New World Development Company Limited

132

Financial Section

4 Financial Risk Management and Fair Value Estimation

(continued)

(c) Liquidity risk

Prudent liquidity risk management includes managing the profile of debt maturities and funding sources, maintaining

sufficient cash and marketable securities, and ensuring the availability of funding from an adequate amount of

committed credit facilities and the ability to close out market positions. It is the policy of the Group to regularly

monitor current and expected liquidity requirements and to ensure that adequate funding is available for operating,

investing and financing activities. The Group also maintain adequate undrawn committed credit facilities to further

reduce liquidity risk in meeting funding requirements.

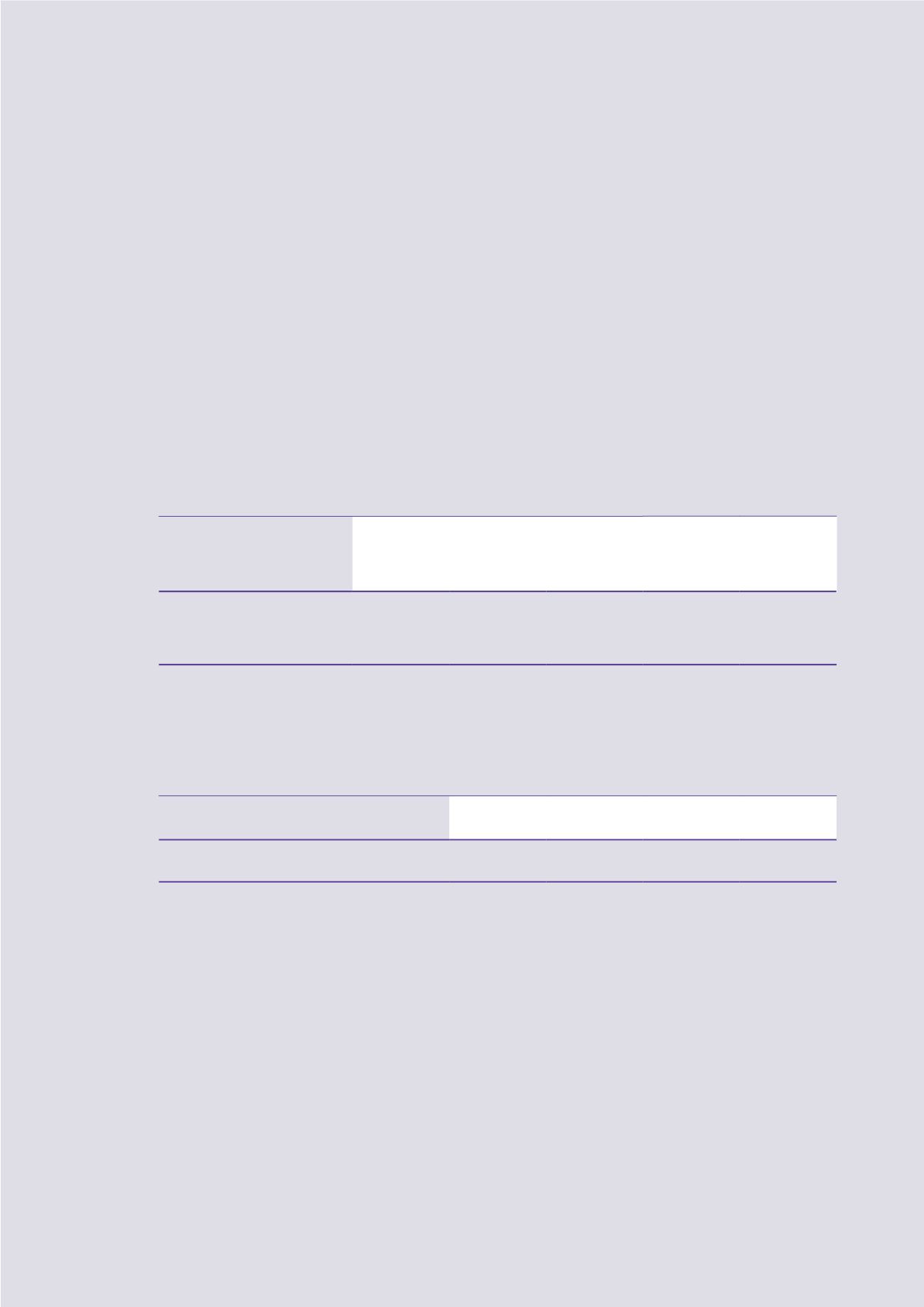

The table below analyses the Group’s non-derivative financial liabilities into relevant maturity groupings based on the

remaining period at the end of the reporting period to the contractual maturity dates. The amounts disclosed in the

table are the contractual undiscounted cash flows.

Non-derivative financial liabilities:

Carrying

amount

Total

contractual

undiscounted

cash flow

Within

1 year or on

demand

Over 1 year

but within

5 years

After

5 years

HK$m

HK$m

HK$m

HK$m

HK$m

At 30 June 2016

Creditors and accrued charges

22,256.1

22,260.6

19,761.1

2,489.0

10.5

Short-term borrowings

3,261.6

3,336.8

3,336.8

–

–

Long-term borrowings

131,670.5

148,989.7

21,128.8

101,432.3

26,428.6

At 30 June 2015

Creditors and accrued charges

24,556.6

24,556.6

22,333.4

2,202.2

21.0

Short-term borrowings

6,261.2

6,404.2

6,404.2

–

–

Long-term borrowings

110,895.3

120,323.2

30,939.6

72,963.3

16,420.3

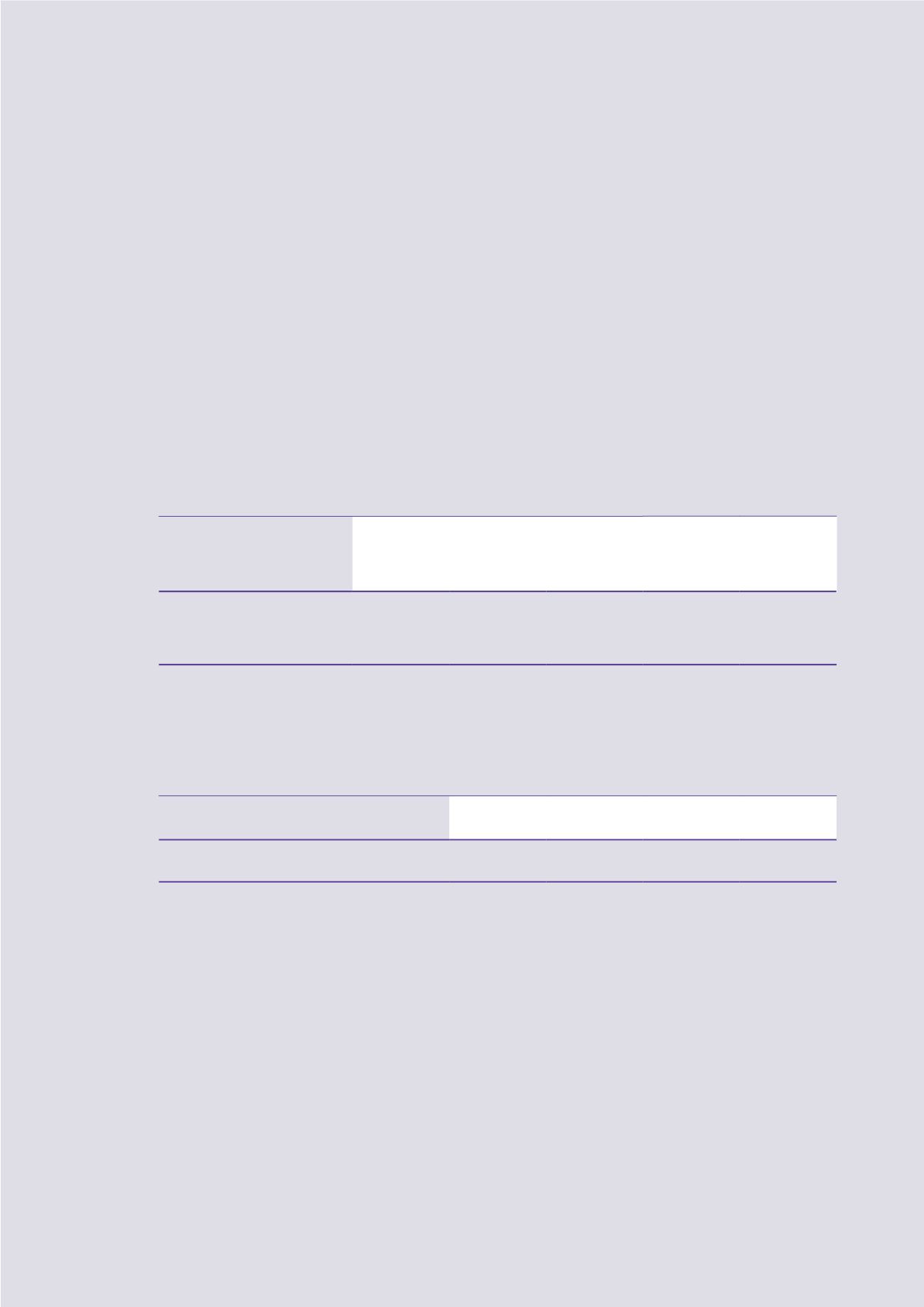

Derivative financial liabilities:

Total

contractual

undiscounted

cash flow

Within

1 year or on

demand

Over 1 year

but within

5 years

After

5 years

HK$m

HK$m

HK$m

HK$m

At 30 June 2016

Derivative financial instruments (net settled)

443.8

203.7

240.1

–

At 30 June 2015

Derivative financial instruments (net settled)

391.4

125.5

263.8

2.1

There are no gross settled derivative financial liabilities as at 30 June 2016.