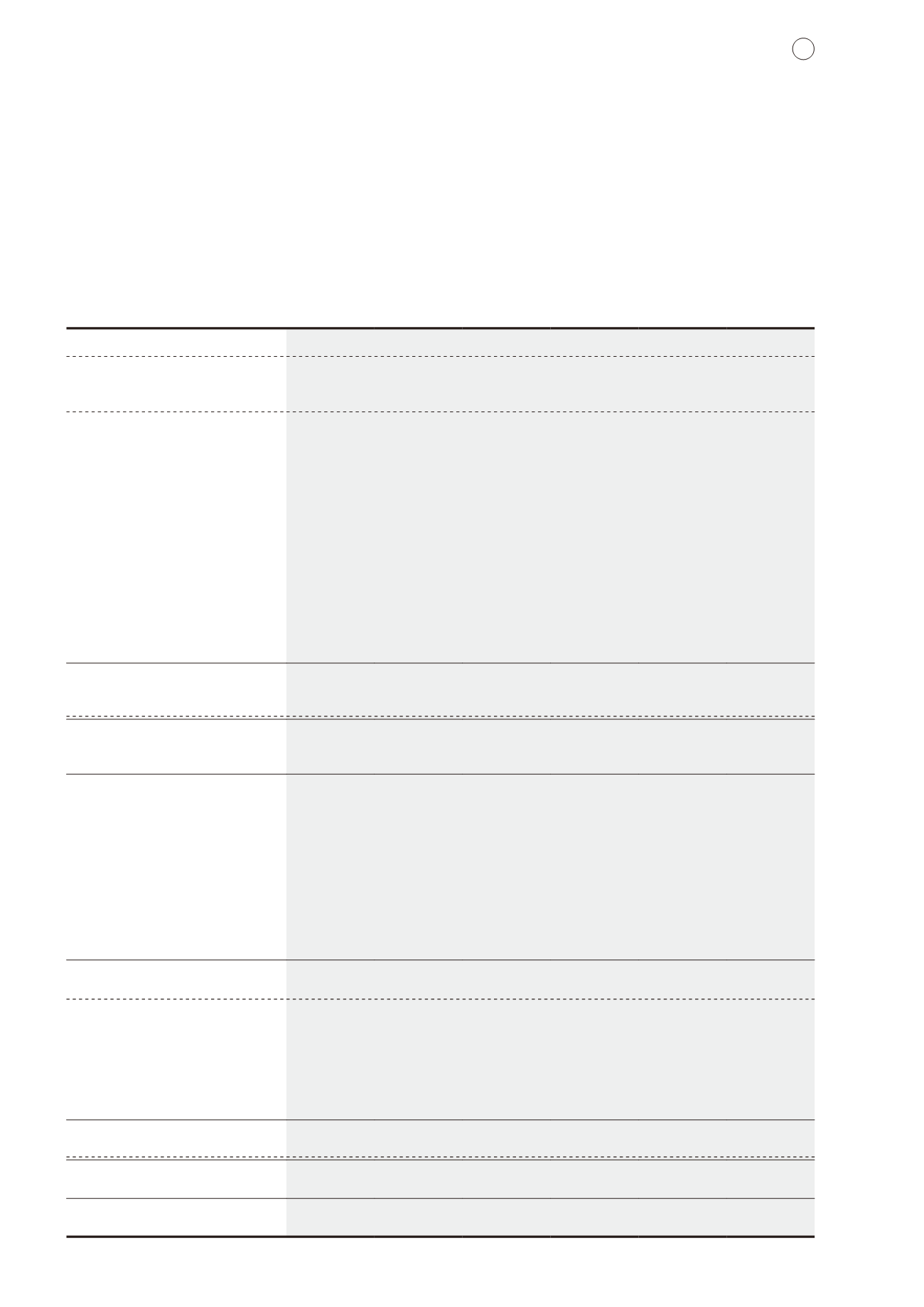

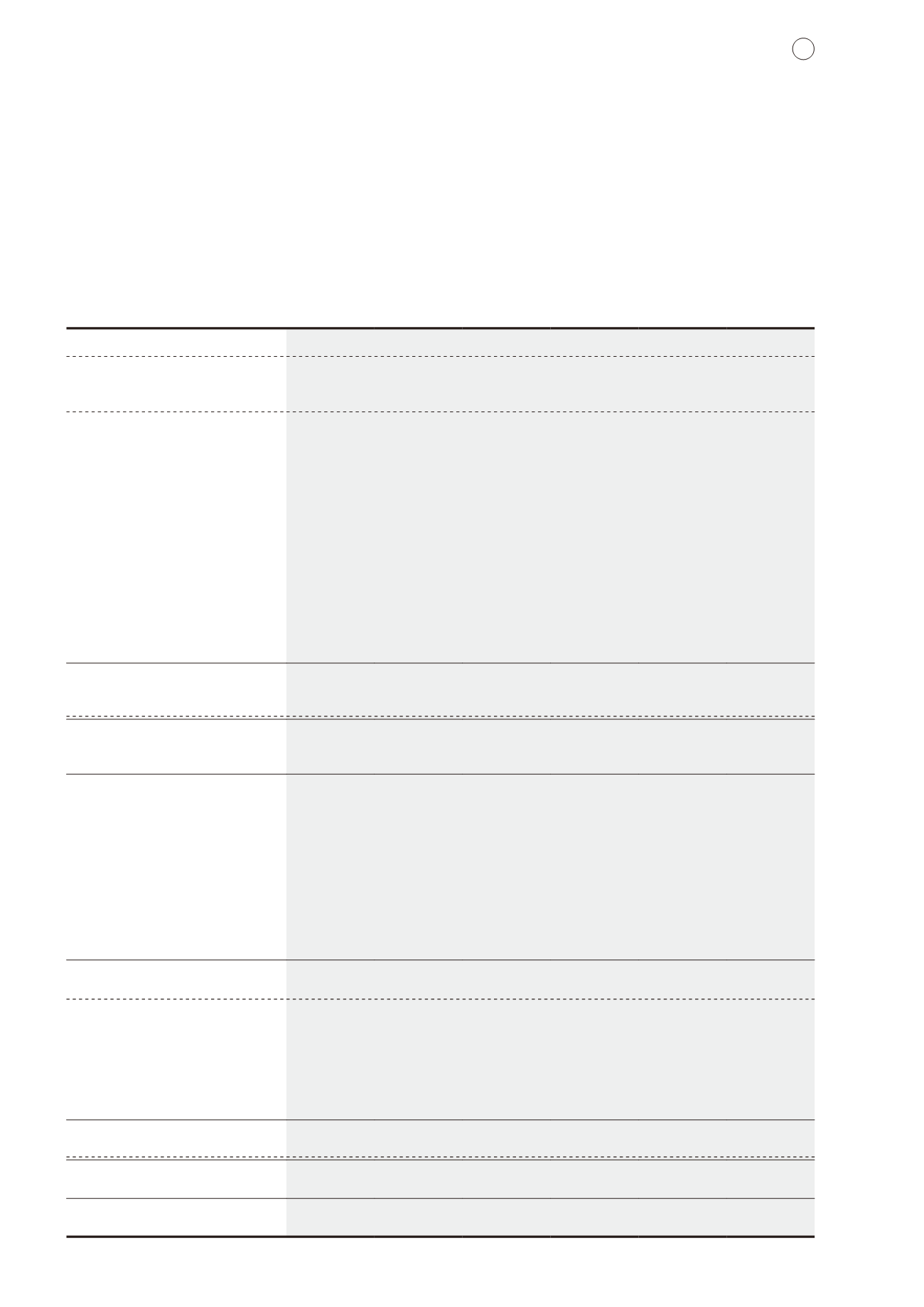

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY ǵ UNAUDITED

For the six months ended 31 December 2015

New World Development Company Limited

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY – UNAUDITED

18

For the six months ended

31 December 2015

Share

capital

Retained

profits

Other

reserves

Shareholders’

funds

Non-

controlling

interests

Total

HK$m HK$m HK$m HK$m HK$m HK$m

As at 1 July 2015

66,711.6

98,427.6

13,779.4

178,918.6

43,439.4

222,358.0

Comprehensive income

Profit for the period

–

3,300.0

–

3,300.0

1,191.6

4,491.6

Other comprehensive income

Remeasurement of post employment

benefit obligation

–

–

(0.3)

(0.3)

–

(0.3)

Fair value changes of available-for-sale

financial assets, net of taxation

–

–

(412.9)

(412.9)

(222.1)

(635.0)

Release of reserve upon disposal of

available-for-sale financial assets

–

–

(239.7)

(239.7)

–

(239.7)

Release of reserves upon disposal of

subsidiaries

–

–

(2.3)

(2.3)

(1.9)

(4.2)

Share of other comprehensive income

of joint ventures and associated

companies

–

(2.4)

(759.5)

(761.9)

(469.0)

(1,230.9)

Cash flow hedges

–

–

(0.2)

(0.2)

(0.2)

(0.4)

Translation differences

–

–

(1,979.4)

(1,979.4)

(847.7)

(2,827.1)

Other comprehensive income for

the period

–

(2.4)

(3,394.3)

(3,396.7)

(1,540.9)

(4,937.6)

Total comprehensive income for

the period

–

3,297.6

(3,394.3)

(96.7)

(349.3)

(446.0)

Transactions with owners

Contributions by/(distributions to)

owners

Dividend

–

(2,699.1)

–

(2,699.1)

(613.6)

(3,312.7)

Issue of new shares as scrip dividend

1,988.0

–

–

1,988.0

–

1,988.0

Issue of new shares upon exercise of

share options

0.9

–

–

0.9

–

0.9

Employees’ share-based payments

–

–

45.4

45.4

9.6

55.0

Share options lapsed

–

11.2

(11.2)

–

–

–

Transfer of reserves

–

(20.4)

20.4

–

–

–

1,988.9

(2,708.3)

54.6

(664.8)

(604.0)

(1,268.8)

Change in ownership interests in

subsidiaries

Acquisition of additional interests in

subsidiaries

–

45.8

–

45.8

(3,353.1)

(3,307.3)

Deemed disposal of interests in

subsidiaries

–

(12.0)

–

(12.0)

28.5

16.5

–

33.8

–

33.8

(3,324.6)

(3,290.8)

Total transactions with owners

1,988.9

(2,674.5)

54.6

(631.0)

(3,928.6)

(4,559.6)

As at 31 December 2015

68,700.5

99,050.7

10,439.7

178,190.9

39,161.5

217,352.4