Interim Report 2015/2016

NOTES TO CONDENSED ACCOUNTS

23

2 Financial risk management and fair value estimation

(continued)

(b) Fair value estimation

(continued)

(ii) The fair value of long-term financial liabilities is estimated by discounting the future contractual cash flows

at the current market interest rate that is available to the Group for similar financial instruments.

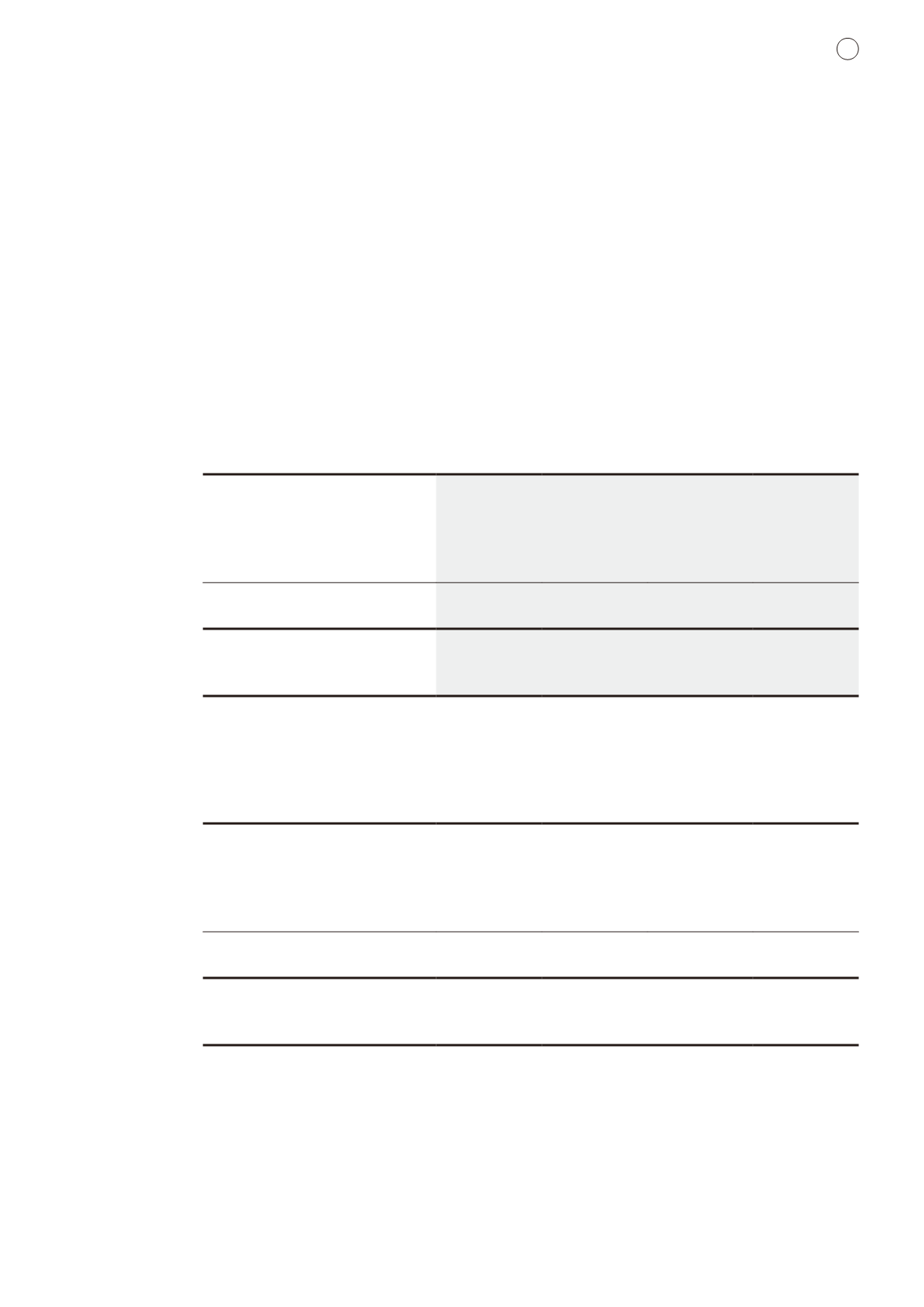

The following table presents the Group’s financial instruments that are measured at fair value at 31

December 2015:

Level 1

Level 2

Level 3

Total

HK$m HK$m HK$m HK$m

Available-for-sale financial assets

2,270.2

54.4

10,336.3

12,660.9

Financial assets at fair value

through profit or loss

0.2

–

706.2

706.4

Derivative financial instruments

Derivative financial assets

–

1.9

58.8

60.7

2,270.4

56.3

11,101.3

13,428.0

Derivative financial instruments

Derivative financial liabilities

–

(764.3)

(27.3)

(791.6)

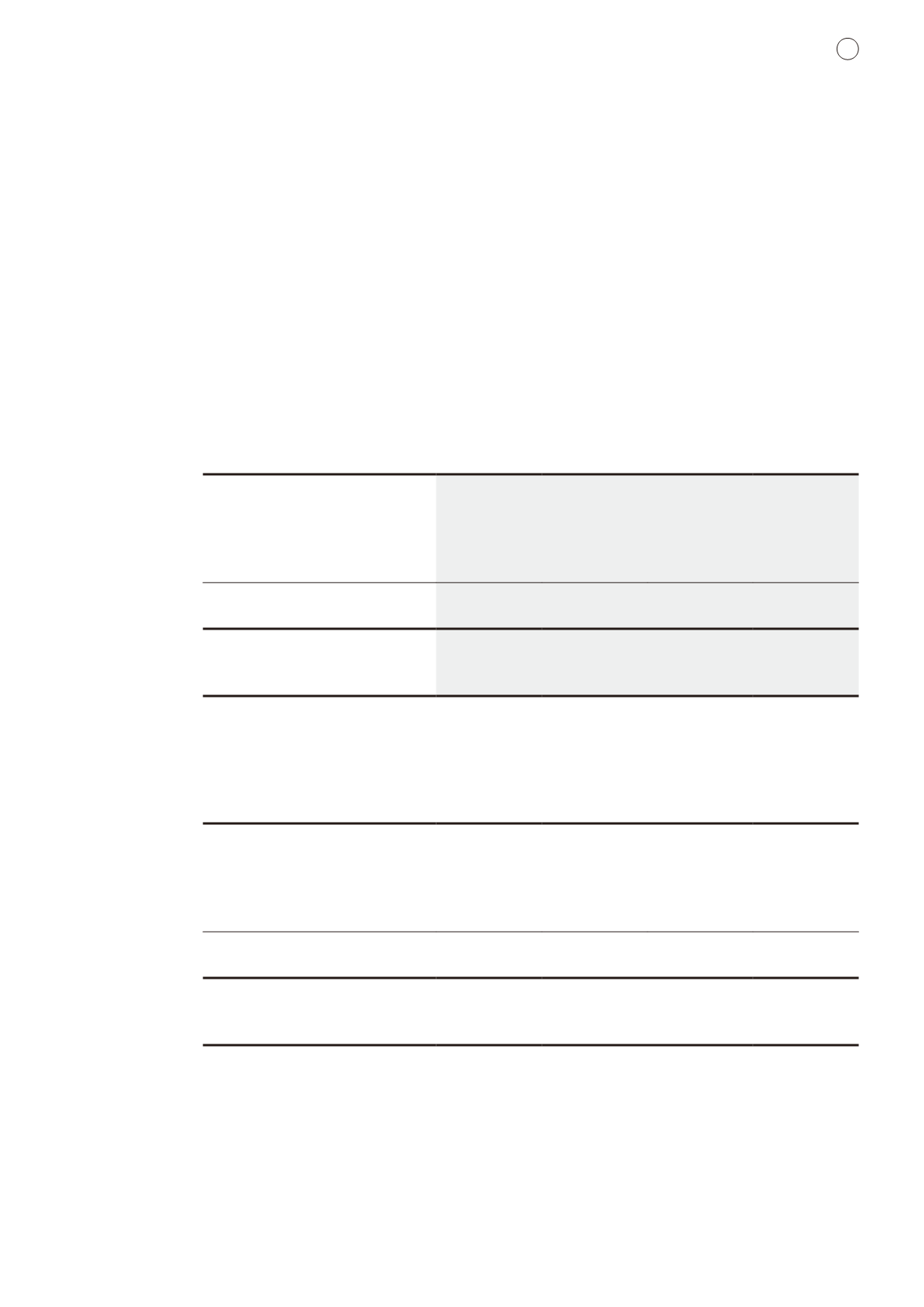

The following table presents the Group’s financial instruments that are measured at fair value at 30 June

2015:

Level 1

Level 2

Level 3

Total

HK$m

HK$m

HK$m

HK$m

Available-for-sale financial assets

3,115.7

60.7

3,732.8

6,909.2

Financial assets at fair value through

profit or loss

0.2

–

847.0

847.2

Derivative financial instruments

Derivative financial assets

–

11.1

58.8

69.9

3,115.9

71.8

4,638.6

7,826.3

Derivative financial instruments

Derivative financial liabilities

–

(817.3)

(30.1)

(847.4)

There were no significant transfer of financial assets between level 1 and level 2 fair value hierarchy

classifications.