New World Development Company Limited

22

Execu t i ve V i ce - Cha i rman ’s Repo r t

Hong Kong Property Investment

For offices, companies from Mainland China, especially

financial service institutions involving asset management

and securities businesses, favored the offices in core

commercial districts for which supply had already been in

shortage. According to the record of new leasing in Central

in the first half of 2016, companies from Mainland China

accounted for approximately 37%. While some multinational

enterprises had deferred their business expansion plans in

view of realigned strategies for business development, some

seeking to enlarge their market share in the Asia Pacific

region were seeking larger and more suitable office spaces

in core districts in Hong Kong for their business integration

to consolidate strengths for future business expansion.

According to statistics, with a mere 1.4% vacancy rate for

office buildings in core Central in the second quarter of

2016, rental performance was well supported in that locality.

For retail shops, the retail market of Hong Kong has reached

a critical point of structural adjustment, following the

change of consumption pattern worldwide and the change

of mix of inbound travellers from Mainland China, and in the

aftermath of the spanking expansion of selected major

international luxury brands in Hong Kong over the past

years. The overall retail sales performance of Hong Kong

was suppressed by the weak performance of luxury goods

such as jewellery and watches. Increasing operating costs

had led to the removal of some high-end luxury brands from

those street shops at prime retail locations, which were in

turn taken up by mid-range brands and mass market

products which addressed the daily needs of the general

public. Meanwhile, the rental performance of shopping malls

were well endorsed, as brands and tenants are more

inclined to rent properties at major malls for well-secured

visitor flow when they re-arranged their mix of outlets,

geographical coverage and product mix.

During the year under review, despite the soft retail market,

the Group’s gross rental income in Hong Kong increased by

5.9% to HK$1,573.2 million. The leasing properties attained

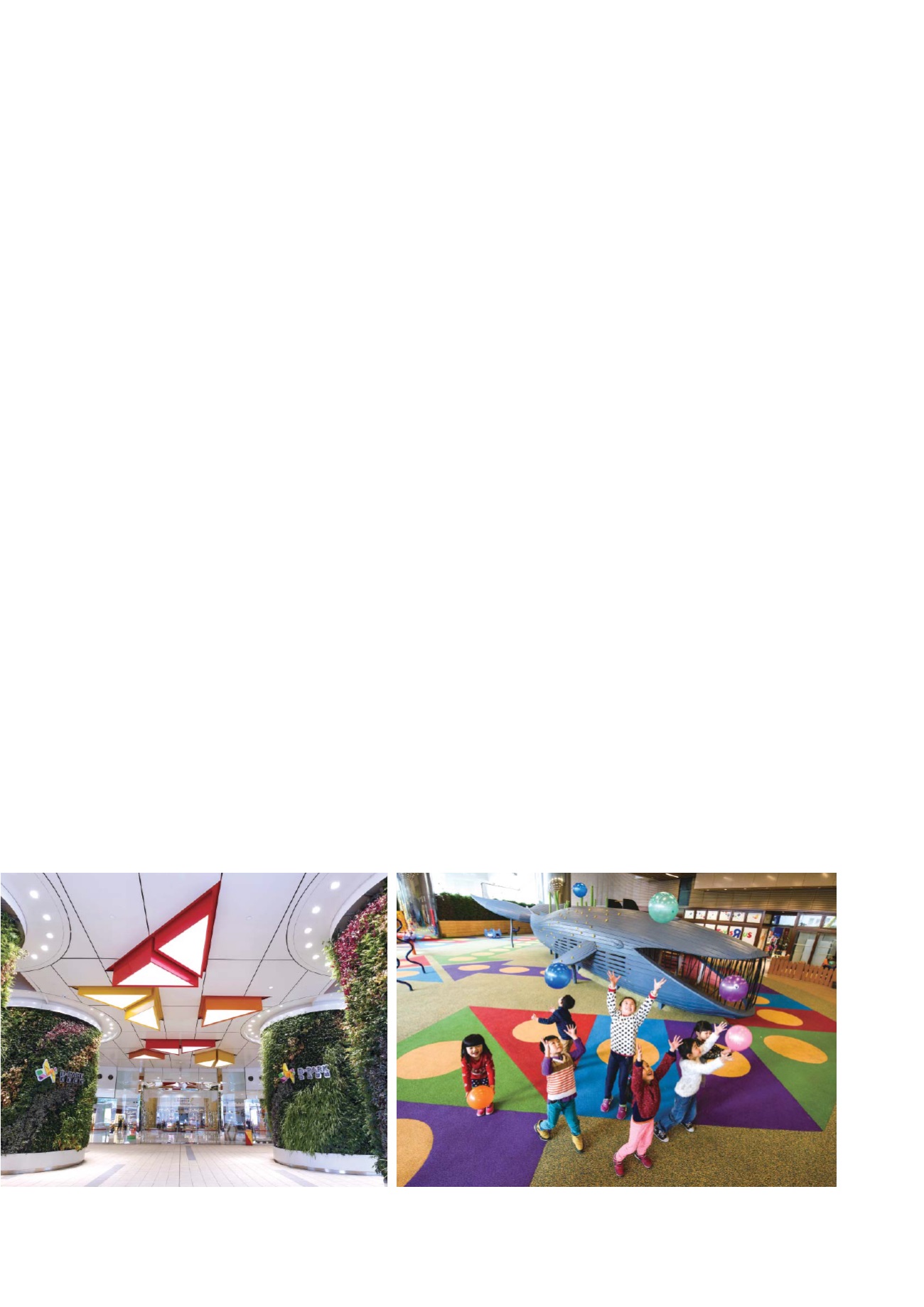

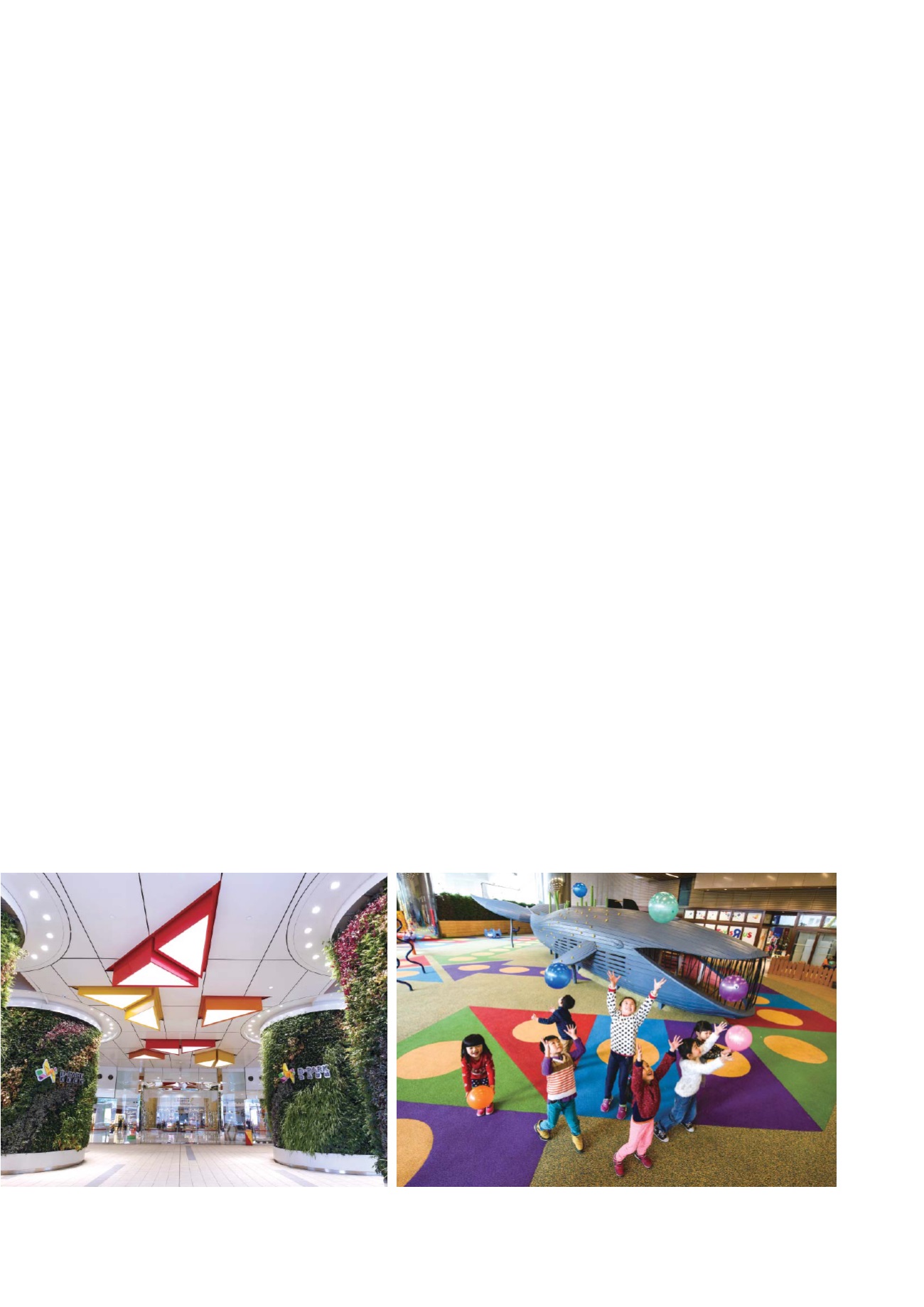

satisfactory occupancies. Hong Kong K11, which is located

in the traditional core retail and tourism district in Tsim Sha

Tsui, recorded an occupancy of almost 100% during the year

under review, with an average monthly pedestrian flow of

approximately 1.4 million, representing an increase of 5.1%

year-on-year. As an international high-end artisanal brand, a

revolutionary museum with retail experience, Hong Kong

K11 has been a popular spot for local consumers and it is

planned to introduce more new food and beverage concepts

together with some first-to-Hong Kong brands in the near

future.