Annual Report 2016

143

Financial Section

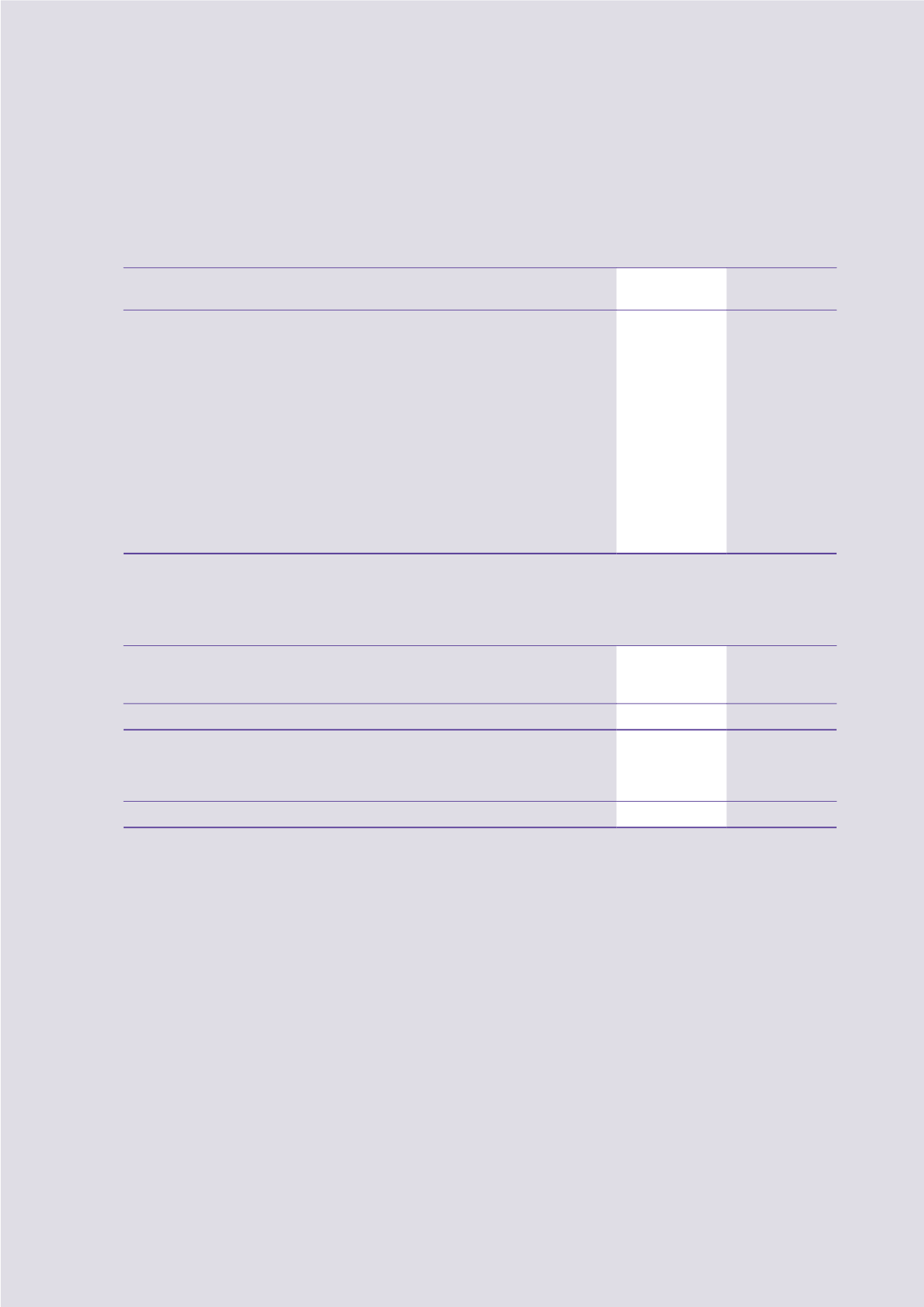

9 Operating Profit

Operating profit of the Group is arrived at after crediting/(charging) the following:

2016

2015

HK$m

HK$m

Gross rental income from investment properties

2,335.6

2,213.7

Outgoings

(664.5)

(717.3)

1,671.1

1,496.4

Cost of inventories sold

(22,058.8)

(19,709.2)

Cost of services rendered

(17,227.1)

(13,177.9)

Depreciation of property, plant and equipment (note 17)

(979.7)

(1,304.3)

Amortisation

Land use rights (note 18)

(84.8)

(93.7)

Intangible concession rights (note 19)

(819.7)

(829.9)

Intangible assets (note 20)

(45.0)

(86.1)

Operating lease rental expense

Land and buildings

(1,225.2)

(1,246.2)

Other equipment

(3.7)

(4.7)

Staff costs (note 14(a))

(6,077.1)

(6,366.8)

Auditors’ remuneration

Audit services

(66.5)

(68.5)

Non-audit services

(12.3)

(19.2)

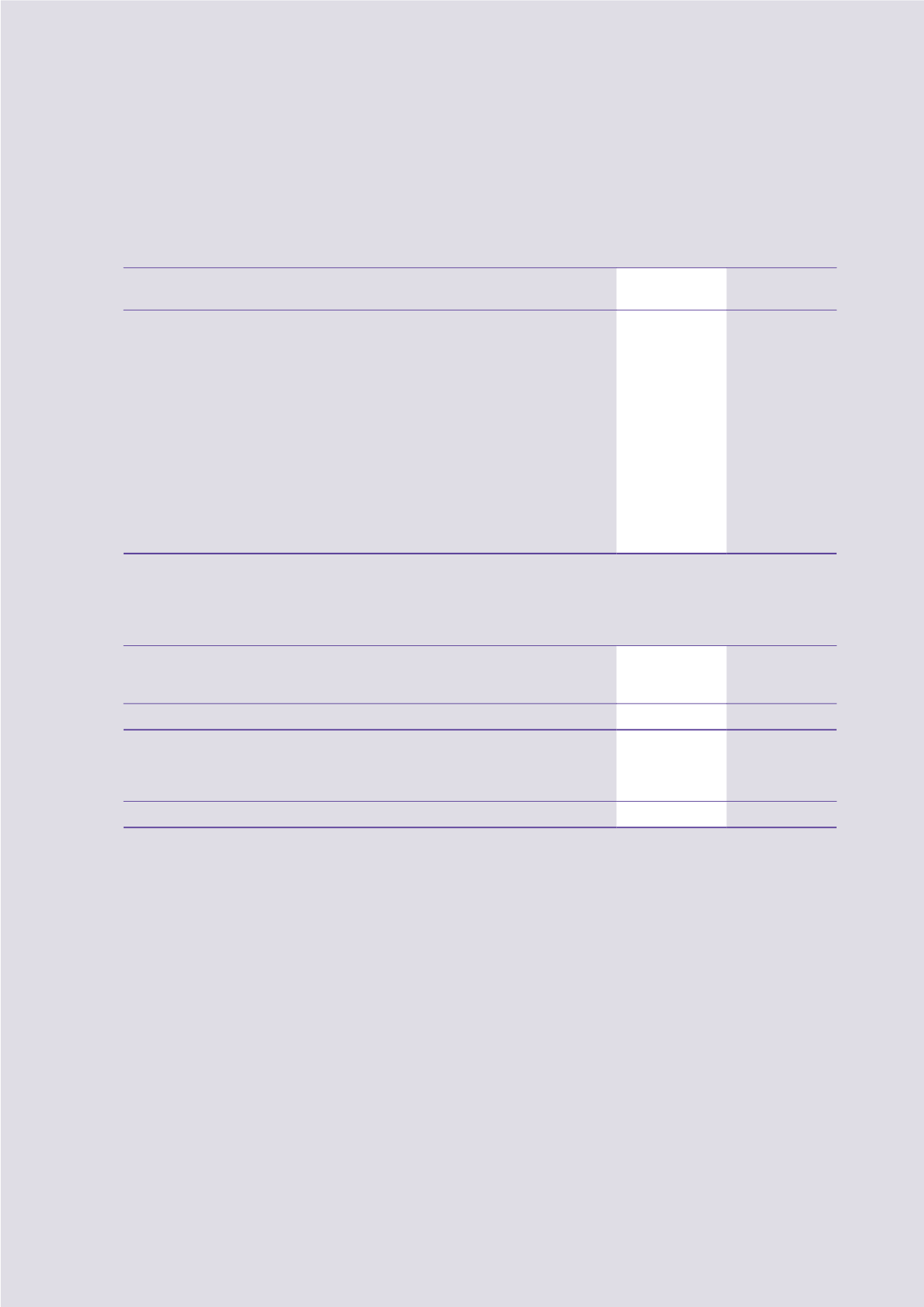

10 Financing Costs

2016

2015

HK$m

HK$m

Interest on bank loans and overdrafts

3,440.9

3,005.4

Interest on fixed rate bonds and notes payable

2,296.3

2,210.6

Interest on loans from non-controlling shareholders

8.2

19.8

Total borrowing costs incurred

5,745.4

5,235.8

Capitalised as (note):

Cost of properties under development

(3,212.3)

(3,092.8)

Cost of assets under construction and investment properties

under development

(597.4)

(521.1)

1,935.7

1,621.9

Note:

To the extent funds are borrowed generally and used for the purpose of financing certain properties under development, assets under

construction and investment properties under development, the capitalisation rate used to determine the amounts of borrowing costs eligible

for the capitalisation is 4.2% (2015: 4.5%) per annum.