Annual Report 2016

135

Financial Section

4 Financial Risk Management and Fair Value Estimation

(continued)

(e) Fair value estimation

(continued)

(ii)

(continued)

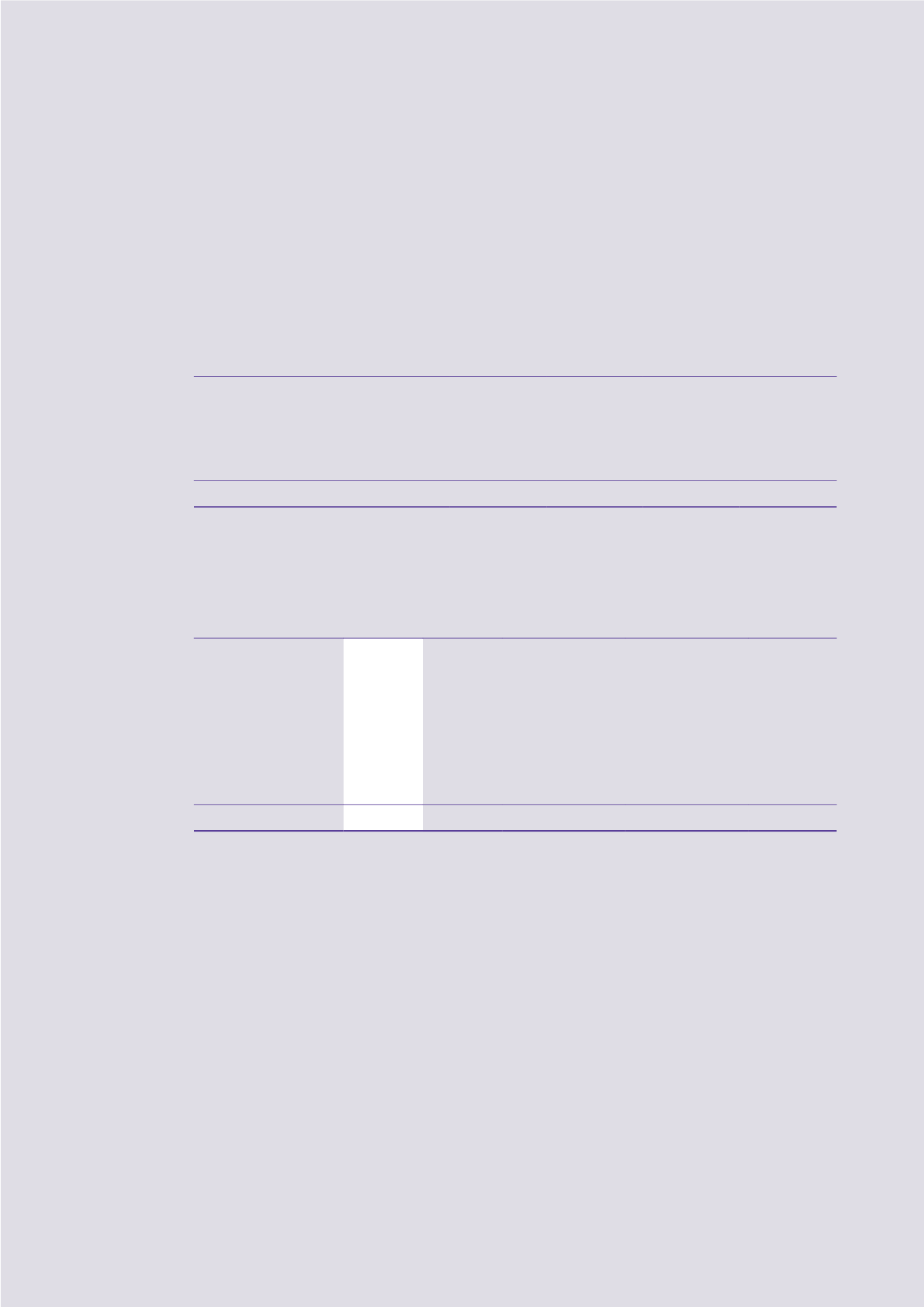

The following table presents the changes in level 3 instruments for the year ended 30 June 2015:

Available-

for-sale

financial

assets

Financial

assets at

fair value

through profit

or loss

Derivative

financial

assets

Derivative

financial

liabilities

HK$m

HK$m

HK$m

HK$m

At 1 July 2014

2,822.9

405.6

58.8

(35.6)

Additions

861.0

317.5

–

–

Net gain recognised in the consolidated

statement of comprehensive income/

income statement

284.9

123.9

–

5.5

Disposals

(236.0)

–

–

–

At 30 June 2015

3,732.8

847.0

58.8

(30.1)

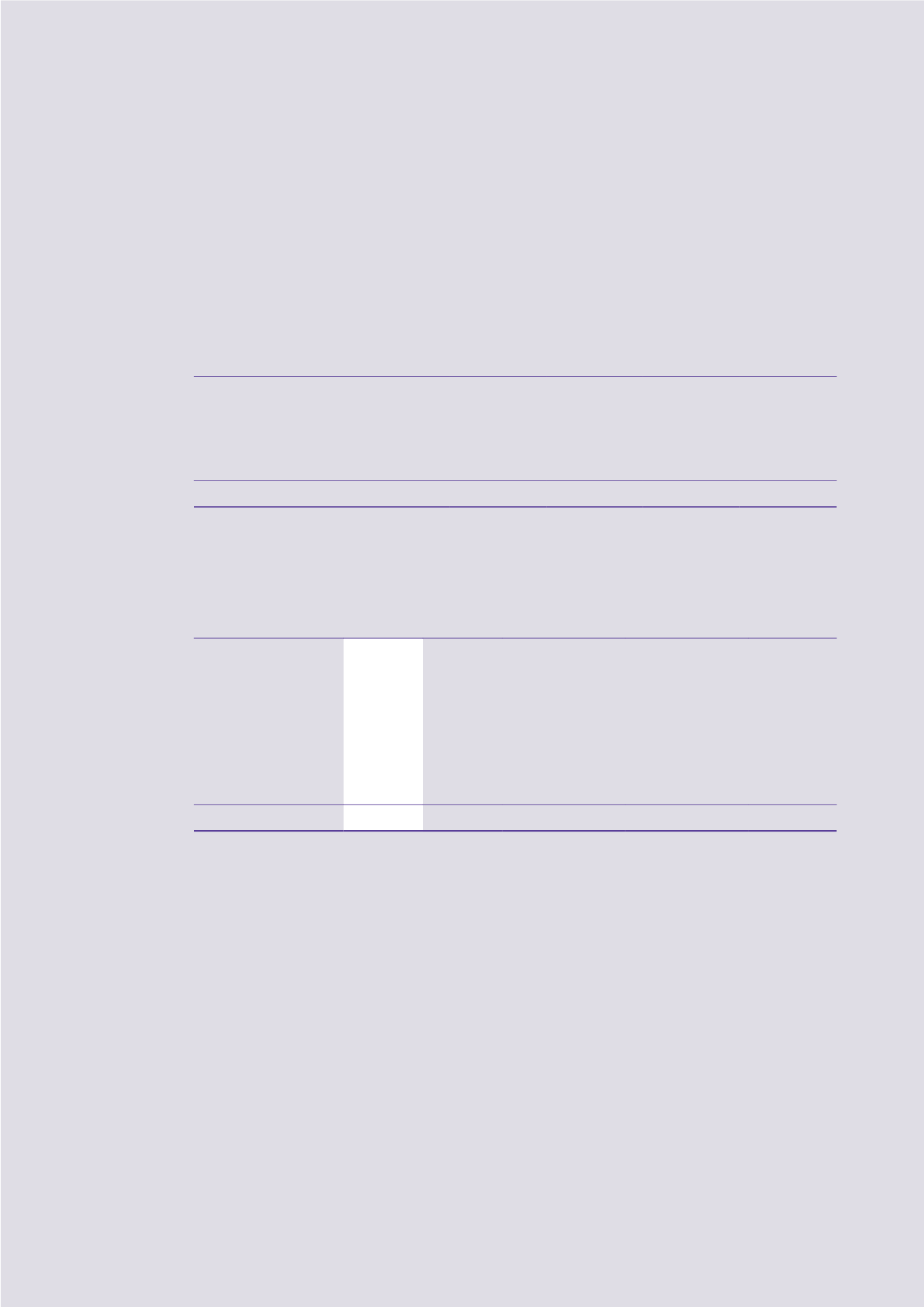

The following unobservable inputs were used to determine the fair value of the available-for-sale financial

assets included in level 3.

2016

Fair value

2015

Fair value

Valuation

techniques

Unobservable

inputs

Range of

unobservable

inputs

HK$m

HK$m

Property development industry

7,079.2

– Income approach

Expected rate of return

9.395%–

10.341%

Property investment industry

1,735.9

1,952.8 Net asset value (note)

N/A

N/A

Entertainment industry

–

516.1 Market comparable

approach

Enterprise value/earnings

before interest and tax

multiple

(2015:

9.37 times–

25.31 times)

Property development industry

–

735.9 Residual method

Development cost,

developer’s profit and

risk margin

N/A

Others

873.5

528.0

9,688.6

3,732.8

Note: The Group has determined that the reported net asset value represents fair value at the end of the reporting period.

5 Critical Accounting Estimates and Judgements

Estimates and judgements are continually evaluated by the Group and are based on historical experience and other factors,

including expectations of future events that are believed to be reasonable under the circumstance.

The Group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by definition,

seldom equal the related actual results. The estimates and assumptions that have a significant effect on carrying amounts

of assets and liabilities are as follows:

(a) Fair value of available-for-sale financial assets and financial assets at fair value through

profit or loss

The fair value of available-for-sale financial assets and financial assets at fair value through profit or loss that are not

traded in an active market is determined by using valuation techniques. The Group uses its judgement to select a

variety of methods (such as discounted cash flow model and option pricing models) and evaluates, among other

factors, whether there is significant or prolonged decline in the fair value below the cost of an investment; and the

financial health and short-term business outlook for the investee and historical price volatility of these investments.

The key assumptions adopted on projected cashflow are based on management’s best estimates.