New World Development Company Limited

172

Financial Section

37 Non-Controlling Interests

The total non-controlling interests as at 30 June 2016 is HK$21,321.9 million (2015: HK$43,439.4 million), of which

HK$17,579.7 million (2015: HK$18,051.3 million) is attributable to NWSH. The total comprehensive income attributable to

non-controlling interests for the year ended 30 June 2016 is HK$1,633.2 million (2015: HK$7,727.0 million), of which HK$773.3

million (2015: HK$1,709.7 million) is attributable to NWSH and HK$758.8 million (2015: HK$1,047.0 million) is attributable to

NWCL. For the year ended 30 June 2015, HK$4,935.3 million was attributable to the gain on partial disposal of interests in

two hotels, namely Grand Hyatt Hong Kong and Renaissance Harbour View Hotel, Hong Kong (note 8). The non-controlling

interests in respect of other subsidiaries are not material to the Group.

The privatisation of NWCL at an cash offer price of HK$7.8 per share was announced on 6 January 2016 and as at final

closing date of 5 April 2016, the Group has an effective interest of 99.58% in NWCL. Total consideration of HK$20,068.9

million was paid as of 30 June 2016. The excess of the consideration paid over the Group’s interest in the net assets

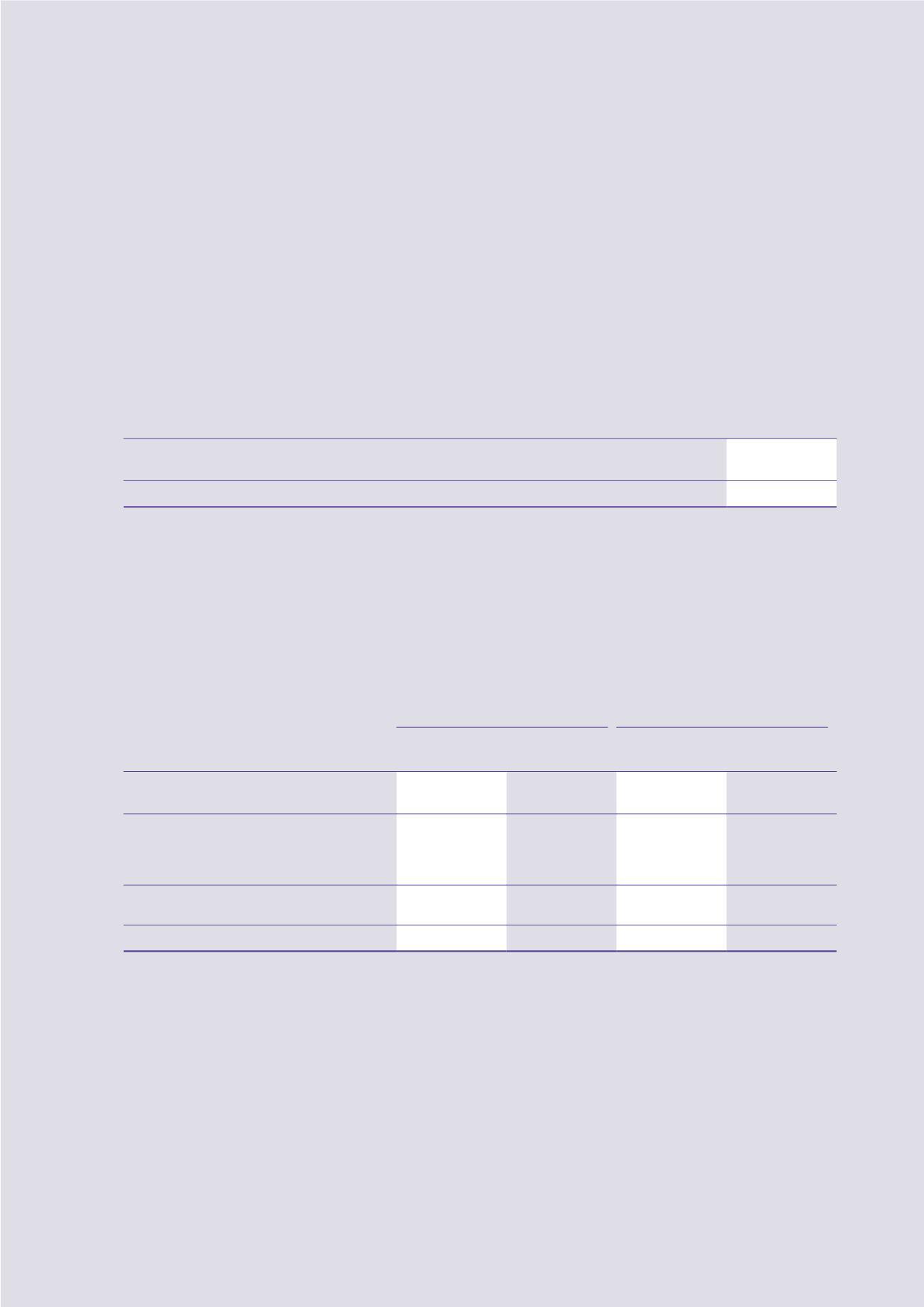

acquired from non-controlling interests, was recognised in equity with details as follows:

2016

HK$m

Consideration paid

20,068.9

Carrying amount of non-controlling interests acquired

(18,932.4)

Excess of consideration paid over carrying amount recognised within equity

1,136.5

Following the privatisation, management has imposed substantial changes to NWCL’s organisational structure in order to

gain full control over its business activities and financing. As a result of these changes, management of NWCL consider that

there is no longer decentralisation of decision nor autonomy in NWCL. Management determined that the functional currency

of NWCL should be changed from Renminbi to Hong Kong dollar from April 2016 onwards to be in line with the Group’s

functional currency as an extension of the Group. The change is accounted for prospectively.

Set out below is the summarised financial information for NWSH and NWCL which are subsidiaries with material non-

controlling interests to the Group.

Summarised consolidated statements of financial position of the respective companies as at 30 June 2016 and 2015 are as

follows:

NWSH

NWCL

2016

2015

2016

2015

HK$m

HK$m

HK$m

HK$m

Non-current assets

51,660.4

55,305.8

60,493.7

67,402.7

Current assets

24,024.6

19,847.8

79,186.2

67,024.8

Total assets

75,685.0

75,153.6

139,679.9

134,427.5

Current liabilities

(18,250.6)

(12,748.9)

(31,648.1)

(31,898.0)

Non-current liabilities

(11,576.0)

(16,217.0)

(42,965.9)

(37,910.7)

Net assets

45,858.4

46,187.7

65,065.9

64,618.8

Non-controlling interests

(239.5)

(774.3)

(1,882.2)

(3,836.9)

Net assets after non-controlling interests

45,618.9

45,413.4

63,183.7

60,781.9