New World Development Company Limited

NOTES TO CONDENSED ACCOUNTS

36

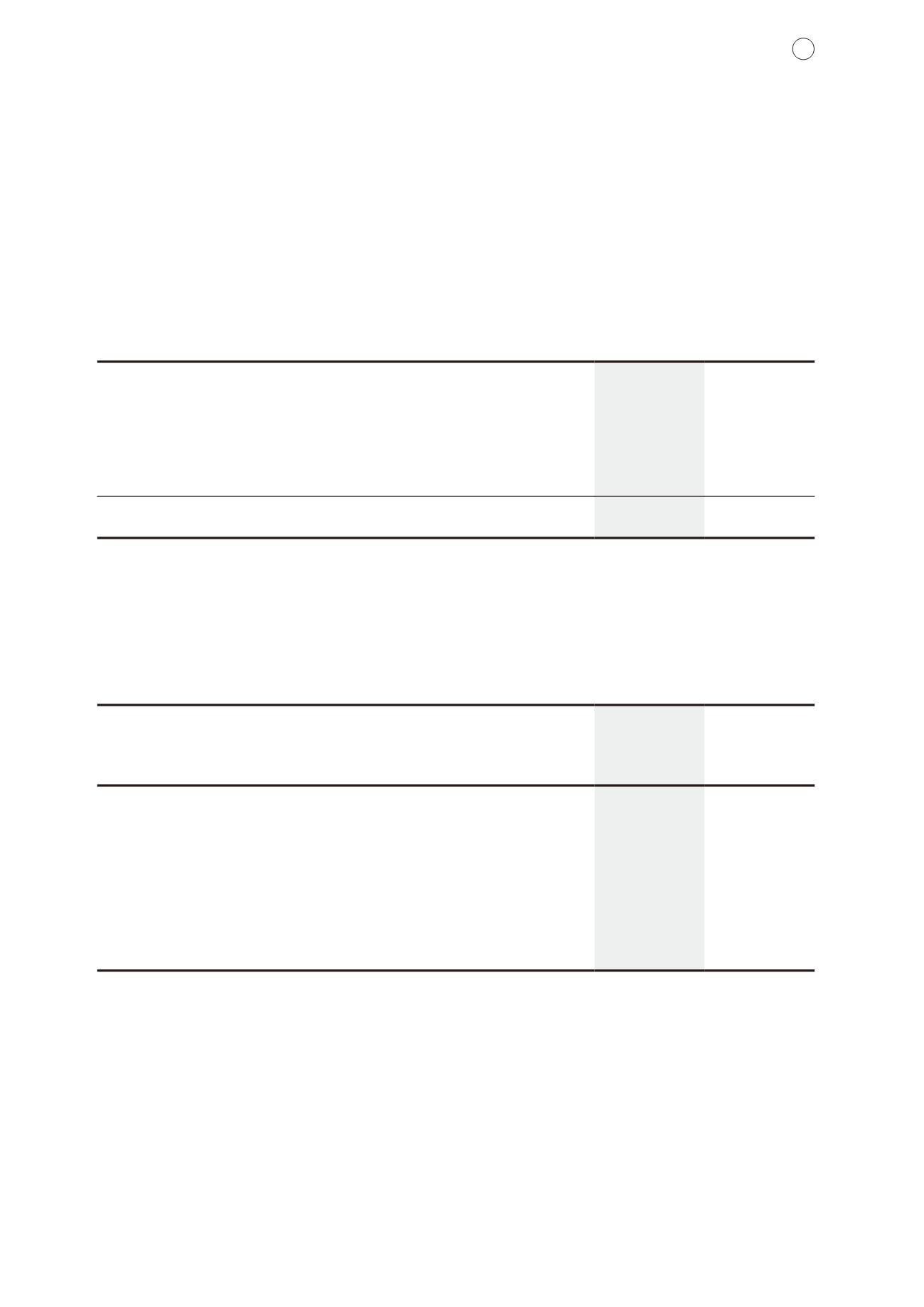

17 Financial guarantee and contingent liabilities

As at

31 December

2015

As at

30 June

2015

HK$m

HK$m

Financial guarantee contracts:

Mortgage facilities for certain purchasers of properties

2,595.8

2,240.0

Guarantees for credit facilities granted to

Joint ventures

4,020.1

4,229.4

Associated companies

1,340.9

20.0

A related company

44.7

49.7

Indemnity to non-wholly owned subsidiaries for Mainland China tax liabilities

1,318.0

1,415.0

9,319.5

7,954.1

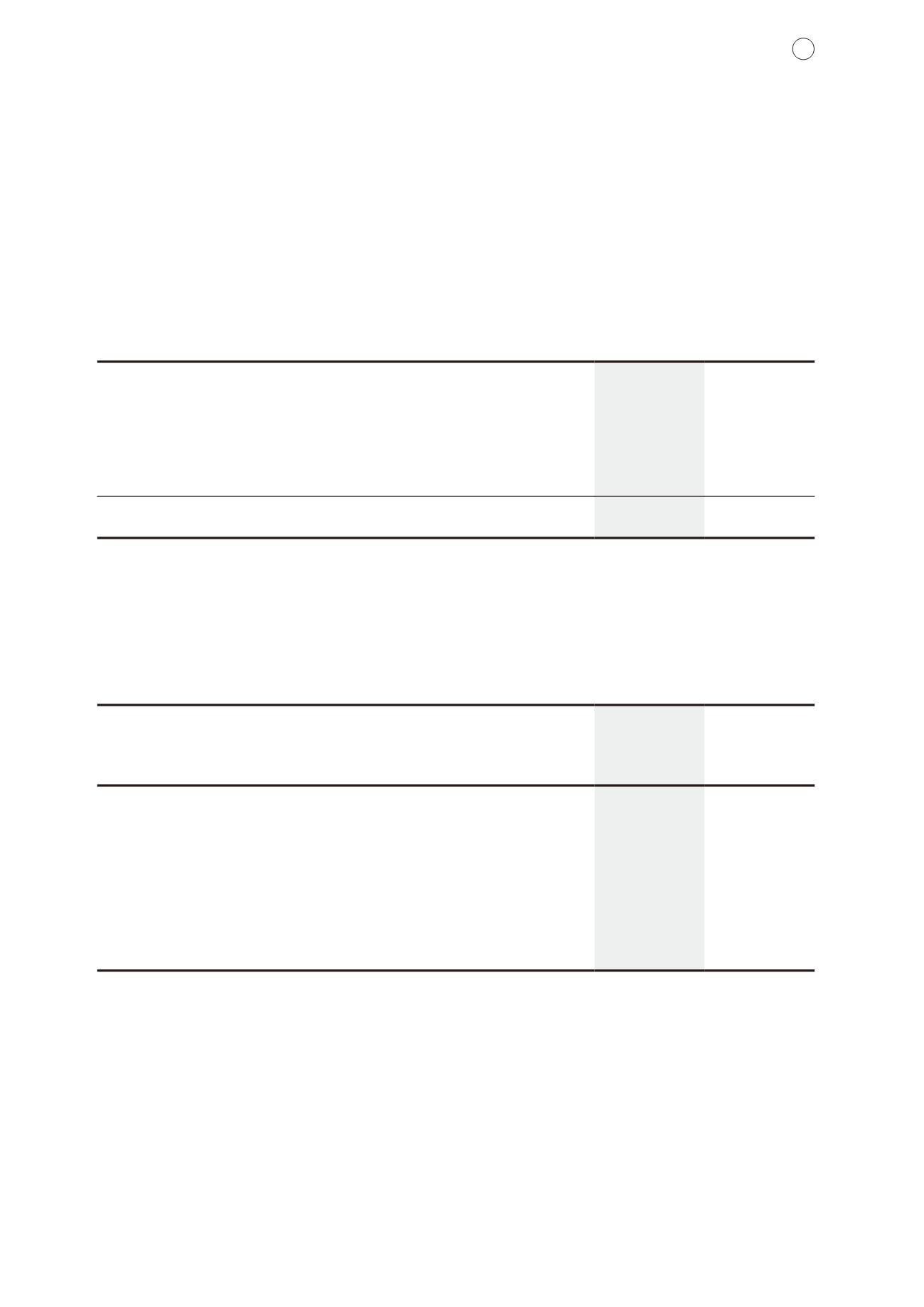

18 Related party transactions

The following is a summary of significant related party transactions during the period which were carried out in the

normal course of the Group’s business:

For the six months ended

31 December

2015

2014

HK$m

HK$m

Transactions with joint ventures and associated companies

Provision of construction work services

415.4

334.9

Interest income

43.4

64.3

Rental expenses

135.5

159.7

Transactions with other related parties

Provision of construction work services

20.1

237.8

Rental income

60.9

71.2

Concessionaires commissions

42.9

51.2

Hotel management services fee income

52.5

19.3

Sales of goods, prepaid shopping cards and vouchers

32.1

26.7

Purchase of goods

8.5

41.5

Engineering and mechanical services

708.6

380.4

Management fee expenses

11.0

66.8

These related party transactions were conducted in accordance with the terms as disclosed in the last annual

report.

No significant transactions have been entered with the directors of the Company (being the key management

personnel) during the period other than the emoluments paid to them (being the key management personnel

compensation).

19 Event subsequent to period end

As referred to Note 11(a), the disposals entered on 2 December 2015 and 29 December 2015, with the exception

of the disposal of property project in Chengdu signed on 29 December 2015, were completed in January and

February 2016 respectively. The consideration for contracts entered on 2 December 2015 will be received by

instalments within two years after the completion.