Annual Report 2016

133

Financial Section

4 Financial Risk Management and Fair Value Estimation

(continued)

(d) Capital management

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern in

order to provide returns for shareholders and benefits for other stakeholders and to maintain an optimal capital

structure to reduce the cost of capital.

The Group generally obtains long-term financing to on-lend or contribute as equity to its subsidiaries, joint ventures

and associated companies to meet their funding needs in order to provide more cost efficient financing. In order to

maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders, issue or

repurchase shares, raise new debt financing or sell assets to reduce debt.

The Group monitors capital on the basis of the Group’s gearing ratio and makes adjustments to it in light of changes

in economic conditions and business strategies. The gearing ratio is calculated as net debt divided by total equity. Net

debt is calculated as total borrowings (excluding loans from non-controlling shareholders) less cash and bank

balances.

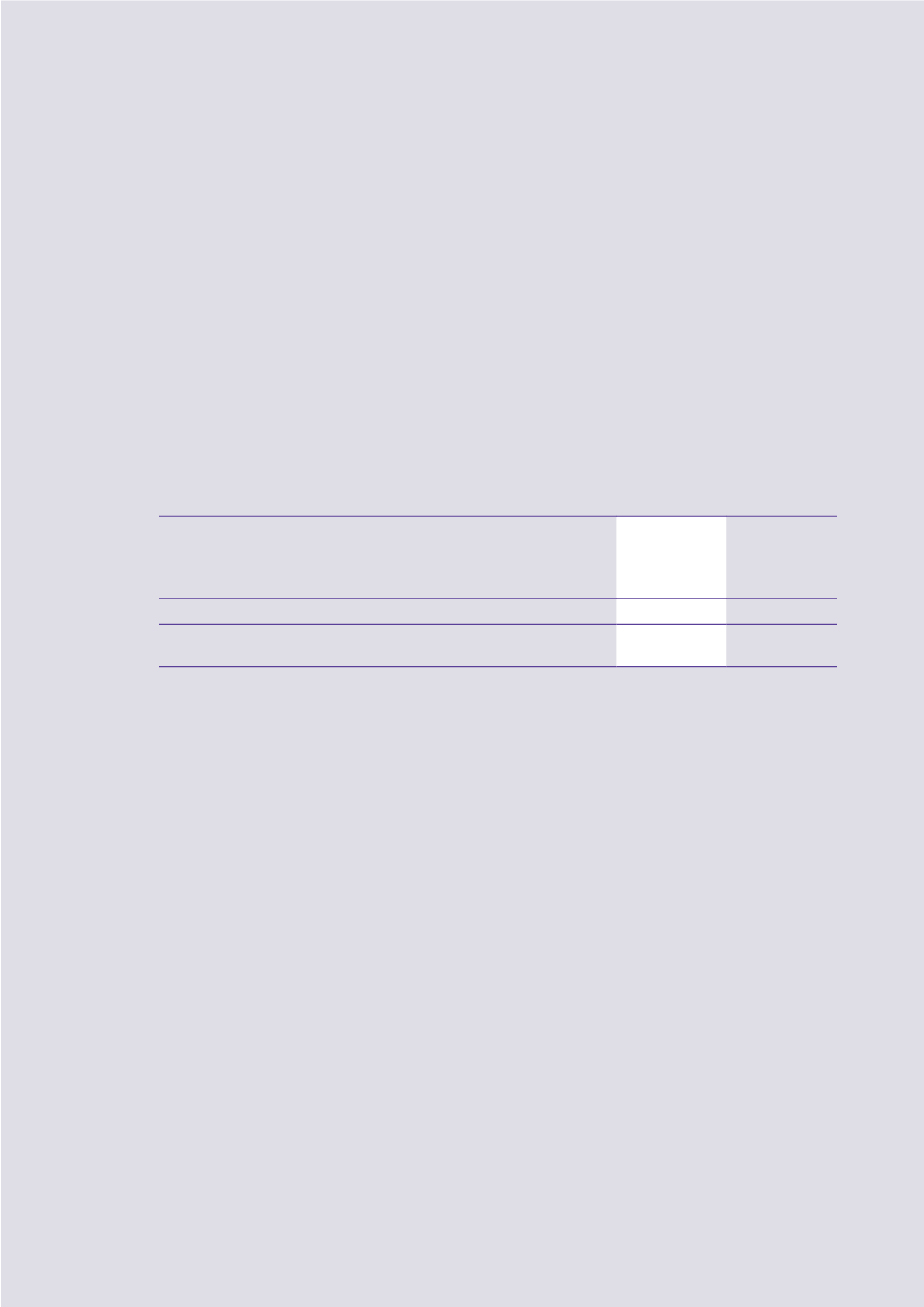

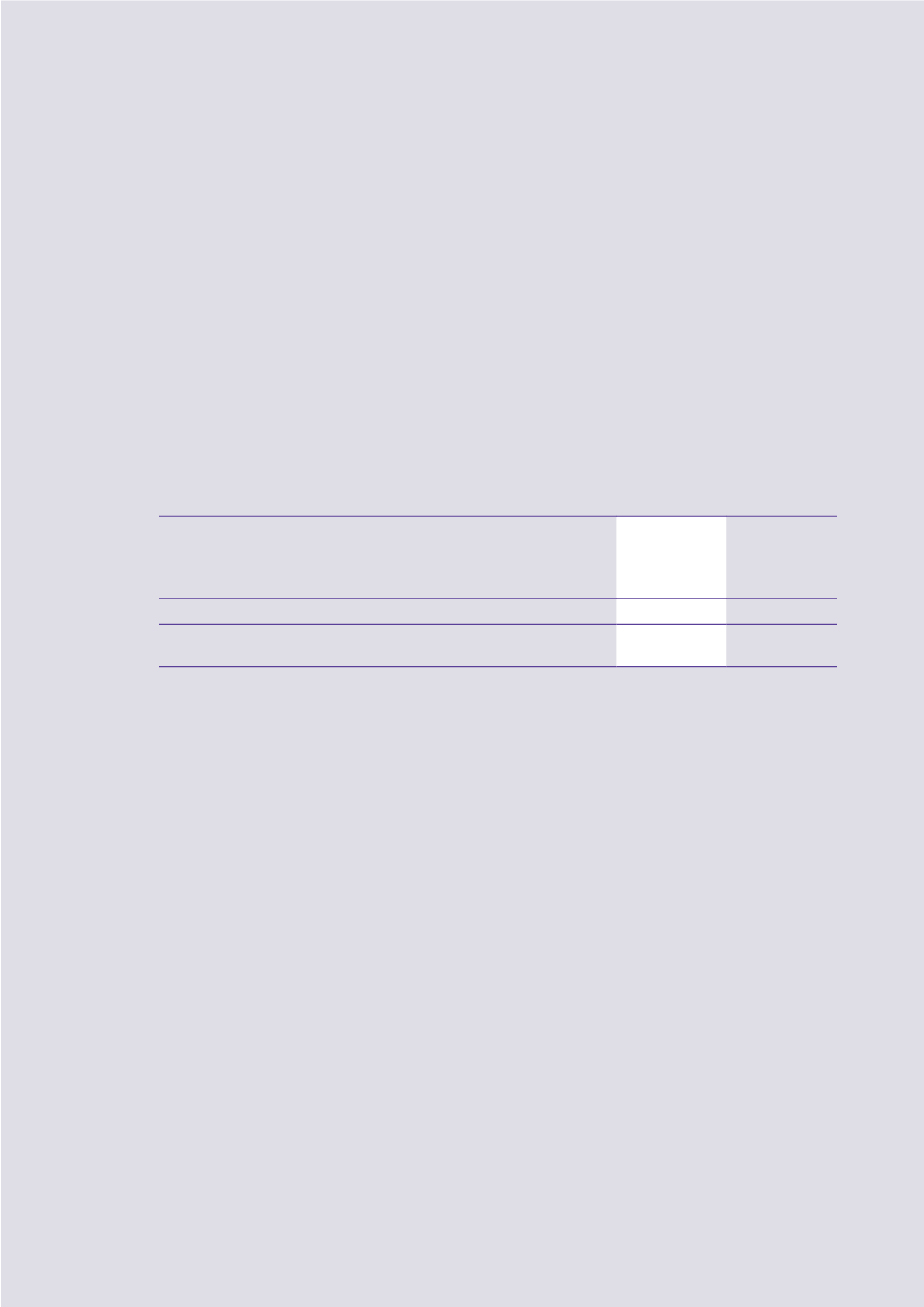

The gearing ratios at 30 June 2016 and 2015 were as follows:

2016

2015

HK$m

HK$m

Consolidated total borrowings

(excluding loans from non-controlling shareholders)

132,219.6

113,004.3

Less: cash and bank balances

(55,170.8)

(59,465.2)

Consolidated net debt

77,048.8

53,539.1

Total equity

200,895.3

222,358.0

Gearing ratio

38.4%

24.1%

(e) Fair value estimation

The Group’s financial instruments that are measured at fair value are disclosed by levels of the following fair value

measurement hierarchy:

•

Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1).

•

Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is, derived from prices) (level 2).

•

Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs)

(level 3).

The carrying amounts of the financial instruments of the Group are as follows. See note 16 for disclosure relating to

the investment properties which are measured at fair value.

(i)

Listed investments are stated at market prices. The quoted market price used for financial assets held by the

Group is the bid price at the end of the reporting period. They are included in level 1.

Unlisted investments are stated at fair values which are estimated using other prices observed in recent

transactions or valuation techniques when the market price is not readily available. The fair value of interest

rate swaps is calculated as the present value of the estimated future cash flows. If all significant inputs required

to estimate the fair value of an instrument are observable, the instrument is included in level 2. If one or more

of the significant inputs is not based on observable market data, the instrument is included in level 3.