Interim Report 2015/2016

NOTES TO CONDENSED ACCOUNTS

27

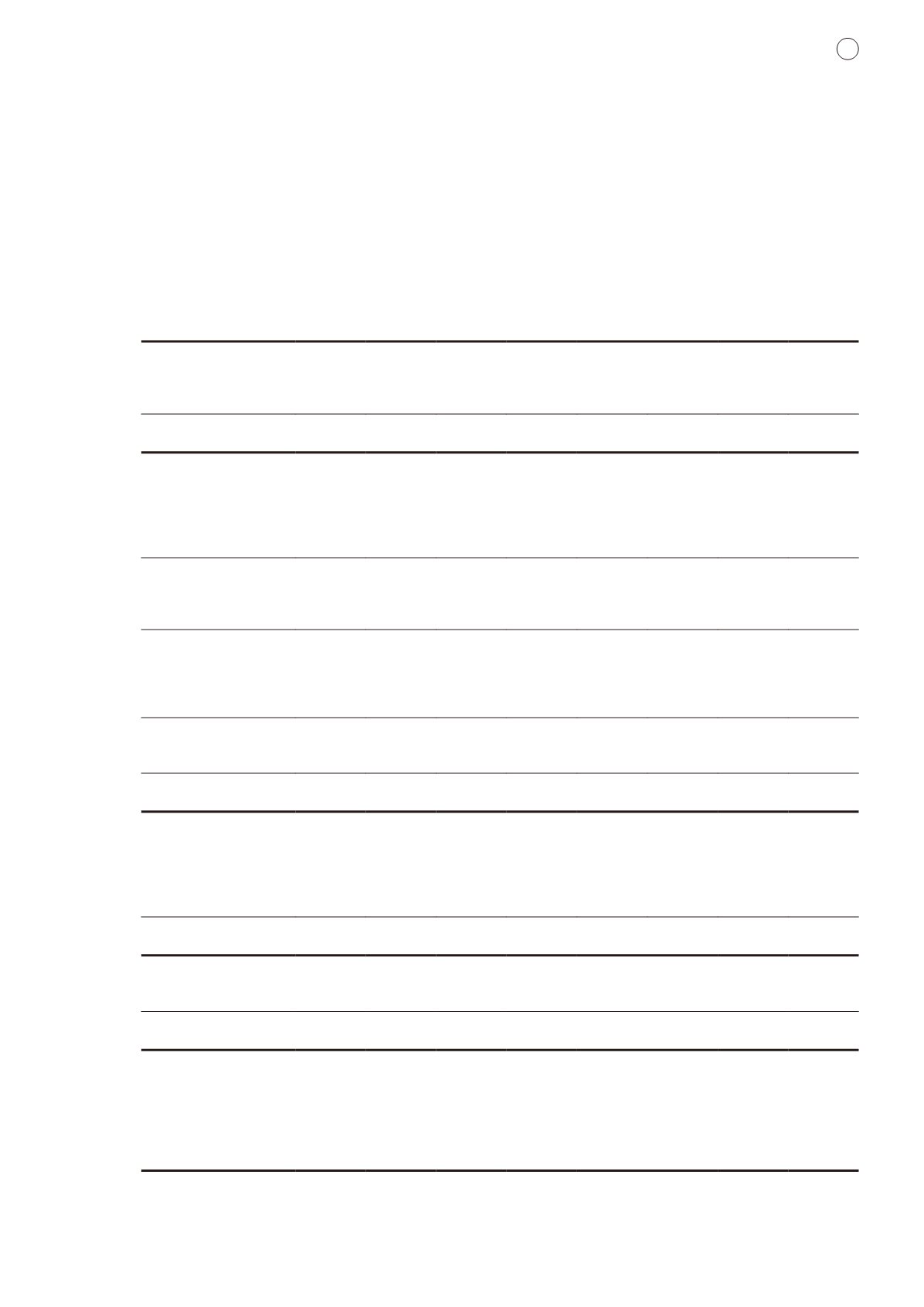

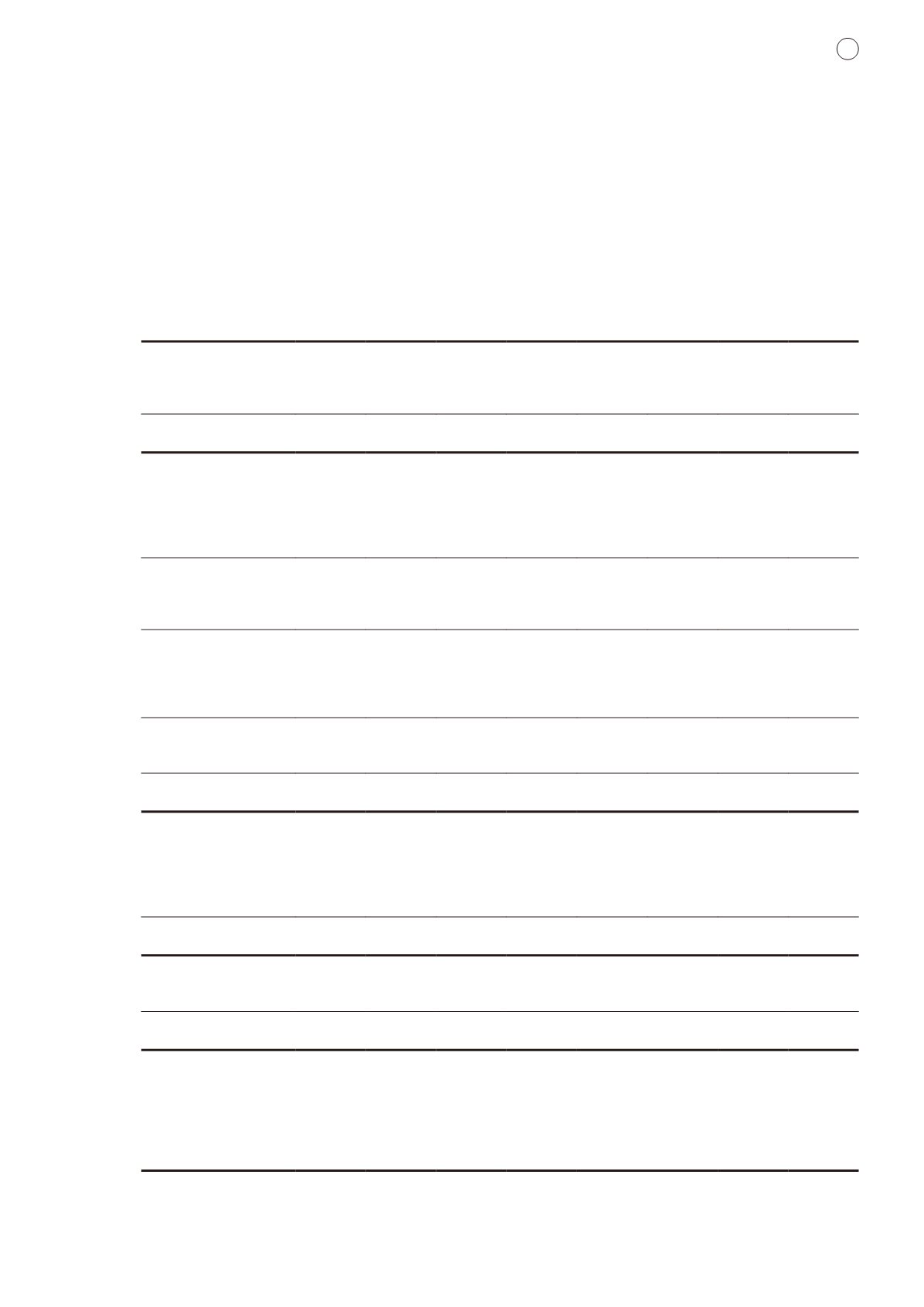

3 Revenues and segment information

(continued)

Property

development

Property

investment

Service Infrastructure

Hotel

operations

Department

stores

Others Consolidated

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

For the six months ended

31 December 2014

Total revenues

11,861.4

1,295.5

11,603.9

1,324.4

2,041.7

2,006.9

490.6

30,624.4

Inter–segment

–

(96.6)

(3,515.2)

–

–

–

(26.3)

(3,638.1)

Revenues–external

11,861.4

1,198.9

8,088.7

1,324.4

2,041.7

2,006.9

464.3

26,986.3

Segment results

3,226.9

743.5

470.2

580.9

188.5

229.9

(64.4)

5,375.5

Other (losses)/gains, net

11.5

15.8

68.3

(31.1)

(14.0)

22.2

353.2

425.9

Changes in fair value of

investment properties

–

1,670.0

141.3

–

–

–

–

1,811.3

Unallocated corporate expenses

(601.8)

Operating profit

7,010.9

Financing income

518.8

Financing costs

(910.7)

6,619.0

Share of results of

Joint ventures (Note a)

1,212.8

244.3

60.2

1,903.5

(23.7)

–

(45.3)

3,351.8

Associated companies (Note b)

2.3

171.0

(1,137.8)

153.0

–

–

6.3

(805.2)

Profit before taxation

9,165.6

Taxation

(1,941.1)

Profit for the period

7,224.5

As at 30 June 2015

Segment assets

118,553.4

91,514.2

11,936.3

16,690.2

13,808.3

6,492.6

11,543.7

270,538.7

Interests in joint ventures

12,355.0

12,312.7

3,125.2

14,576.0

6,200.9

–

882.1

49,451.9

Interests in associated companies

992.1

2,819.9

6,499.1

7,108.0

1.1

–

311.5

17,731.7

Unallocated assets

60,208.4

Total assets

397,930.7

Segment liabilities

25,909.1

1,073.3

8,259.1

751.3

540.0

4,061.2

1,735.2

42,329.2

Unallocated liabilities

133,243.5

Total liabilities

175,572.7

For the six months ended

31 December 2014

Additions to non-current assets

(Note c)

3,014.2

1,597.6

52.2

48.0

965.1

833.0

605.7

7,115.8

Depreciation and amortisation

45.7

5.5

82.7

420.9

304.6

209.3

36.0

1,104.7

Impairment charge and provision

–

–

–

–

56.4

–

0.1

56.5