New World Development Company Limited

176

Financial Section

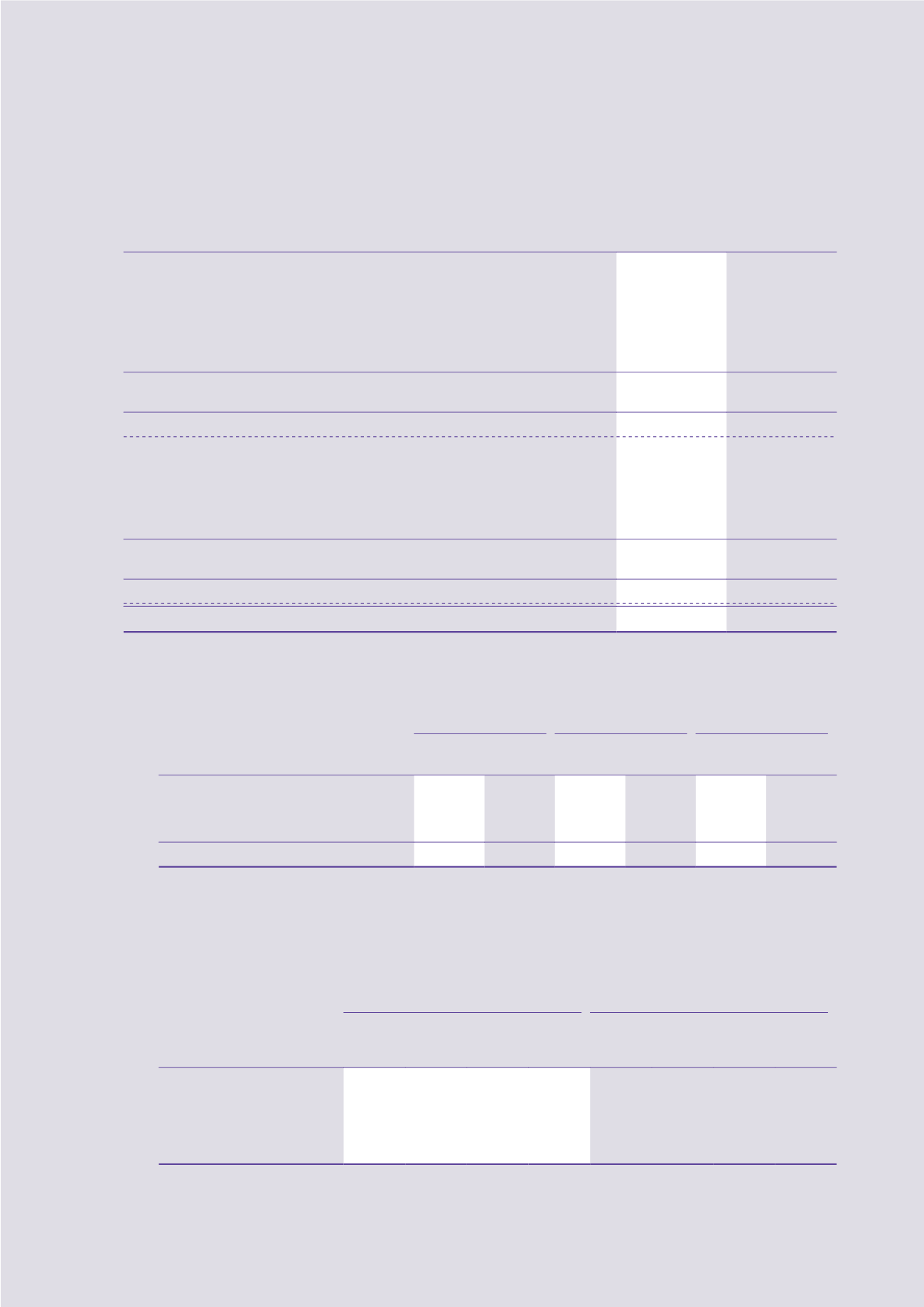

39 Borrowings

2016

2015

HK$m

HK$m

Long-term borrowings

Secured bank loans

22,130.9

22,958.5

Unsecured bank loans

62,580.7

52,393.8

Other secured loans

2,374.3

–

Other unsecured loans

1,625.7

1,062.9

Fixed rate bonds and notes payable

41,989.8

33,311.5

Loans from non-controlling shareholders (note (b))

969.1

1,168.6

131,670.5

110,895.3

Current portion of long-term borrowings

(16,828.1)

(27,256.9)

114,842.4

83,638.4

Short-term borrowings

Secured bank loans

49.4

65.4

Unsecured bank loans

1,463.8

2,330.9

Other secured loans

–

625.0

Other unsecured loans

5.0

256.3

Loans from non-controlling shareholders (note (b))

1,743.4

2,983.6

3,261.6

6,261.2

Current portion of long-term borrowings

16,828.1

27,256.9

20,089.7

33,518.1

Total borrowings

134,932.1

117,156.5

Notes:

(a)

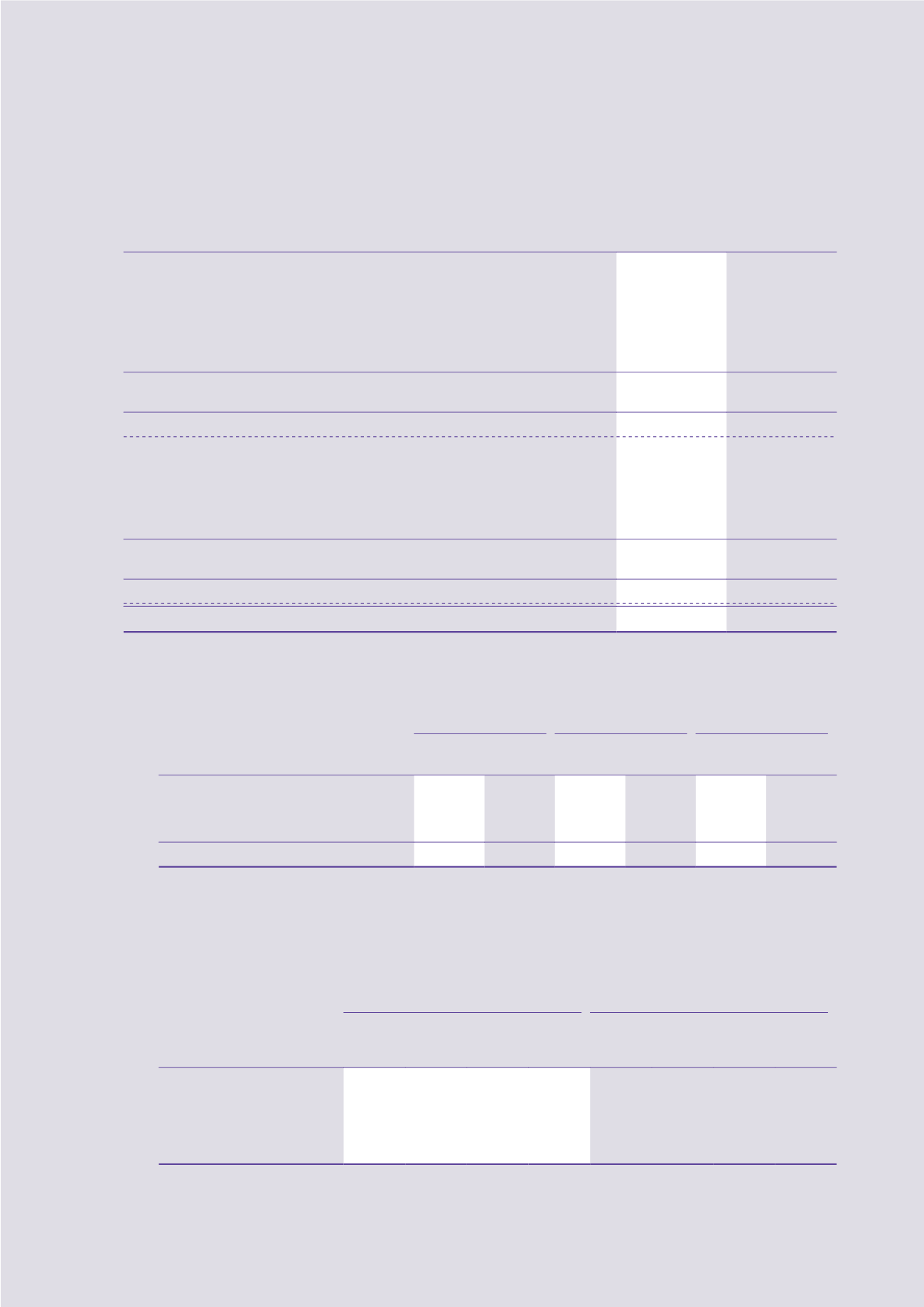

Bank loans, other loans and fixed rate bonds and notes payable are repayable as follows:

Bank loans

Other loans

Fixed rate bonds

and notes payable

2016

2015

2016

2015

2016

2015

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

Within one year

14,152.6

29,640.6

344.2

894.1

3,849.5

–

In the second year

10,739.5

12,425.7

–

362.7

3,709.8

3,868.4

In the third to fifth year

59,483.8

33,000.3

3,660.8

687.4

18,480.8

16,440.6

After the fifth year

1,848.9

2,682.0

–

–

15,949.7

13,002.5

86,224.8

77,748.6

4,005.0

1,944.2

41,989.8

33,311.5

(b)

Loans from non-controlling shareholders

The loans of HK$504.8 million (2015: HK$238.9 million) are unsecured and interest bearing at 2.2% over HIBOR (2015: 6.2%) per annum.

The remaining loans are unsecured and interest free. A total amount of HK$969.1 million (2015: HK$1,168.6 million) is not repayable

within the next 12 months and the remaining balances have no specific repayment term.

(c)

Effective interest rates

2016

2015

Hong

Kong

dollar

Renminbi

United

States

dollar

Others

Hong

Kong

dollar

Renminbi

United

States

dollar

Others

Bank loans

2.1% 5.6% 2.1% 2.0%

2.1% 6.5% 6.2% 2.2%

Fixed rate bonds and notes payable

5.6% 5.5% 5.6%

–

5.6% 5.5% 6.0%

–

Loans from non-controlling

shareholders

2.7%

–

–

–

2.5% 6.2%

–

–

Other secured loans

–

6.5%

–

–

–

10.1%

–

–

Other unsecured loans

3.0% 7.2%

–

–

2.8% 7.6%

–

–

(d)

Carrying amounts and fair values of the borrowings

The fair value of the fixed rate bonds and notes payable at the end of the reporting period is HK$44,172.4 million (2015: HK$35,035.4

million). The carrying amounts of other borrowings approximate their fair values.