New World Development Company Limited

178

Financial Section

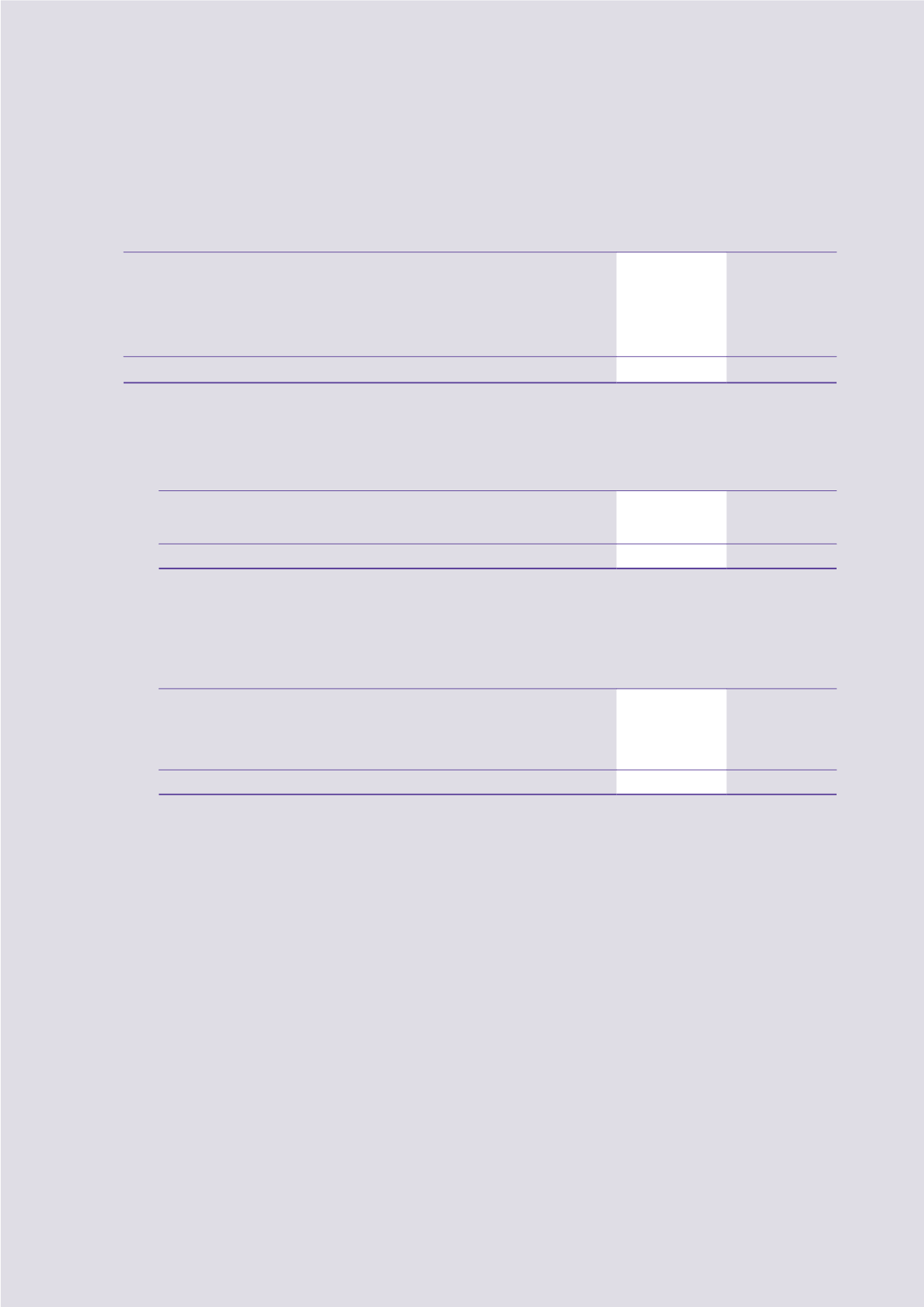

41 Creditors and Accrued Charges

2016

2015

HK$m

HK$m

Trade creditors (note (a))

7,980.1

11,088.1

Amounts due to customers for contract work (note 34)

1,592.3

850.3

Deposits received on sale of properties

9,828.7

12,603.6

Amounts due to joint ventures (note (b))

1,897.7

2,061.5

Amounts due to associated companies (note (b))

180.3

250.4

Other creditors and accrued charges

16,711.8

13,751.6

38,190.9

40,605.5

Notes:

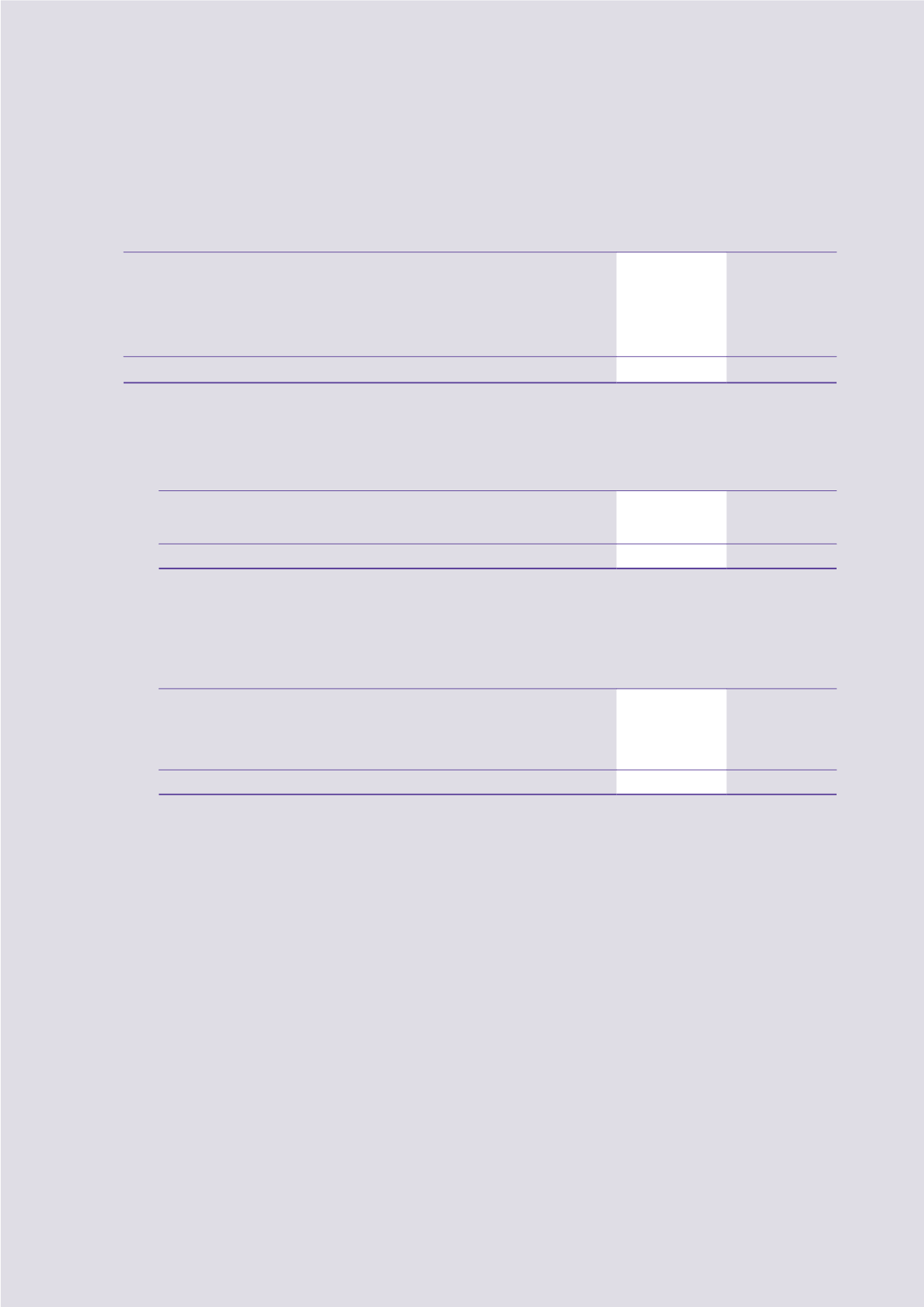

(a)

Aging analysis of trade creditors based on invoice date is as follows:

2016

2015

HK$m

HK$m

Current to 30 days

5,496.4

8,869.1

31 to 60 days

894.3

670.7

Over 60 days

1,589.4

1,548.3

7,980.1

11,088.1

(b)

The amounts payable are interest free, unsecured and have no fixed terms of repayment.

(c)

The carrying amounts of creditors and accrued charges, which approximate their fair values, are denominated in the following

currencies:

2016

2015

HK$m

HK$m

Hong Kong dollar

17,254.1

20,128.5

Renminbi

19,964.6

19,490.5

United States dollar

556.5

553.3

Macau Pataca

273.7

231.6

Others

142.0

201.6

38,190.9

40,605.5

42 Financial Instruments by Category

In accordance with HKFRS 7, the financial assets and financial liabilities of the Group as shown in the consolidated

statements of financial position are classified as follows:

(a)

Financial assets at fair value through profit or loss and derivative financial instruments are categorised as financial

assets at fair value through profit or loss and carried at fair value;

(b)

Available-for-sale financial assets are categorised as available-for-sale financial assets and carried at fair value;

(c)

Held-to-maturity investments are categorised as held-to-maturity investments and carried at amortised cost using the

effective interest method;

(d)

Long-term receivables, long-term deposits, restricted bank deposits, trade and other debtors, and cash and bank

balances are categorised as loans and receivables and carried at amortised cost using the effective interest method;

and

(e)

Borrowings, trade and other creditors are categorised as financial liabilities and carried at amortised cost using the

effective interest method. Derivative financial instruments are categorised as financial liabilities at fair value through

profit or loss and carried at fair value.