New World Development Company Limited

NOTES TO CONDENSED ACCOUNTS

30

5 Taxation

(continued)

Taxation on Mainland China and overseas profits has been calculated on the estimated taxable profit for the period

at the rates of taxation prevailing in the countries in which the Group operates. These rates range from 12% to

25% (2014: 9% to 25%).

Mainland China land appreciation tax is provided at progressive rates ranging from 30% to 60% (2014: 30% to

60%) on the appreciation of land value, being the proceeds of sale of properties less deductible expenditures

including costs of land use rights and property development expenditures.

Share of results of joint ventures and associated companies is stated after deducting the share of taxation of

joint ventures and associated companies of HK$372.4 million and HK$102.8 million (2014: HK$677.5 million and

HK$66.4 million) respectively.

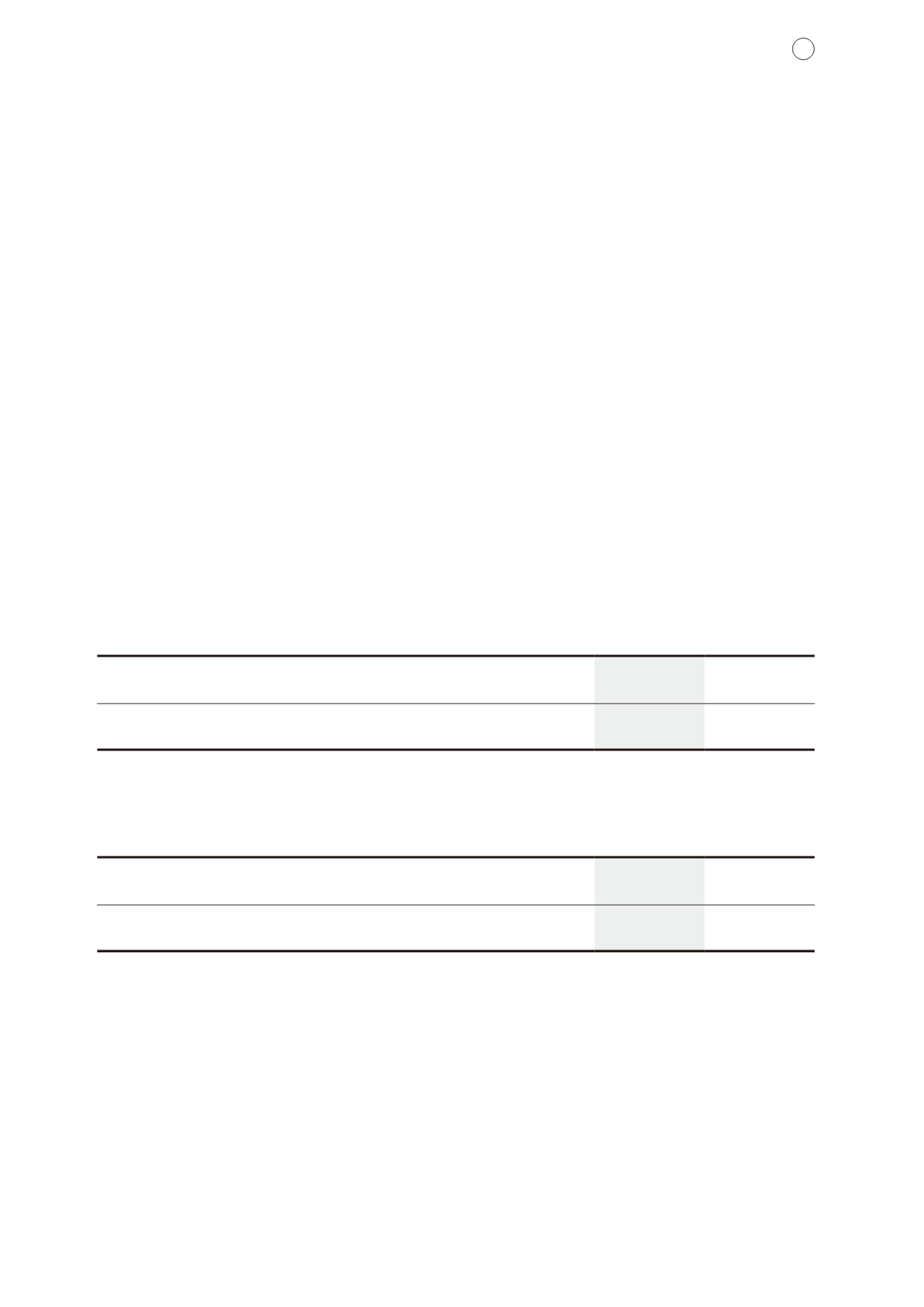

6 Earnings per share

The calculation of basic and diluted earnings per share for the period is based on the following:

For the six months ended

31 December

2015

2014

HK$m

HK$m

Profit attributable to shareholders of the Company

3,300.0

5,854.6

Adjustment on the effect of dilution in the results of subsidiaries

(0.6)

(1.0)

Profit for calculating diluted earnings per share

3,299.4

5,853.6

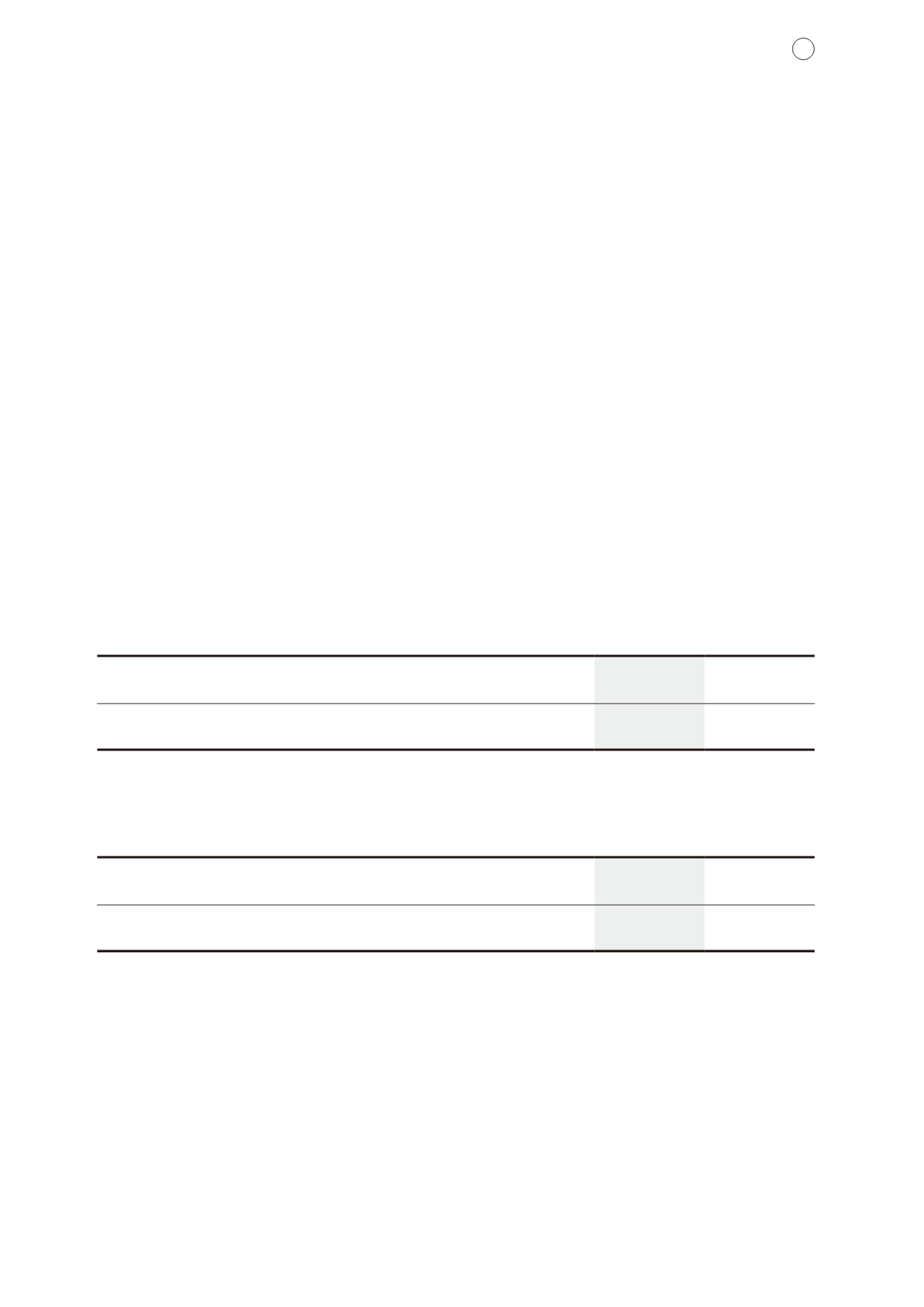

Number of shares (million)

For the six months ended

31 December

2015

2014

Weighted average number of shares for calculating basic earnings per share

8,999.9

8,665.9

Effect of dilutive potential ordinary shares upon the exercise of share options

–

0.2

Weighted average number of shares for calculating diluted earnings per share

8,999.9

8,666.1

Diluted earnings per share for the six months ended 31 December 2015 did not assume the exercise of share

options outstanding during the period since the exercise would have an anti-dilutive effect. This effect had been

assumed for the six months ended 31 December 2014 since the exercise would have a dilutive effect.

7 Capital expenditure

For the six months ended 31 December 2015, the Group has acquired investment properties, property, plant and

equipment, land use rights and intangible concession rights of HK$5,487.0 million (2014: HK$4,260.6 million). The

Group has disposed of investment properties, property, plant and equipment and intangible concession rights of net

book value of HK$537.4 million (2014: HK$179.2 million).