Annual Report 2016

165

Financial Section

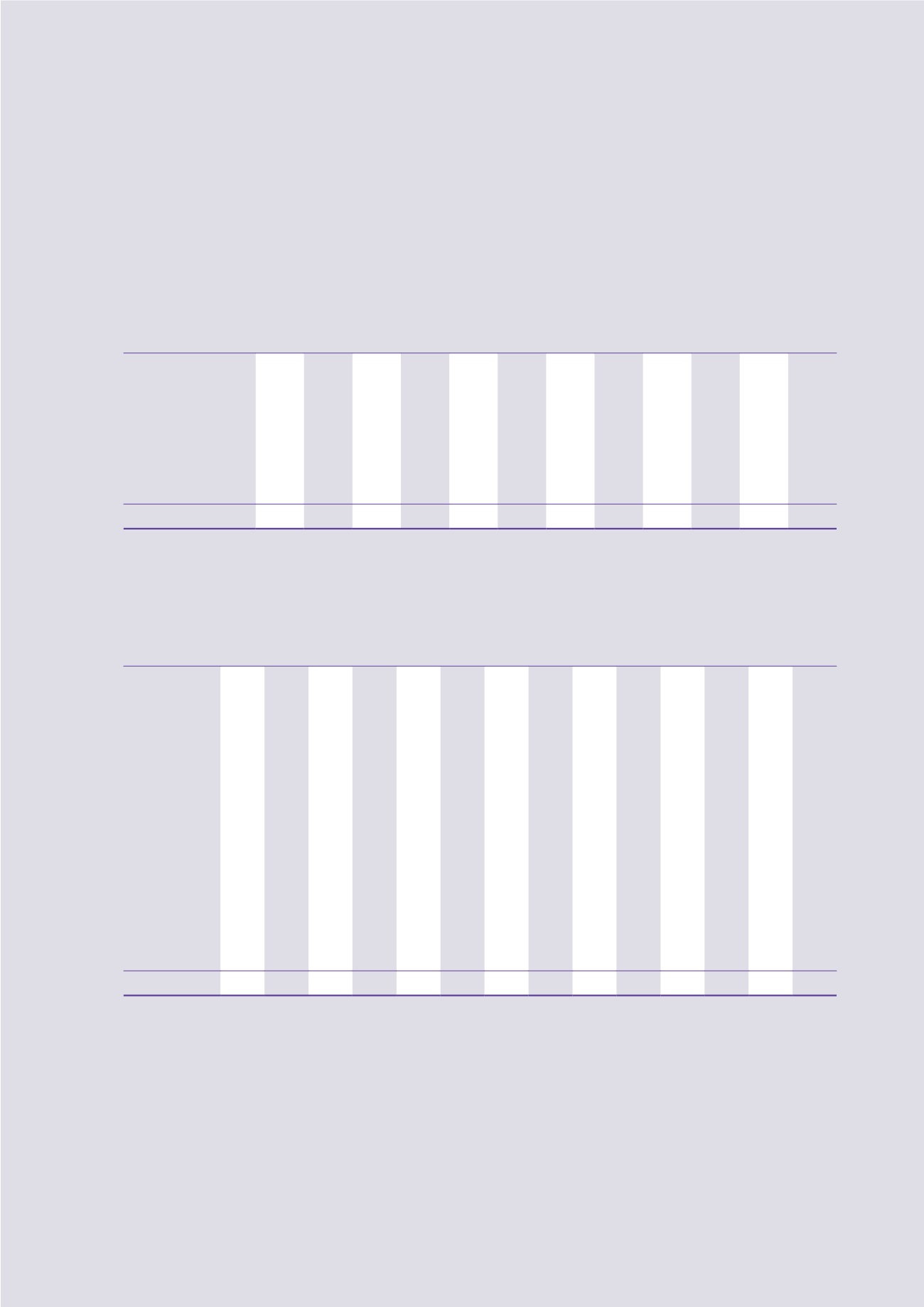

27 Deferred Taxation

(continued)

The movement in deferred tax assets and liabilities (prior to offsetting balances within the same taxation jurisdiction) during

the year was as follows:

Deferred tax assets

Provisions

Accelerated

accounting

depreciation

Tax losses

Unrealised intra-

group profit

Other items

Total

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

At beginning of the year

20.0

36.6

1.4

8.0

473.5

488.4

71.1

139.3

242.9

257.6

808.9

929.9

Translation differences

(1.2)

(0.5)

–

–

(16.0)

(11.1)

–

–

(15.2)

–

(32.4)

(11.6)

Transfer to non-current assets

classified as assets held for sale

–

–

–

–

–

(9.9)

–

–

–

–

–

(9.9)

Transfer to liabilities directly

associated with non-current

assets classified as assets

held for sale

–

–

–

–

(4.0)

–

–

–

–

–

(4.0)

–

(Charged)/credited to

consolidated income statement

(4.9)

(16.1)

9.9

(6.6)

(81.4)

6.1

(30.7)

(68.2)

(12.3)

(14.7)

(119.4)

(99.5)

At end of the year

13.9

20.0

11.3

1.4

372.1

473.5

40.4

71.1

215.4

242.9

653.1

808.9

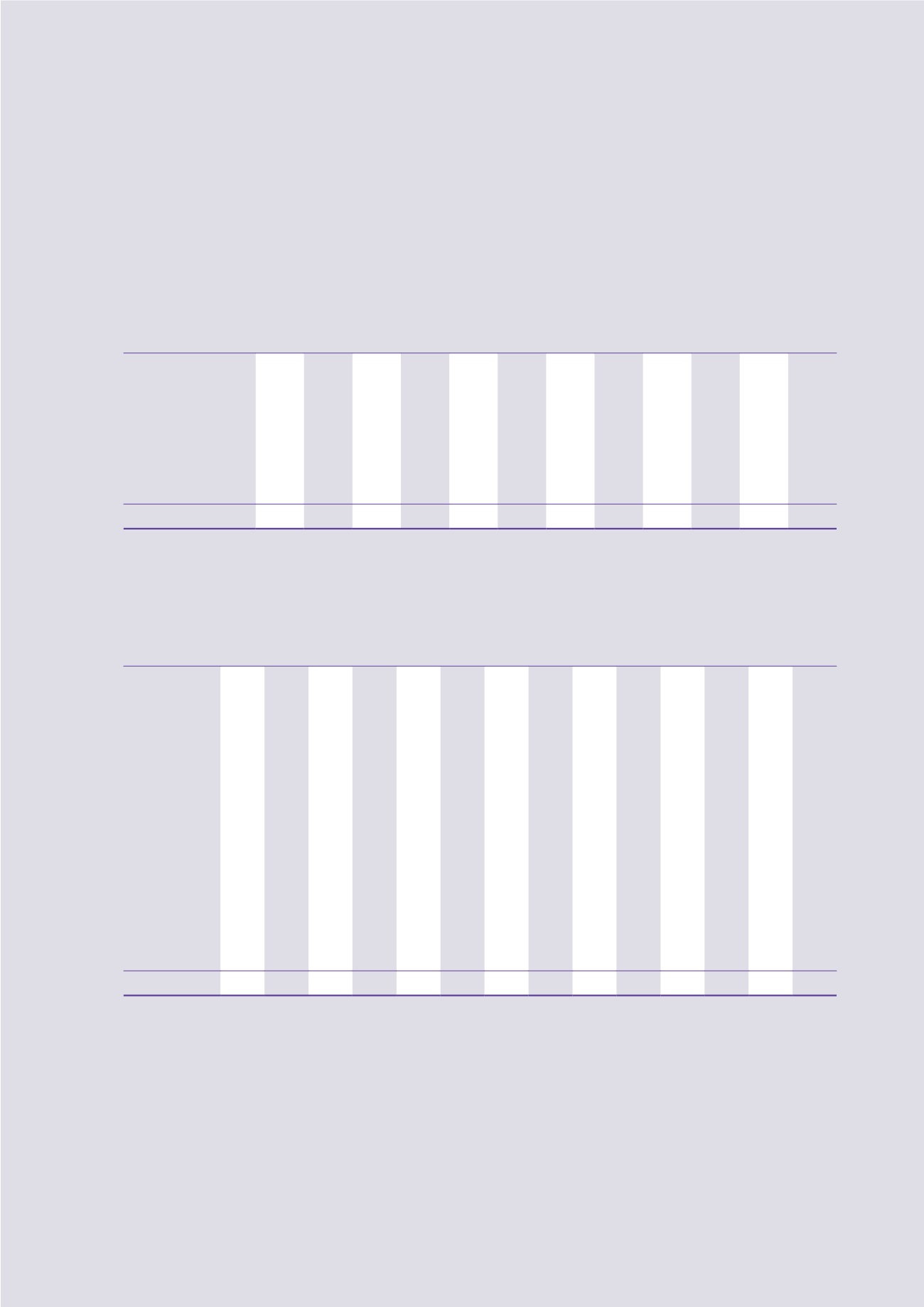

Deferred tax liabilities

Accelerated

tax depreciation

Valuation of

properties

Fair value

adjustments of

properties on

acquisitions

Amortisation

of intangible

concession rights

Undistributed profits

of subsidiaries,

joint ventures and

associated companies

Other items

Total

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

At beginning of the year

(2,704.4)

(2,623.3)

(1,609.3)

(1,423.4)

(1,869.3)

(1,907.4)

(2,143.4)

(2,260.9)

(808.6)

(769.9)

(288.6)

(192.2)

(9,423.6)

(9,177.1)

Translation differences

20.6

(1.7)

96.2

0.1

105.5

0.1

139.9

–

46.7

(0.1)

1.3

(16.0)

410.2

(17.6)

Acquisition of subsidiaries

–

(1.0)

–

–

–

(5.7)

–

–

–

(0.3)

–

–

–

(7.0)

Disposal of subsidiaries

(2.6)

29.0

124.9

–

177.9

–

–

–

62.9

–

–

1.3

363.1

30.3

Written back upon disposal

of intangible concession

rights

–

–

–

–

–

–

33.8

–

–

–

–

–

33.8

–

Transfer to current tax payable

–

–

–

–

–

–

–

–

16.7

4.2

–

–

16.7

4.2

Transfer to non-current

assets classified as assets

held for sale

–

(24.1)

–

–

–

–

–

–

–

–

–

–

–

(24.1)

Transfer to liabilities

directly associated with

non-current assets

classified as assets

held for sale

60.8

–

–

–

–

–

–

–

–

–

–

–

60.8

–

(Charged)/credited to

consolidated income

statement

(23.8)

(83.3)

(60.5)

(178.5)

215.6

43.7

85.9

117.5

(191.0)

(42.5)

(10.1)

(23.7)

16.1

(166.8)

(Charged)/credited to

reserves

–

–

(5.0)

(7.5)

–

–

–

–

–

–

106.5

(58.0)

101.5

(65.5)

At end of the year

(2,649.4)

(2,704.4)

(1,453.7)

(1,609.3)

(1,370.3)

(1,869.3)

(1,883.8)

(2,143.4)

(873.3)

(808.6)

(190.9)

(288.6)

(8,421.4)

(9,423.6)

Deferred tax assets are recognised for tax loss carried forward to the extent that realisation of the related tax benefit

through the future taxable profits is probable. The Group has unrecognised tax losses of HK$17,079.4 million (2015:

HK$17,961.5 million) to carry forward for offsetting against future taxable income. These tax losses have no expiry dates

except for the tax losses of HK$4,641.1 million (2015: HK$3,494.8 million) which will expire at various dates up to and

including 2021 (2015: 2020).

For the investment properties that are located outside Hong Kong, they are held by certain subsidiaries with a business

model to consume substantially all the economic benefits embodied in the investment properties over time, rather than

through sale, the presumption is rebutted and related deferred tax continues to be determined based on recovery of use.

For the remaining investment properties, the tax consequence is on the presumption that they are recovered entirely by

sale.

As at 30 June 2016, the aggregate amount of temporary differences associated with investments in subsidiaries and joint

ventures for which deferred tax liabilities have not been recognised totalled approximately HK$7.5 billion (2015: HK$9.2

billion), as the directors consider that the timing of reversal of the related temporary differences can be controlled and the

temporary differences will not be reversed in the foreseeable future.