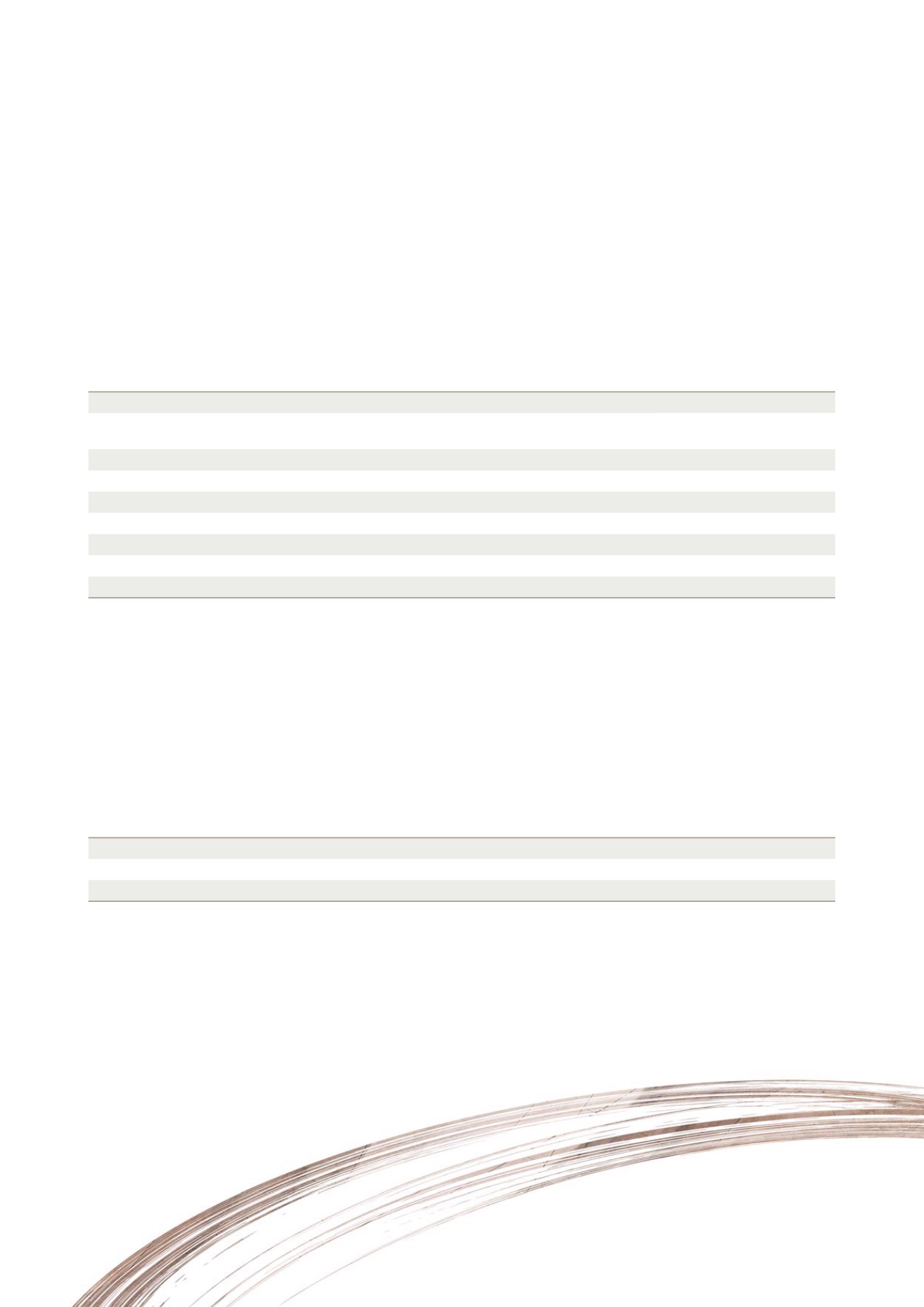

F i nanc i a l H i gh l i gh t s

Annual Report 2016

13

FY2016

HK$m

FY2015

HK$m

Revenues

59,570.0

55,245.0

Segment results (include share of results of joint ventures and associated companies (excluding

changes in fair value of investment properties))

13,997.5

14,552.5

Changes in fair value of investment properties

307.3

3,165.5

Profit attributable to shareholders of the Company*

8,666.3

19,112.0

Underlying profit

9,662.2

6,770.0

Dividend per share (HK$)

Interim

0.13

0.12

Final

0.31

0.30

Full-year

0.44

0.42

As at

30 June

2016

HK$m

As at

30 June

2015

HK$m

Total assets

392,108.6

397,930.7

Net debt

(1)

77,048.8

53,539.1

Gearing ratio

(2)

(%)

38.4

24.1

* The decrease was mainly due to 1) one time gain on the disposal of 50% interest of three hotels in Hong Kong recorded in FY2015; 2) RMB

depreciation led to the net exchange loss recorded in FY2016

For the year ended 30 June 2016, the Group’s EBITDA amounted to HK$9,857.1 million, of which HK$5,055.0 million

(representing 51.3%) was attributable to operations in Hong Kong and HK$4,802.1 million (representing 48.7%) was

attributable to operations in Mainland China and other regions.

Remarks:

(1) Net debt: The aggregate of bank loans, other loans and fixed rate bonds and notes payable less cash and bank balances

(2) Gearing ratio: Net debt divided by total equity