New World Development Company Limited

NOTES TO CONDENSED ACCOUNTS

28

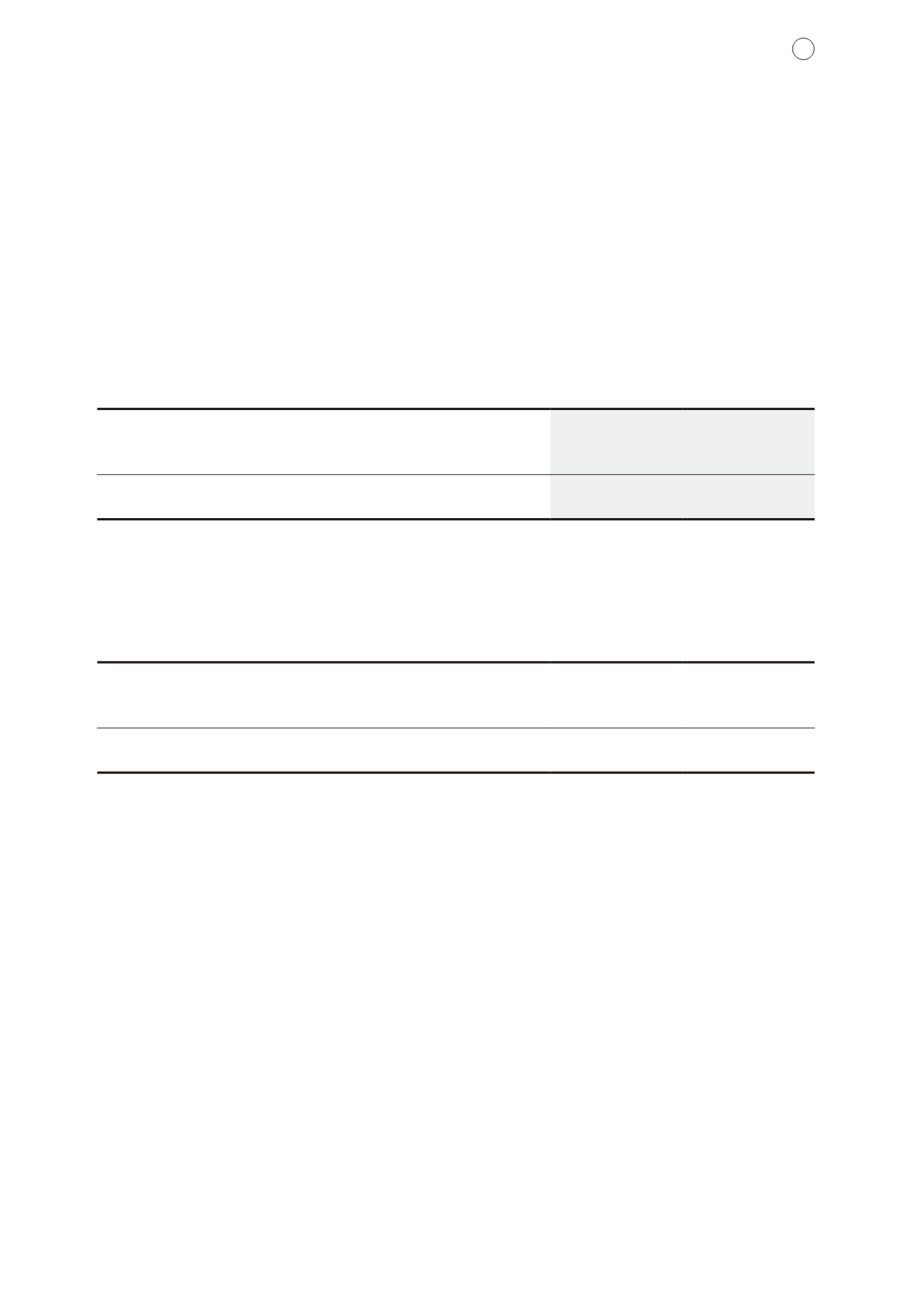

3 Revenues and segment information

(continued)

Revenues

Non-current

assets (Note c)

Six months ended

31 December

2015

As at

31 December

2015

HK$m

HK$m

Hong Kong

21,949.0

83,245.8

Mainland China

11,304.7

67,530.4

Others

524.5

351.5

33,778.2

151,127.7

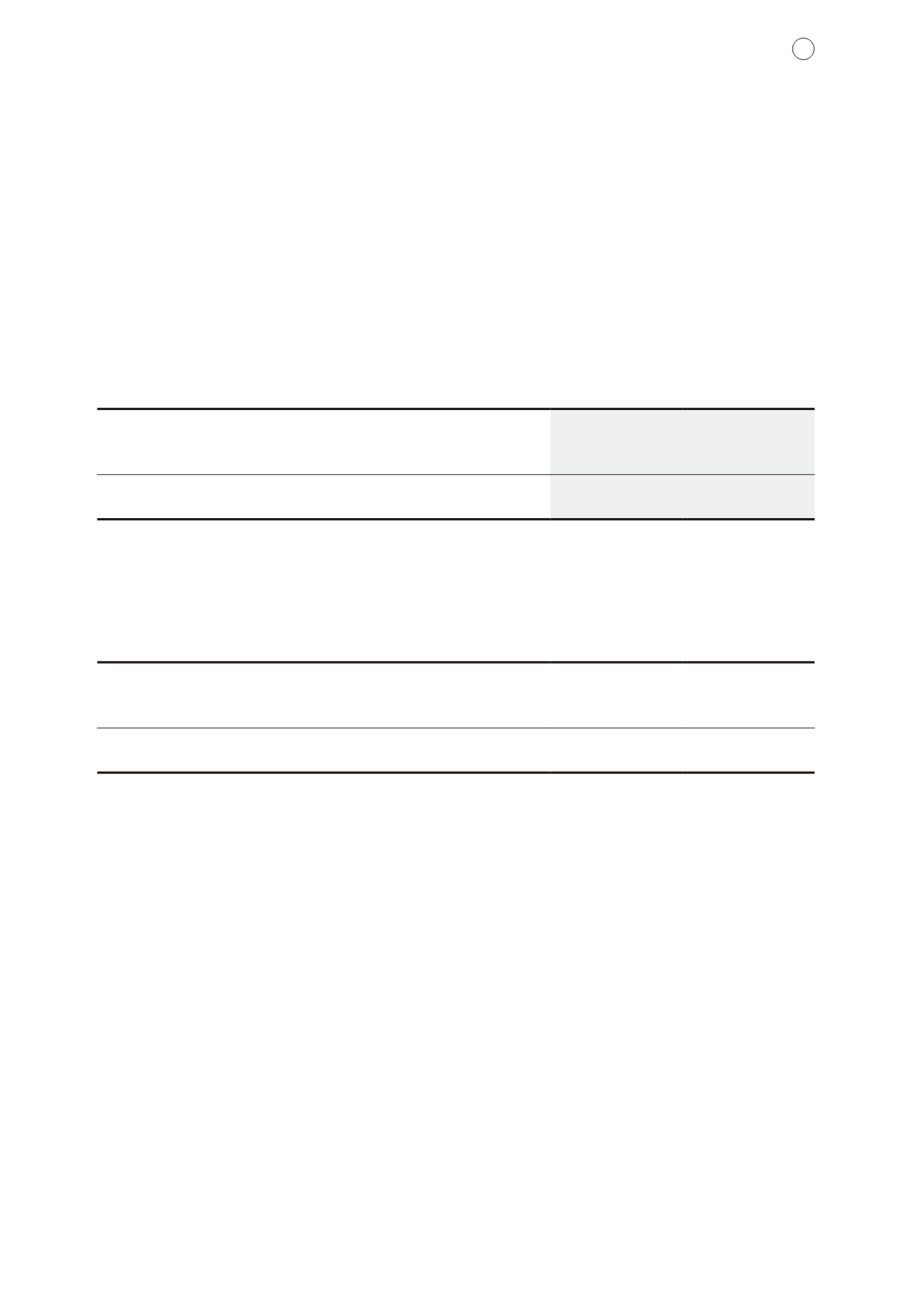

Revenues

Non-current

assets (Note c)

Six months ended

31 December

2014

As at

30 June

2015

HK$m

HK$m

Hong Kong

14,480.7

81,469.7

Mainland China

12,337.1

76,854.2

Others

168.5

394.7

26,986.3

158,718.6

Notes:

a.

For the six months ended 31 December 2015, the amount in the service segment includes the Group’s share of impairment loss of

HK$177.6 million for Hyva Holding B.V. and the amount in the infrastructure segment includes the Group’s share of gain of HK$179.3

million arising from deemed disposal of its indirect interest in Chongqing Water Group Co., Ltd..

For the six months ended 31 December 2014, the amount in the infrastructure segment includes (i) the Group’s share of gain of

approximately HK$1,549.9 million arising from the disposal of its indirect interest in Companhia de Electricidade de Macau – CEM, S.A.

and (ii) the Group’s share of impairment loss of HK$300.0 million for Guangzhou Dongxin Expressway.

b.

For the six months ended 31 December 2015, the amount in the service segment includes an impairment loss of HK$200.0 million

made for the Group’s interest in Tharisa plc.

For the six months ended 31 December 2014, the amount in the service segment includes an impairment loss of HK$1,300.0 million

made for the Group’s interest in Newton Resources Ltd, a listed associated company.

c.

Non-current assets represent non-current assets other than financial instruments (financial instruments include interests in joint

ventures and associated companies), deferred tax assets and retirement benefit assets.

d.

The amount in the others segment included net exchange loss of HK$1,565.3 million for the six months ended 31 December 2015.

e.

For the six months ended 31 December 2015, the operating profit before depreciation and amortisation amounted to HK$6,356.5

million, of which HK$3,379.5 million was attributable to Hong Kong and HK$2,977.0 million was attributable to Mainland China and

Others.