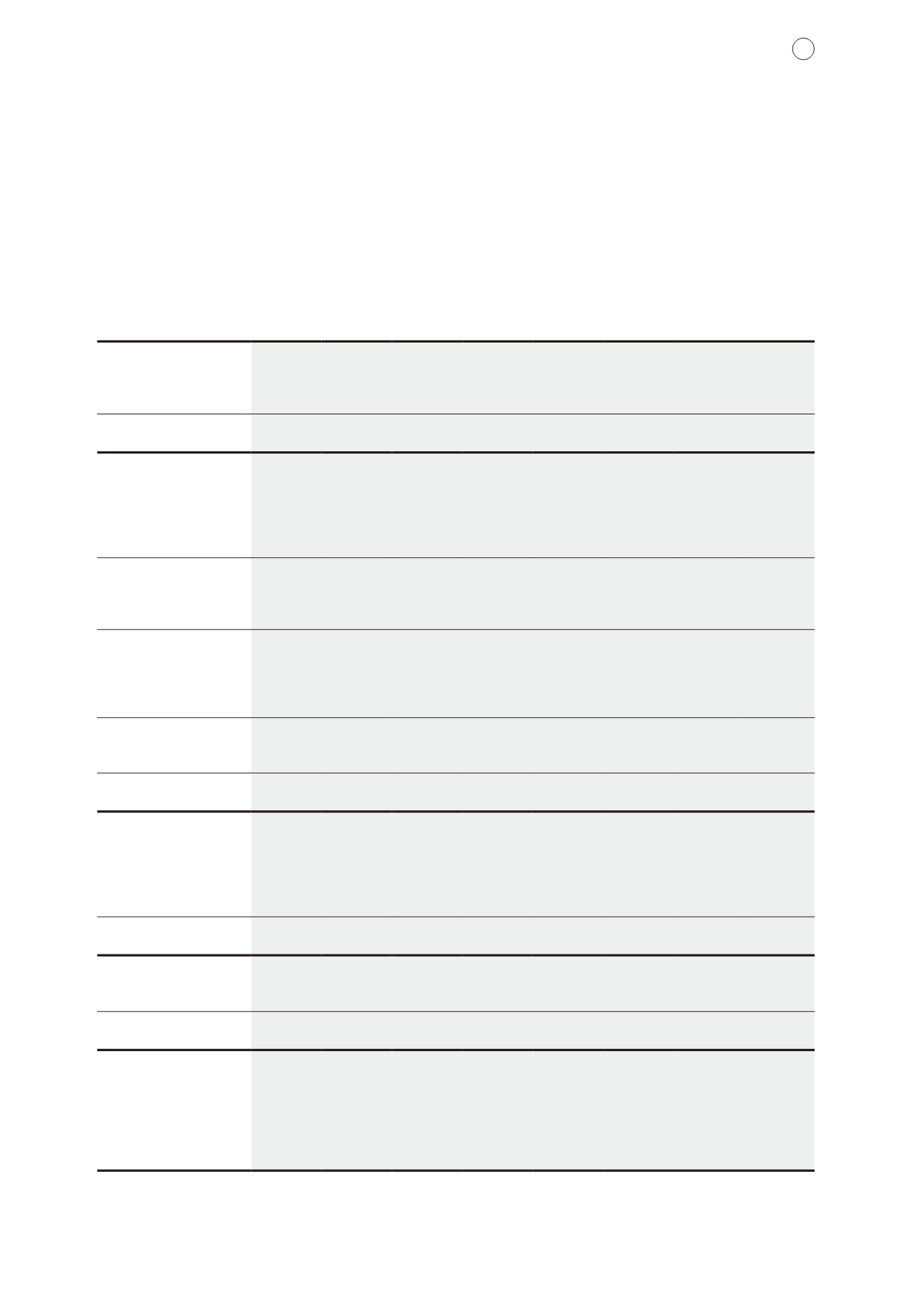

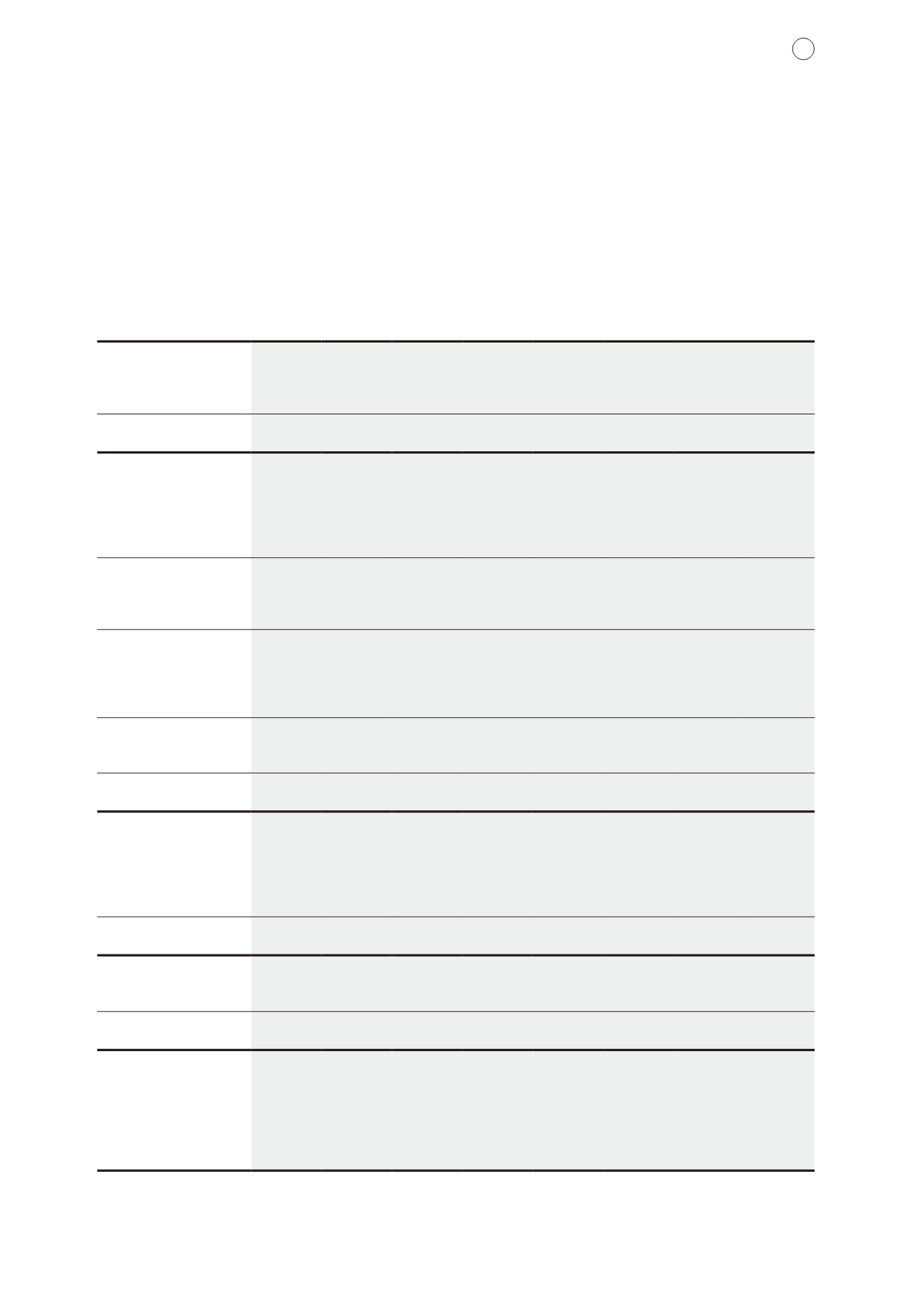

New World Development Company Limited

NOTES TO CONDENSED ACCOUNTS

26

3 Revenues and segment information

(continued)

Property

development

Property

investment

Service Infrastructure

Hotel

operations

Department

stores

Others Consolidated

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

HK$m

For the six months ended

31 December 2015

Total revenues

17,820.5

1,376.4

13,673.0

1,252.4

1,074.8

1,894.4

532.8

37,624.3

Inter–segment

–

(120.6)

(3,682.3)

–

–

(1.1)

(42.1)

(3,846.1)

Revenues–external

17,820.5

1,255.8

9,990.7

1,252.4

1,074.8

1,893.3

490.7

33,778.2

Segment results

4,155.2

774.5

511.0

530.8

(11.2)

155.6

(45.0)

6,070.9

Other (losses)/gains, net (Note d)

91.6

5.1

110.8

92.4

768.7

(6.5)

(1,225.6)

(163.5)

Changes in fair value of

investment properties

–

(548.1)

584.8

–

–

–

–

36.7

Unallocated corporate expenses

(630.5)

Operating profit

5,313.6

Financing income

435.4

Financing costs

(744.7)

5,004.3

Share of results of

Joint ventures (Note a)

(101.4)

246.9

(94.6)

900.4

(37.9)

–

(50.4)

863.0

Associated companies (Note b)

(0.5)

75.7

(31.6)

329.9

–

–

3.2

376.7

Profit before taxation

6,244.0

Taxation

(1,752.4)

Profit for the period

4,491.6

As at 31 December 2015

Segment assets

123,745.4

93,884.7

13,614.0

15,096.6

13,091.9

6,256.5

11,335.5

277,024.6

Interests in joint ventures

11,701.4

12,085.5

3,737.0

14,414.9

6,015.8

–

1,017.2

48,971.8

Interests in associated companies

1,059.4

2,856.0

6,521.7

7,482.9

1.1

–

342.1

18,263.2

Unallocated assets

65,423.2

Total assets

409,682.8

Segment liabilities

25,152.6

1,632.6

7,294.8

652.4

653.7

4,487.6

1,753.7

41,627.4

Unallocated liabilities

150,703.0

Total liabilities

192,330.4

For the six months ended

31 December 2015

Additions to non-current assets

(Note c)

7,201.2

3,001.7

399.2

159.4

1,574.8

97.2

457.1

12,890.6

Depreciation and amortisation

44.4

19.9

89.9

412.2

217.8

189.0

69.7

1,042.9

Impairment charge and provision

–

–

–

–

–

–

–

–