New World Development Company Limited

180

Financial Section

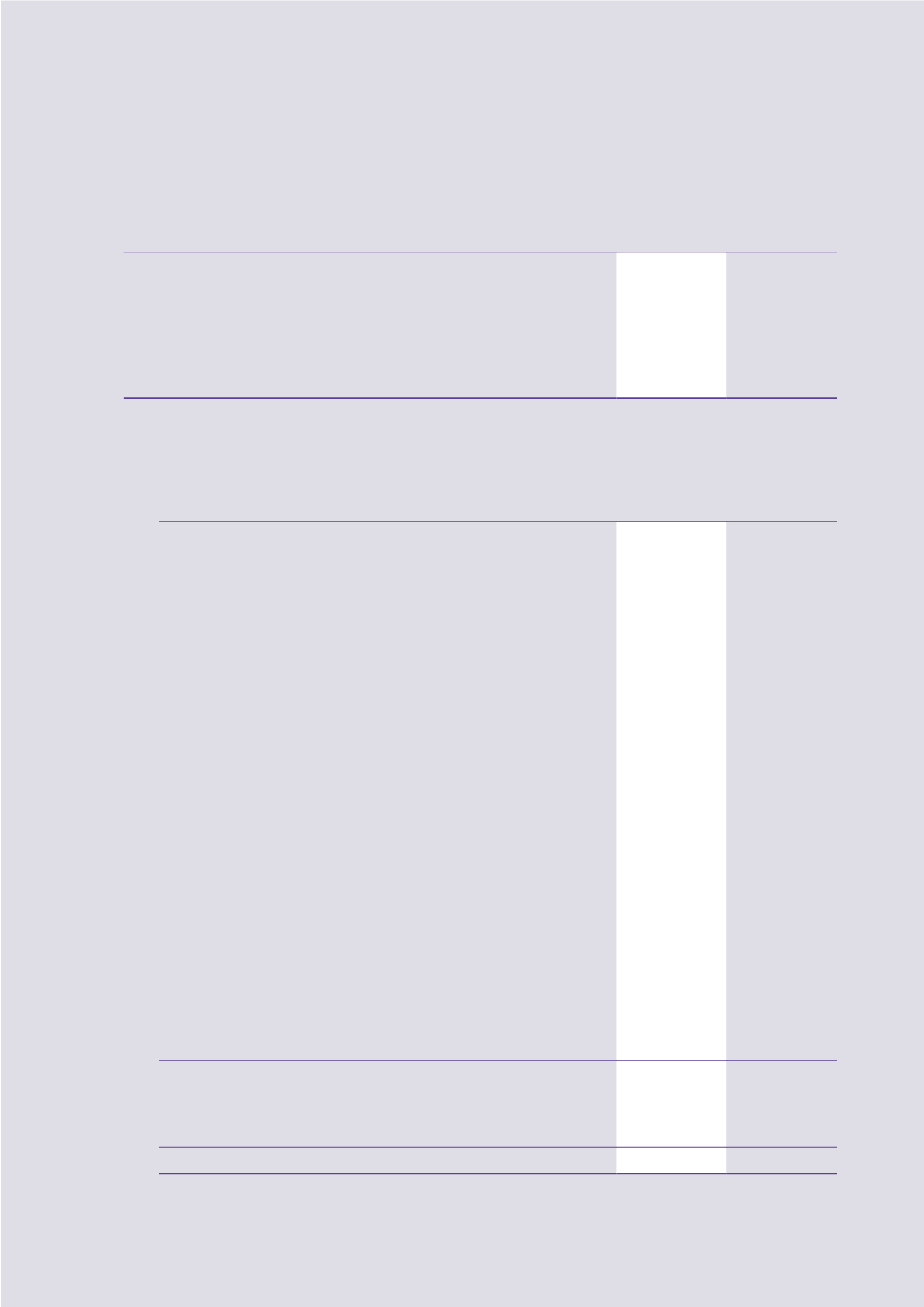

44 Financial Guarantee and Contingent Liabilities

2016

2015

HK$m

HK$m

Financial guarantee contracts:

Mortgage facilities for certain purchasers of properties

2,428.4

2,240.0

Guarantees for credit facilities granted to

Joint ventures

4,421.8

4,229.4

Associated companies

1,340.9

20.0

A related company

–

49.7

Indemnity to non-wholly owned subsidiaries for Mainland China tax liabilities

18.0

1,415.0

8,209.1

7,954.1

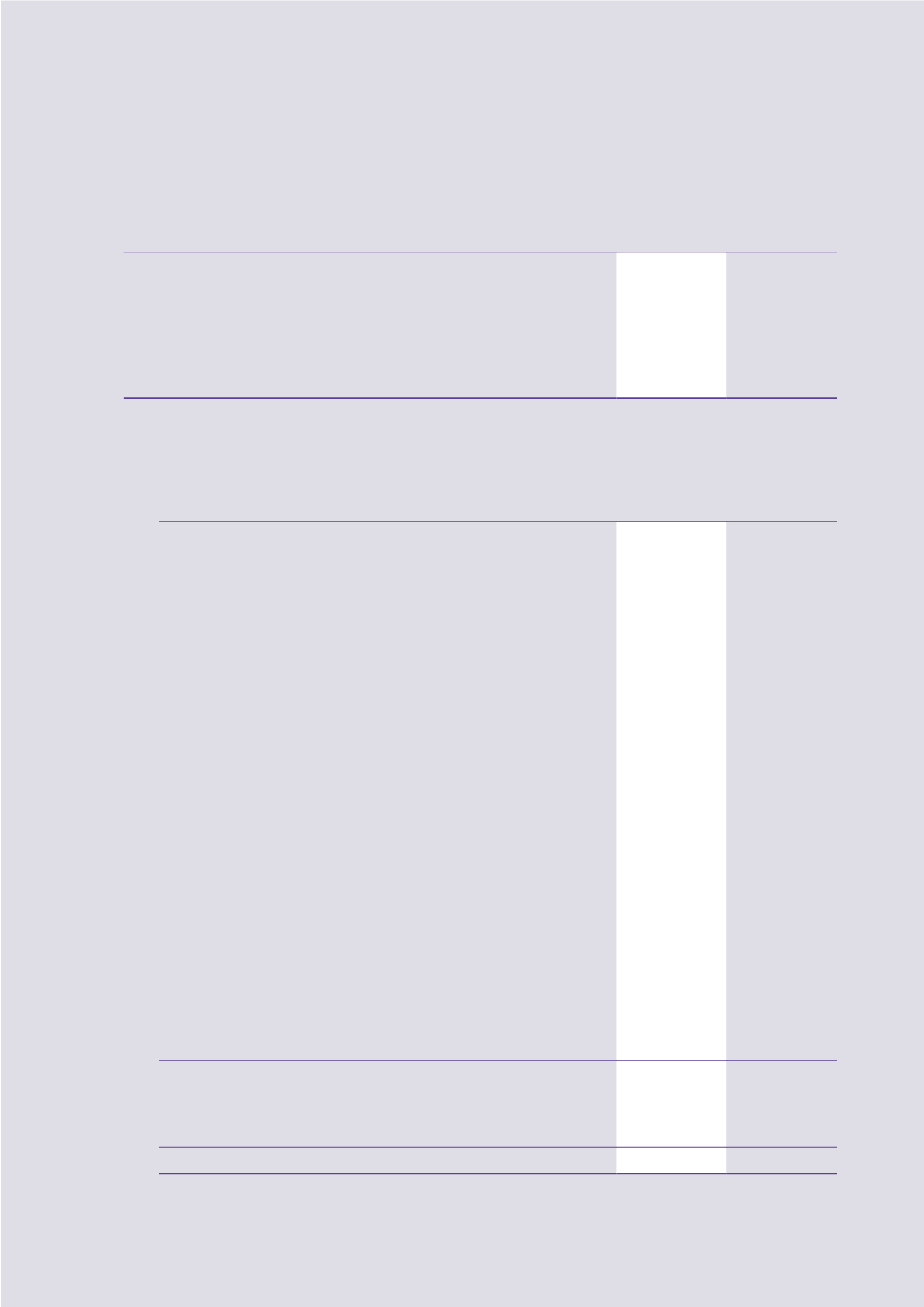

45 Notes to Consolidated Statement of Cash Flows

(a) Reconciliation of operating profit to net cash generated from operations

2016

2015

HK$m

HK$m

Operating profit

16,583.3

27,970.9

Depreciation

979.7

1,304.3

Amortisation

949.5

1,009.7

Changes in fair value of investment properties

(307.3)

(3,165.5)

Write back of provision for loans and other receivables

(210.4)

(376.6)

Write back of provision of property, plant and equipment

(567.3)

–

Gain on deemed disposal of interest in an associate company

–

(50.7)

Gain on partial disposal of interests in subsidiaries and remeasurement

of retained interest at fair value after reclassification to a joint venture

(40.0)

(13,709.2)

Gain on remeasurement of an available-for-sale financial asset retained at fair

value upon reclassification from an associated company

–

(914.0)

Gain on remeasurement of previously held interest of an associated company

at fair value upon further acquisition to become a subsidiary

(18.2)

–

Loss/(gain) on remeasurement of previously held interest of a joint venture at

fair value upon further acquisition to become a subsidiary

40.5

(986.6)

Net loss on fair value of financial assets at fair value through profit or loss

154.0

38.9

Net (gain)/loss on disposal of

Non-current assets classified as assets held for sale

(784.9)

(30.3)

Available-for-sale financial assets

(413.3)

(66.2)

Financial assets at fair value through profit or loss

(9.8)

23.5

Investment properties, property, plant and equipment and intangible

concession rights and their related assets and liabilities

(207.2)

63.2

Subsidiaries

(6,965.4)

(18.0)

Joint ventures

(53.0)

–

Associated companies

(3.0)

137.9

Impairment loss on

Available-for-sale financial assets

692.4

11.8

Loans and other receivables

7.4

61.2

Property, plant and equipment

30.1

532.0

Intangible assets

–

100.5

Dividend income from available-for-sale financial assets, perpetual securities

and a financial asset at fair value through profit or loss

(855.5)

(31.8)

Share options expenses

124.8

168.9

Net exchange loss/(gain)

1,894.0

(93.8)

Operating profit before working capital changes

11,020.4

11,980.1

Decrease/(increase) in inventories

42.6

(77.5)

Increase in properties for/under development and properties held for sale

(3,346.9)

(7,004.7)

Decrease/(increase) in debtors and prepayments

323.3

(657.7)

Increase in creditors and accrued charges

4,325.2

9,588.4

Net cash generated from operations

12,364.6

13,828.6