

Translation differences

377.8

(29.2)

Acquisition of subsidiaries

–

(7.0)

Disposal of subsidiaries

363.1

30.3

Written back upon disposal of intangible concession rights

33.8

–

Transfer to current tax payable

16.7

4.2

Transfer to non-current assets classified as assets held for sale (note 35)

56.8

(34.0)

Charged to consolidated income statement (note 11)

(103.3)

(266.3)

Credited/(charged) to reserves

101.5

(65.5)

At end of the year

(7,768.3)

(8,614.7)