LIQUIDITY AND CAPITAL RESOURCES

Interim Report 2015/2016

LIQUIDITY AND CAPITAL RESOURCES

37

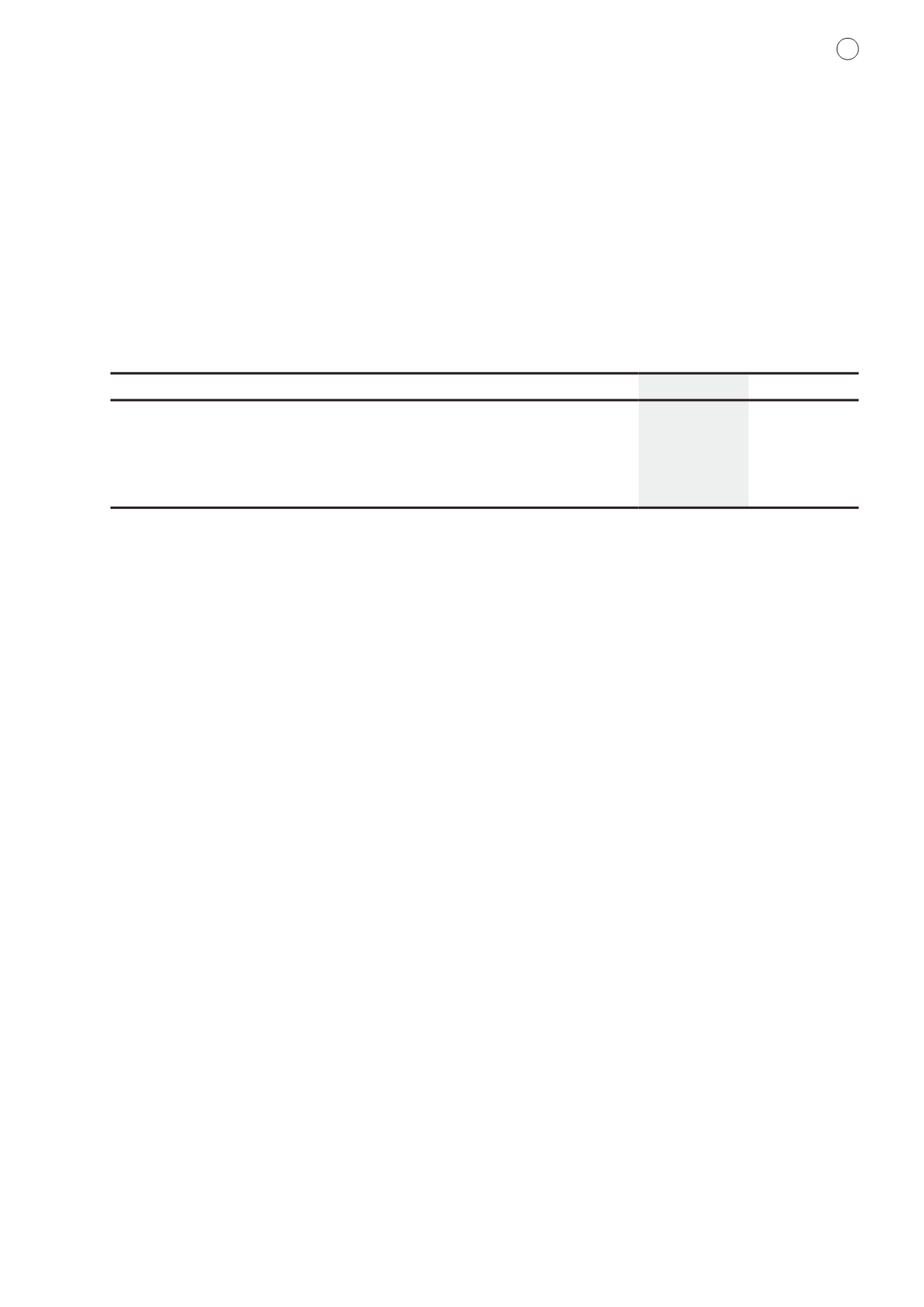

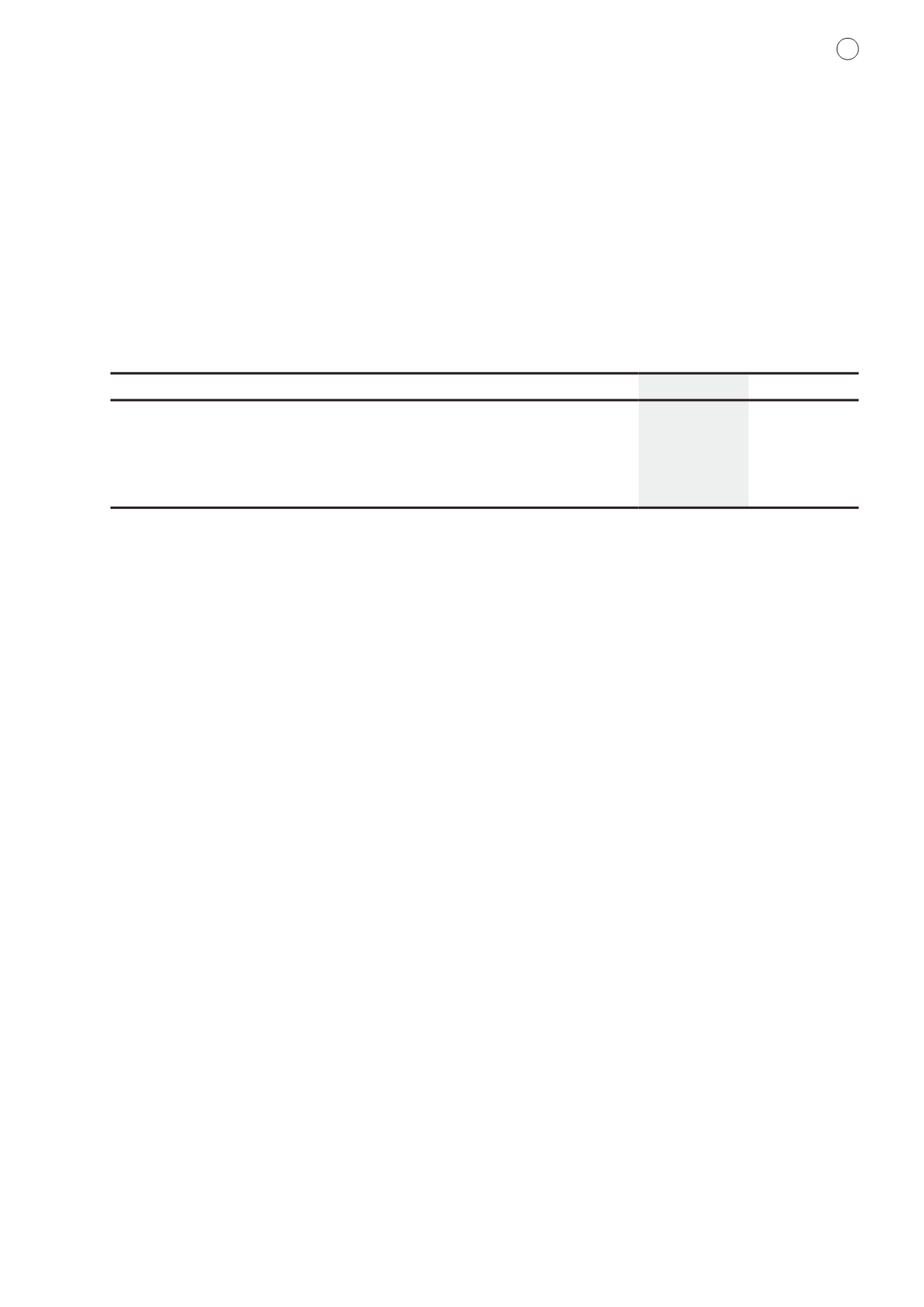

Net Debt

As at

31 December

2015

As at

30 June

2015

HK$m

HK$m

Consolidated net debt

68,162.7

53,539.1

NWSH (stock code: 0659)

7,086.7

6,389.1

NWCL (stock code: 0917)

29,605.2

27,255.6

NWDS – net cash and bank balances (stock code: 0825)

(1,020.1)

(408.8)

Net debt (exclude listed subsidiaries)

32,490.9

20,303.2

The Group’s debts were primarily denominated in Hong Kong dollar and Renminbi. In respect of the Group’s operations

in Mainland China, the Group maintains an appropriate level of external borrowings in Renminbi for natural hedging of

Renminbi contributed to those projects. The Renminbi exposure of the Group is mainly derived from the translation of

non-current assets and liabilities of the subsidiaries, associated companies and joint ventures in Mainland China with

functional currency of Renminbi and the Renminbi deposits held for future development costs to be expended to Hong

Kong Dollar. As at 31 December 2015, the translation of non-current assets and liabilities of subsidiaries, associated

companies and joint ventures with functional currency other than Hong Kong Dollar to Hong Kong Dollar by using

exchange rates at that day resulted a loss of HK$4,147.0 million was recognised in equity. Apart from this, the Group

does not have any material foreign exchange exposure.

The Group’s borrowings were mainly arranged on a floating rate basis. The Group used interest rate swaps and foreign

currency swap to hedge part of the Group’s underlying interest rate and foreign exchange exposure. As at 31 December

2015, the Group had outstanding derivative instruments in the amounts of HK$5,800.0 million and US$600.0 million

(equivalent to approximately HK$4,662.0 million). As at 31 December 2015, the Group had outstanding foreign currency

swap contracts in the amounts of US$60.0 million (equivalent to approximately HK$466.2 million).

During the period, a subsidiary of the Group issued US$950.0 million bonds (equivalent to approximately HK$7,381.5

million) at fixed rate of 4.375% due in 2022.

As at 31 December 2015, the Group’s cash and bank balances stood at HK$64,698.5 million (30 June 2015: HK$59,465.2

million) and the consolidated net debt amounted to HK$68,162.7 million (30 June 2015: HK$53,539.1 million). The

net debt to equity ratio was 31.4%, an increase of 7.3 percentage points as compared to 30 June 2015 mainly due to

payment of development costs, acquisition of 36% interest in Beames Holdings Limited (“Beames”) of HK$3,592.8

million and subscription for perpetual securities of US$900.0 million (equivalent to approximately HK$6,993.0 million).