New World Development Company Limited

142

Financial Section

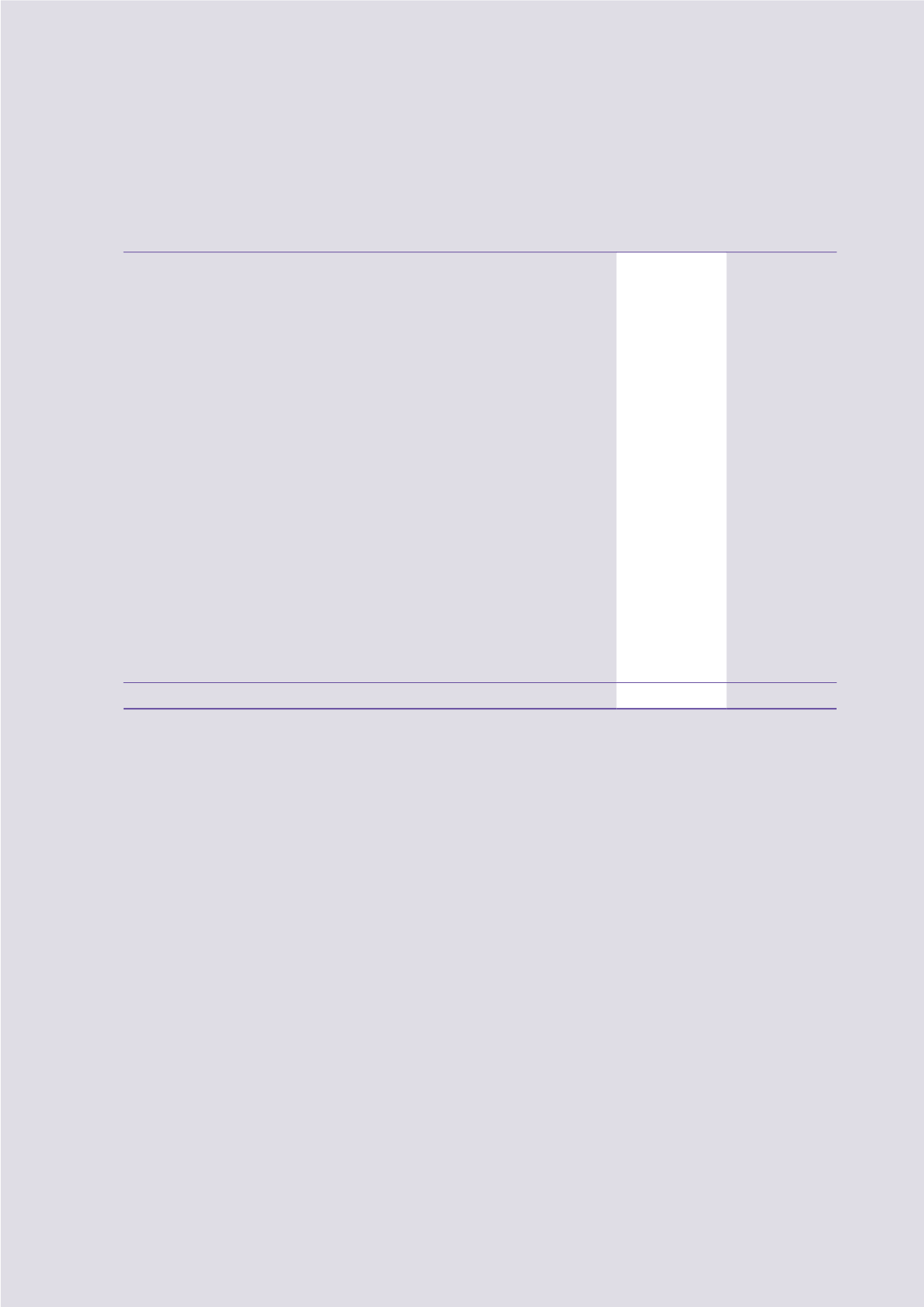

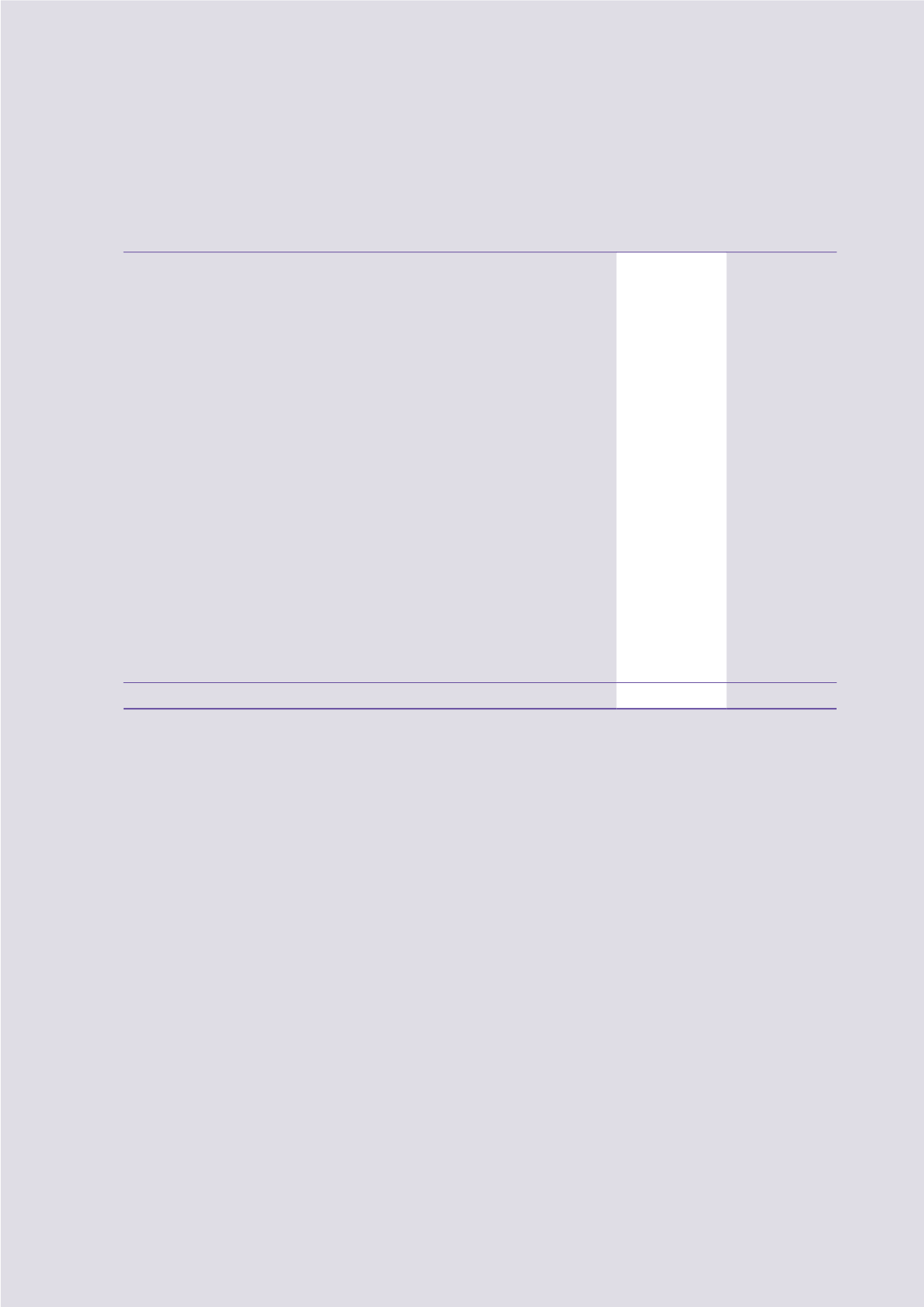

8 Other Gains, Net

2016

2015

HK$m

HK$m

Write back of provision for loans and other receivables

210.4

376.6

Write back of provision for property, plant and equipment

567.3

–

Gain on deemed disposal of interest in an associated company

–

50.7

Gain on partial disposal of interests in subsidiaries and remeasurement of

retained interest at fair value after reclassification to a joint venture

40.0

13,709.2

Gain on remeasurement of an available-for-sale financial asset retained at

fair value upon reclassification from an associated company

–

914.0

Gain on remeasurement of previously held interest of an associated

company at fair value upon further acquisition to become a subsidiary

18.2

–

(Loss)/gain on remeasurement of previously held interest of a joint

venture at fair value upon further acquisition to become a subsidiary

(40.5)

986.6

Net loss on fair value of financial assets at fair value through profit or loss

(154.0)

(38.9)

Net gain/(loss) on disposal of

Available-for-sale financial assets

413.3

66.2

Non-current assets classified as assets held for sale (note (a))

784.9

30.3

Financial assets at fair value through profit or loss

9.8

(23.5)

Investment properties, property, plant and equipment and

intangible concession rights and their related assets and liabilities

207.2

(63.2)

Subsidiaries (note (b))

6,965.4

18.0

Joint ventures

53.0

–

Associated companies

3.0

(137.9)

Impairment loss on

Available-for-sale financial assets (note (c))

(692.4)

(11.8)

Loans and other receivables

(7.4)

(61.2)

Property, plant and equipment

(30.1)

(532.0)

Intangible assets

–

(100.5)

Net exchange (losses)/gains

(1,894.0)

93.8

6,454.1

15,276.4

Notes:

Other gains, net recognised are mainly as follows:

(a)

Net gain on disposal of non-current assets classified as assets held for sale mainly includes the following:

On 3 July 2015, the Group entered into a sales and purchase agreement with Chow Tai Fook Enterprises Limited (“CTF”), to sell its

entire interest in New World Hotel Management (BVI) Limited, its subsidiaries and a joint venture (the “Disposal Hotel Group”) and to

assign and transfer of the shareholder’s loan for an aggregate consideration of HK$2,753.0 million. The Disposal Hotel Group is

engaged in the provision of worldwide hotel management services, which is not the core business of the Group. The disposal was

completed on 29 December 2015 and the Group recognised a gain on disposal of HK$768.9 million in the consolidated income

statement for the year ended 30 June 2016.

(b)

Net gain on disposal of subsidiaries during the year mainly includes the followings:

On 2 December 2015 and 29 December 2015, the Group entered into sale and purchase agreements with Shengyu (BVI) Limited

(“Shengyu”), a wholly owned subsidiary of Evergrande Real Estate Group Limited (“Evergrande”), as purchaser, a company listed on the

Stock Exchange, pursuant to which the Group had conditionally agreed to sell and Shenyu had conditionally agreed to purchase the

entire equity interests in Hinto Developments Limited, Dragon Joy (China) Limited, White Heron Limited, Superb Capital Enterprises

Limited, Best Wealth Investments Limited, Triumph Hero International Limited, Rise Eagle Worldwide Limited and their subsidiaries and

joint ventures (collectively refer to as the “Disposal Property Group”) and to assign and transfer of the shareholders’ loan for an

aggregate consideration of RMB20,800.0 million (equivalent to HK$25,106.1 million) subject to adjustments. The Disposal Property

Group is engaged in the provision of property sale and investment in Wuhan, Huiyang, Haikou, Guiyang and Chengdu. The disposal was

completed as at 30 June 2016, and the Group recognised a gain on disposal of interests in subsidiaries of approximately HK$6,603.2

million in the consolidated income statement for the year ended 30 June 2016.

On 18 February 2016, the Group entered into a sale and purchase agreement with HKBN Group Limited, to dispose the entire equity

interests in Concord Ideas Ltd. and Simple Click Investments Limited and their subsidiaries at an adjusted aggregate consideration of

HK$725.7 million. These two subsidiaries together with their subsidiaries are principally engaged in the provision in Hong Kong of fixed

line and broadband telecommunications services and online marketing solutions services. The disposal was completed on 31 March

2016, resulted in a gain of approximately HK$283.9 million in the consolidated income statement for the year ended 30 June 2016.

(c)

The amount included the impairment loss of HK$670.4 million arising from drop of the share price of Haitong International Securities

Group Limited which is held by the Group as an available-for-sale financial asset.