Annual Report 2016

141

Financial Section

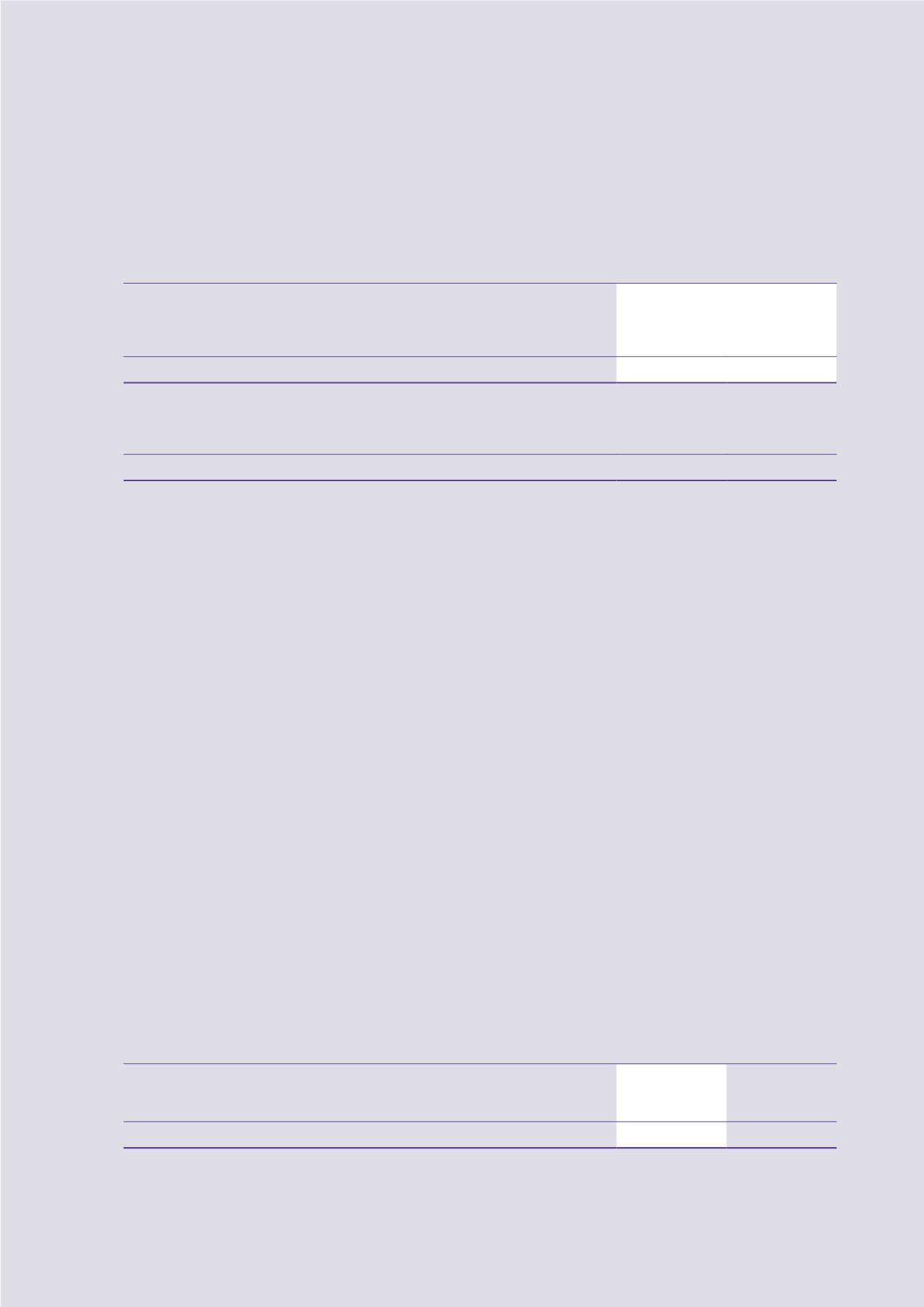

6 Revenues and Segment Information

(continued)

Revenues Non-current

assets

HK$m

HK$m

(note (c))

2016

Hong Kong

33,721.9

84,282.1

Mainland China

24,772.5

61,885.2

Others

1,075.6

400.0

59,570.0

146,567.3

2015

Hong Kong

29,907.9

81,469.7

Mainland China

24,360.5

76,854.2

Others

976.6

394.7

55,245.0

158,718.6

Notes:

(a)

For the year ended 30 June 2016, the amount in the service segment includes the Group’s share of impairment loss of HK$177.6 million

for Hyva and the amount in the infrastructure segment includes the Group’s share of gain of HK$179.3 million arising from deemed

disposal of its indirect interest in Chongqing Water Group Co., Ltd., a project under a joint venture.

For the year ended 30 June 2015, the amount in the infrastructure segment includes (i) the Group’s share of gain of approximately

HK$1,549.9 million arising from the disposal of its indirect interest in Companhia de Electricidade de Macau – CEM, S.A. and (ii) the

Group’s share of impairment loss of HK$300.0 million for Guangzhou Dongxin Expressway.

(b)

For the year ended 30 June 2016, the amount in the service segment includes an impairment loss of HK$200.0 million made for the

Group’s interest in Tharisa.

For the year ended 30 June 2015, the amount in the service segment includes an impairment loss of HK$1,779.4 million made for the

Group’s interest in Newton Resources.

(c)

Non-current assets represent non-current assets other than financial instruments, interests in joint ventures, interests in associated

companies, deferred tax assets and retirement benefit assets.

(d)

For the year ended 30 June 2016, the decrease in revenue in hotel segment is due to the disposal of its 50% interest in three hotels by

the Group, namely Grand Hyatt Hong Kong, Renaissance Harbour View Hotel, Hong Kong and Hyatt Regency, Tsim Sha Tsui on 15 June

2015 and the remaining interest was reclassified as interest in a joint venture.

For the year ended 30 June 2015, the hotel operation segment includes the gain on partial disposal of interests in subsidiaries holding

the three hotels in Hong Kong and remeasurement of retained interest at fair value after reclassification to a joint venture of

HK$13,709.2 million.

(e)

The amount in the others segment includes net exchange loss of HK$1,306.7 million for the year ended 30 June 2016. The

telecommunication business in this segment ceased after the completion of the disposal of the telecommunication services in March

2016.

(f)

For the year ended 30 June 2016, the operating profit before depreciation and amortisation, change in fair value of investment

properties and other gains, net and after net exchange difference amounted to HK$9,857.1 million, of which HK$5,055.0 million was

attributable to Hong Kong and HK$4,802.1 million was attributable to Mainland China and others.

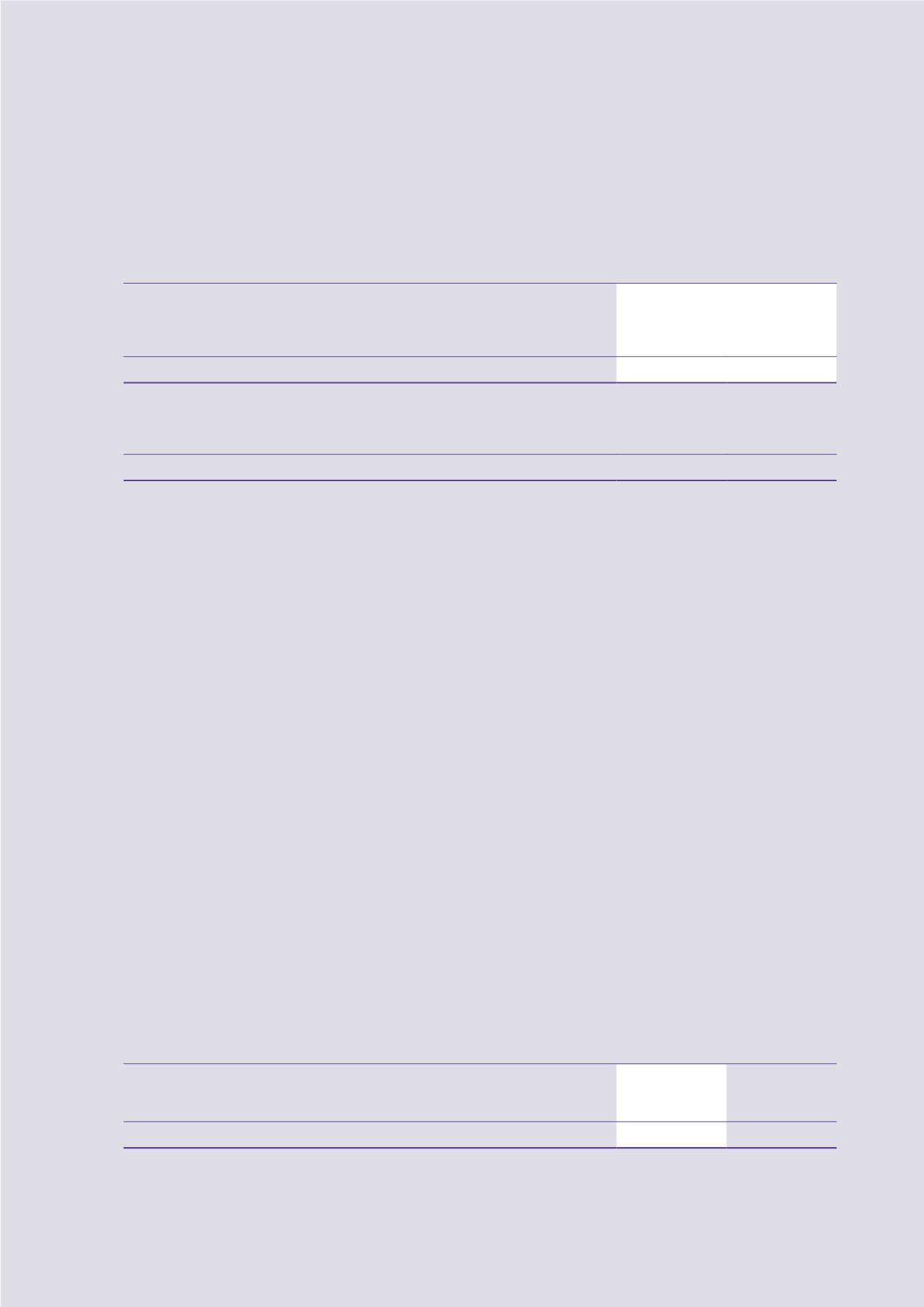

7 Other Income

2016

2015

HK$m

HK$m

Dividend income from available-for-sale financial assets, perpetual securities

and a financial asset at fair value through profit or loss

855.5

31.8

Others

68.0

–

923.5

31.8